When trying to find stocks that could potentially be multi-baggers, there are often underlying trends that can provide clues. In particular, there are two things you should look at. The first is an increasing return on invested capital (ROCE), and the second is a growing amount of invested capital. Ultimately, this points to a company that is reinvesting profits at increasing rates of return. Speaking of which, we’ve seen a big change in return on invested capital for BE Semiconductor Industries (AMS:BESI), so let’s take a look.

What is Return on Invested Capital (ROCE)?

For those who don’t know, ROCE is a measure of a company’s annual pre-tax profit (revenue) relative to the capital employed in the business. The formula to calculate this metric for BE Semiconductor Industries is:

Return on Invested Capital = Earnings Before Interest and Taxes (EBIT) ÷ (Total Assets – Current Liabilities)

0.31 = €199m ÷ (€777m – €128m) (Based on the trailing twelve months to June 2024).

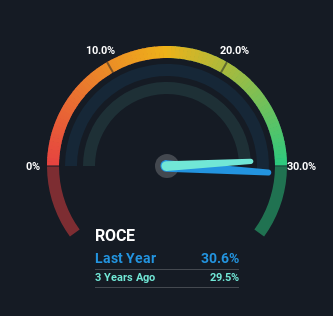

So BE Semiconductor Industries has an ROCE of 31%. In absolute terms, this is an excellent return and better than the semiconductor industry average of 12%.

Check out our latest analysis for BE Semiconductor Industries

Above you can see how BE Semiconductor Industries’ current ROCE compares to its prior returns on capital, but the history can only tell you so much – if you’d like you can see forecasts from the analysts covering BE Semiconductor Industries for free.

What does the ROCE trend for BE Semiconductor Industry indicate?

BE Semiconductor Industries’ ROCE growth rate is very impressive. Looking at the numbers, over the past five years, ROCE has grown by 65%, while capital has remained roughly the same. So, this tells us that the business is able to generate high returns through increased efficiency, without needing further investment all the while. Things are looking good from that perspective, so it’s worth looking into what management has to say about its future growth plans.

Key Takeaways

In summary, we’re pleased to see BE Semiconductor Industries becoming more efficient and achieving higher returns on the same amount of capital. The company’s stock has also performed very well over the past five years, a pattern that investors are taking into consideration. That said, we still believe the company’s fundamentals are favorable and therefore worth further due diligence.

Finally, we’ve found 1 warning sign for BE Semiconductor Industries you should be aware of.

BE Semiconductor Industries isn’t the only stock producing high return on equity, and if you want to know more, check out this free list of companies with solid fundamentals and producing high return on equity.

Valuation is complicated, but we’re here to simplify it.

Our detailed analysis, including fair value estimates, potential risks, dividends, insider transactions, financials and more, will help you determine whether BE Semiconductor Industries is undervalued or overvalued.

Access free analysis

Have feedback about this article? Concerns about the content? Please contact us directly or email us at editorial-team (at) simplywallst.com.

This article by Simply Wall St is of general nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodology, and our articles are not intended as financial advice. It is not a recommendation to buy or sell a stock, and does not take into account your objectives or financial situation. We aim to provide long-term analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned herein.