Recent news about Intel’s (INTC) Lunar Lake processors and their potential in the artificial intelligence (AI) PC market should have given investors a lot more hope than they actually had. And new information about the company’s manufacturing plans should have bolstered that hope, too. Still, Intel shares were down slightly in afternoon trading on Tuesday.

At the IFA conference in Berlin, Intel executives gave a presentation about their Lunar Lake processor lineup and what value it will bring to the AI PC market. Intel went all out to demonstrate their confidence in their Core Ultra 200V line, and by all reports, it was abundantly clear that Intel believes in these processors.

Intel showed off significant gains in performance per watt of power, including a nearly 40% reduction in system memory latency compared to the Meteor Lake Core Ultra 100 series. Instructions per clock (the number of tasks a computer processor can complete per clock cycle) increased by 68%, but this is just the beginning of impressive metrics that give the Lunar Lake lineup a surprisingly bright future.

The manufacturing shuffle

As we found out yesterday, with Intel’s Chip and Science Bill funding in a bit of a cloud, Intel is trying to prove out its chip-making capabilities while revamping its manufacturing processes to cut costs. The 20A process has reportedly been effectively scrapped, but Intel’s best manufacturing process, the 18A process, is expected to be ready by the end of the year. This is a bit of a blemish on Intel, but the $500 million Intel will reportedly save by not building the 20A process is probably a consolation.

Should you buy, sell or hold Intel?

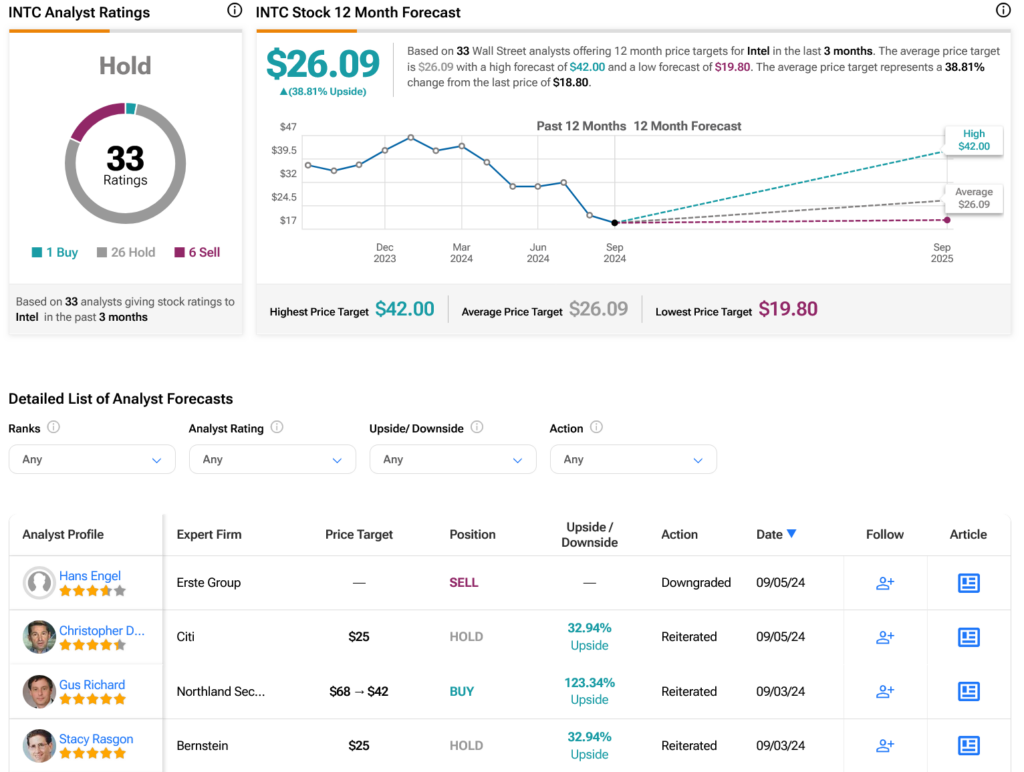

Turning to Wall Street, analysts have a consensus rating of Hold for INTC stock based on 1 Buy, 25 Hold, and 6 Sell ratings in the past three months (see chart below). The average price target for INTC is $26.09 per share, suggesting an upside potential of 38.81%, after the stock price fell 50.46% over the past year.

See more INTC analyst ratings

Disclosure