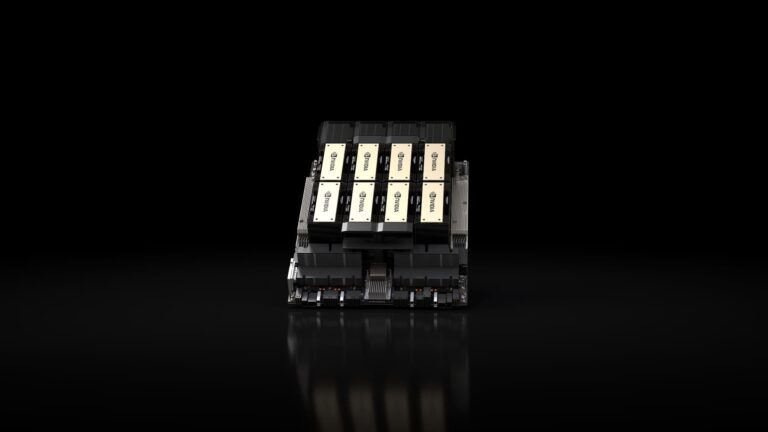

According to Jefferies, there is one global stock that stands out as a “unique player” in the NVIDIA and artificial intelligence supply chain. That is German semiconductor company SUSS MicroTec, Jefferies said in a Sept. 17 report, calling the company a “hidden gem” among European semiconductor companies. The stock is also traded over-the-counter in the United States. The investment bank initiated coverage on the stock with a buy recommendation and a price target of 76 euros ($84), which means there is room for upside of about 28%. Jefferies said the company has “multi-layered exposure” to an advanced packaging technology called Chip-on-Wafer-on-Substrate, which is used to manufacture AI chips. SMHN-FF 1Y mountain SUSS MicroTec NVIDIA uses the technology to package its AI graphics processing units, Jefferies noted. “As such, demand for CoWoS has increased significantly over the past 24 months as AI adoption accelerates.” SUSS sells the products used to manufacture its advanced packages to two major high-bandwidth memory suppliers and TSMC. According to Jefferies, TSMC’s largest CoWoS customer is Nvidia. Memory chips are gaining attention as AI becomes more prevalent, as they are used in the graphics processing units that underpin most generative AI tools. “SUSS has exposure to CoWoS/NVIDIA at multiple layers,” the investment bank said. The packaging technique required for high-bandwidth memory, called “temporary bonding,” is the “biggest opportunity,” Jefferies said, and SUSS’ orders will surge in 3Q23. “This segment has seen the biggest surge in orders since 3Q23, which is largely tied to the recent growth seen across the NVIDIA/AI supply chain,” the bank wrote. The bank explained that there is “huge” demand for SUSS’ tools, as the “multi-layer architecture” of high-bandwidth memory allows all layers to fit within the package. SUSS has a 55% market share in the sector and is “positioned to benefit” from two growth drivers over the next 1-2 years: rising CoWoS shipments from TSMC and an increasing number of high-bandwidth memory layers. Because the company’s involvement in the packaging technology required for high-bandwidth memory is “completely new,” Jefferies said the upside potential for orders and revenue is “much greater” than other equipment suppliers. “Furthermore, we believe SUSS is one of the most attractive CoWoS companies globally as it faces much less competition than its advanced packaging peers,” the bank wrote. Jefferies forecasts fiscal 2025 revenue of €471 million, implying 16% growth year over year. — CNBC’s Michael Bloom contributed to this report.