Taiwan Semiconductor is playing a key role in the widespread adoption of AI.

Taiwan Semiconductor (TSM -4.20%) Taiwan Semiconductor is arguably the most important company in the world. It is a contract chip manufacturer and without its chip foundries, the technological marvels of Nvidia, AMD and Apple would not be possible. The company’s shares are down about 10% from their all-time highs, but is now the time to take advantage of this discount and buy Taiwan Semiconductor shares?

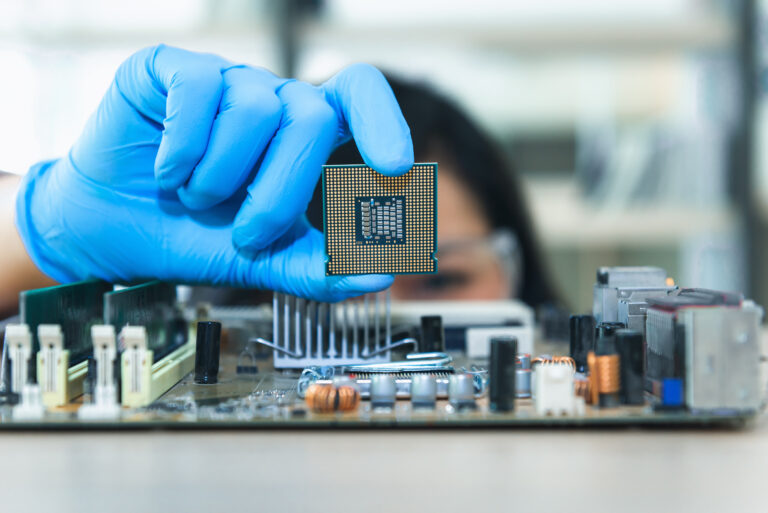

TSMC has best-in-class technology

Taiwan Semiconductor has been a leader in semiconductor manufacturing for many years, and because they are manufacturer neutral, it doesn’t matter who has the best product – they will benefit from the overall trend towards more advanced technology adoption.

TSMC is one of the few companies capable of manufacturing 3nm (nanometer) chips, the most powerful chips available today. The distance these chips are named for corresponds to the distance between the wires on the chip. By comparison, the width of a human hair is about 80,000 to 10,000 nanometers. This gives investors an idea of just how small these chips can get.

The shorter distances between wires mean more logic and transistors can be packed onto chips, encouraging companies like Taiwan Semiconductor to innovate and release even more powerful chips.

The next generation of chips is already in development, with TSMC’s 2nm chips scheduled to start production in 2025. Pre-production demand for these chips is outstripping demand for 3nm and 5nm, so management is very excited about this technology.

While 2nm chips can be configured for higher processing power, the real improvement is in energy efficiency: When configured for the same computational power, these chips are expected to consume 25% to 30% less power than previous-generation chips. Given that power input is a huge cost for computing servers dedicated to training artificial intelligence (AI) models, it’s no wonder these chips are in high demand.

Taiwan Semiconductor is expected to reap big profits in the coming years because it partners with just about every company that needs chips.

Significant growth expected in the coming years

Management didn’t provide precise guidance for the fiscal year, but said it expects revenue to grow at a compound annual growth rate (CAGR) of 15% to 20% over the “next few years.” That’s massive sustainable growth for a company the size of TSMC, but it’s easy to see how it might be possible given the massive demand for the company’s chips.

This is primarily due to the surge in demand for AI computing power, with management expecting this segment to grow at a 50% CAGR and account for more than 20% of total revenues by 2028. That’s a lot of growth, but how will it impact the stock price?

Let’s say TSMC can maintain its current profit margins of 38% while achieving a revenue CAGR of 15% between now and 2028. Over the course of four years, TSMC would generate $134 billion in revenue and $50.9 billion in profits.

Using Taiwan Semiconductor’s 10-year average price-to-earnings (P/E) ratio of 20 as our base valuation case, it suggests the stock could rise 14% from here.

TSM PE ratio data from YCharts.

That’s not a very attractive investment, especially considering it will take four years to get back to that level. If we tweak our assumptions to assume that TSMC’s revenue will grow 20% and that its terminal P/E ratio will be 24 (a five-year average), that upside increases to 63%, which equates to a 13% CAGR in the stock price, above the long-term market average.

Still, TSMC would need to hit the high end of expectations to achieve that, and there isn’t much room for error. However, I still think this could be an opportunity to buy TSMC’s shares, as the company has strong growth prospects. Investors need to realize that high expectations are priced in, even if the current stock price is down 10% from its all-time high.

Keithen Drury invests in Taiwan Semiconductor Manufacturing. The Motley Fool invests in and recommends Advanced Micro Devices, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.