The AI supercycle is fueling fierce competition among Advanced Micro Devices Inc. Am and Nvidia Corp NVDAThe two tech giants are competing for a piece of the growing AI market.

AMD shares have risen 39.98% over the past year, while Nvidia has surged 161.90%. Year-to-date, the gap has widened even further, with AMD up 8.80% and Nvidia up 147.33%. After all, Nvidia’s first-mover advantage in the AI space has helped the company amass a market cap of more than $2.9 trillion, while AMD is catching up at about $245 billion.

AMD CEO Lisa Su recently reaffirmed that AMD’s AI roadmap is accelerating, while Nvidia has confirmed positive prospects for its upcoming Blackwell AI GPUs. But how do the two stocks compare on the tech side?

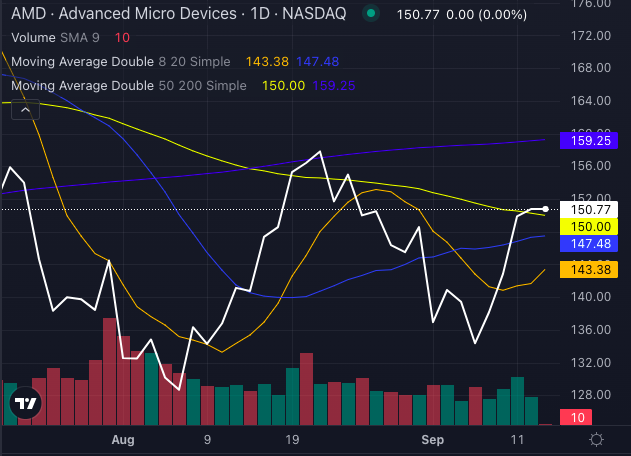

AMD Bullish Momentum

Chart created using Benzinga Pro

The bull market for AMD shares continues with the stock price at $150.77 trading above the 5-day, 20-day, and 50-day exponential moving averages (EMAs), indicating strong buying pressure.

AMD’s 8-day simple moving average (SMA) is $143.38 and 20-day SMA is $147.48, both of which are indicating bullish signals, while the 50-day SMA is $150.00, strengthening bullish sentiment in the short to medium term.

However, a slight warning signal has been raised as AMD’s 200-day SMA at $159.25 is above the current share price, creating a long-term bearish signal.

While longer-term indicators are pointing to potential resistance, the near-term outlook remains favorable, making AMD stock an attractive pick in the AI space in the near term.

Related story: Cathie Wood’s Ark Invest buys $6.9 million in Nvidia rival AMD, sells shares in Palantir and Robinhood

Nvidia’s AI dominance, bullish trend

Chart created using Benzinga Pro

Nvidia continues to lead the AI race, and the company’s technical indicators are also pointing to a bullish trend. With a share price of $119.11, Nvidia shares are currently trading above the 5-day, 20-day, and 50-day EMAs, indicating slight buying pressure. Nvidia shares have an 8-day SMA of $110.75 and a 20-day SMA of $118.74, both of which are sending out bullish signals, while the 50-day SMA of $117.55 further supports this bullish view.

Unlike AMD, Nvidia’s 200-day SMA is at $90.74, well below the current price, indicating a strong bullish signal in the long term, and the company’s stock is likely to remain strong, boosted by upcoming Blackwell chips and AI leadership.

Both AMD and NVIDIA are experiencing strong near-term bullish momentum with strong technical support. While AMD is making aggressive strides to catch up with Nvidia’s AI dominance, Nvidia’s market leadership remains solid, backed by solid technical metrics and an advanced product roadmap.

Investors may find opportunity in both stocks, but Nvidia currently has the edge.

Read also:

Photo: Shutterstock

Market news and data provided by Benzinga API

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.