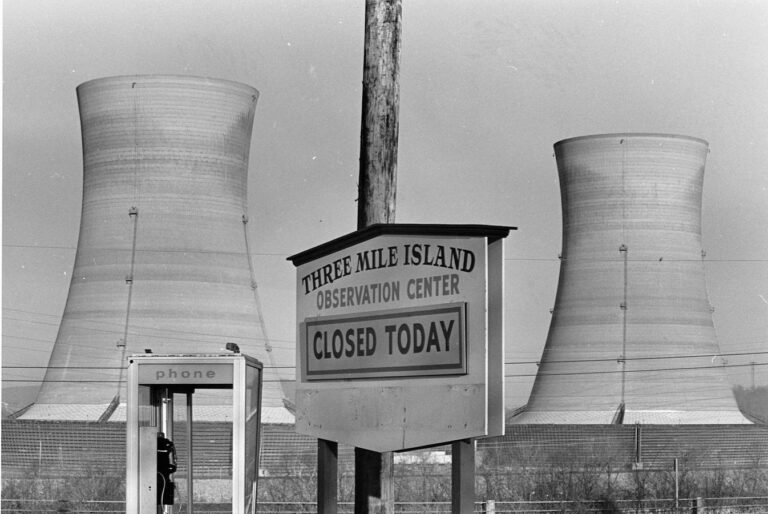

A sign announcing the closure of the monitoring center at the Three Mile Island Nuclear Power Plant. … (+)

Corbis via Getty Images

Nvidia shares are up 156% in 2024. Meanwhile, shares of Constellation Energy, a provider of nuclear power generation services and owner of the Three Mile Island nuclear plant, which suffered an accident in March 1979, are up 129%.

Constellation, which recently inked a 10-year deal to pay nuclear energy giant Microsoft roughly $16 billion, could be a better investment than Nvidia, according to Seeking Alpha, for three reasons:

As Nvidia’s revenue growth slows, demand for energy to fuel data centers is accelerating. Constellation’s sluggish growth is likely to accelerate as more hyperscalers follow Microsoft’s lead. Analysts expect Constellation’s stock price to rise even further.

One drawback to consider is that analysts’ price targets capture a lot of Constellation’s upside potential, according to TipRanks.

AI energy demand surges as Nvidia’s rapid revenue growth slows

As Nvidia’s revenue growth slows, energy demand to run data centers is expected to increase. According to TheStreet, electricity demand in the U.S. remained roughly flat from 2014 to 2024. But a May 2024 Goldman Sachs report said overall data center electricity demand is expected to surge “160% by 2030.”

Indeed, demand for AI-related hardware and software is also expected to grow rapidly. More specifically, Bain predicts that the total addressable market will grow at a rate of 40% to 55% annually, reaching a range of $780 billion to $990 billion by 2027, according to Barron’s.

Nvidia expects to outperform the industry, but revenue growth at the AI chip designer is slowing. Investor’s Business Daily predicts Nvidia’s revenue will grow in the range of 206% to 265% from the second quarter of 2023 to the first quarter of 2024.

Nvidia is still growing fast, but its growth rate is slowing: For example, the AI chip designer’s revenue grew 122% in the second quarter of 2024, and the company predicts 80% growth in the third quarter of 2024, a September Forbes article noted.

Constellation growth should accelerate

Constellation Energy, which operates the largest fleet of nuclear power plants in the U.S. and is a preferred generating fuel for technology companies, according to Seeking Alpha, was spun out of utility company Exelon.

Constellation shares soared 22% on September 20 after the company announced a 20-year contract with Microsoft to supply $1.6 billion in power from the intact restart of the 835-megawatt Three Mile Island Nuclear Power Plant, which was “closed due to economic pressures” in 2019, according to The Wall Street Journal.

The facility’s Unit 2 was shut down after suffering a partial meltdown in 1979. The resulting five-day panic “raised awareness of potential safety problems at nuclear power plants and helped erode enthusiasm for the industry after decades,” The Wall Street Journal reported.

The company’s latest financial report, which ends in June 2024, missed earnings and revenue expectations. However, Constellation Energy did raise its 2024 earnings per share forecast.

Specifically, the company’s EPS of $1.68 was 4 cents below the consensus estimate, and revenue of $5.48 billion was $70 million below analysts’ consensus estimate, TheStreet noted.

TheStreet reported that Constellation raised its fiscal 2024 adjusted EPS outlook by 4.8% to the midpoint of the range of $8 per share, 19 cents above the consensus estimate.

Analysts predict further gains for Constellation shares

Could the company’s increased profit growth target be a harbinger of better-than-expected revenue growth?

Analysts have significantly increased their price targets for Constellation following the Microsoft deal. Examples include:

Wells Fargo raised its price target for Constellation Energy by 20% to $300, noting “strong tech giant interest in securing clean power,” according to thefly.com. Morgan Stanley raised its price target for CEG by 24% to $313, suggesting Microsoft’s “premium price” portends future deals with cloud service providers at higher prices, TheStreet noted. Jefferies raised its price target by 40% to $256, TheStreet reported. Jefferies analyst Paul Zimbardo noted that the Constellation-Microsoft MSFT deal “has a very positive impact on the industry, supporting the data center thesis and broadening the scope of the nuclear opportunity,” according to MarketWatch.

Other analysts were bullish on Constellation, with Guggenheim’s Shahriar Pourreza adding that “demand for clean megawatts of power from hyperscalers is real,” while Mizuho’s Maheep Mandloi noted that the deal “shows the need for 24/7 clean energy to power data centers,” MarketWatch noted.

To be sure, anti-nuclear sentiment, while negative, is not as pronounced as it once was, and Constellation is gaining more support than it used to as state and federal governments encourage utilities to use nuclear and renewable fuels to generate electricity.

Additionally, nuclear power has an advantage over renewables because it “doesn’t immediately require expensive battery storage or additional natural gas capacity equivalent to 110% of renewable energy capacity,” reports TheStreet.

Wall Street still seems to see upside for Nvidia shares. TipRanks reports that 42 analysts covering the AI chip designer have an average price target of $152, implying a 24% upside. Meanwhile, 20 analysts covering Constellation have an average price target of $214, calling the stock about 1% overvalued.