CNN

—

Once the world’s most valuable company, AI chip giant Nvidia has suddenly found itself in an unfamiliar position of major impasse.

NVIDIA (NVDA) suffered its worst day in stock market history on Tuesday, as measured by the loss of total market cap: its shares fell 9.5%, dropping the company’s market cap to a staggering $279 billion, far surpassing the previous record of $240 billion set by Meta in 2022.

To put this shocking stock price drop into perspective, only 27 companies on the planet are worth as much as Nvidia lost on Tuesday. That $279 billion loss is worth more than the combined stocks of some of America’s largest companies, including McDonald’s, Chevron and Pepsi.

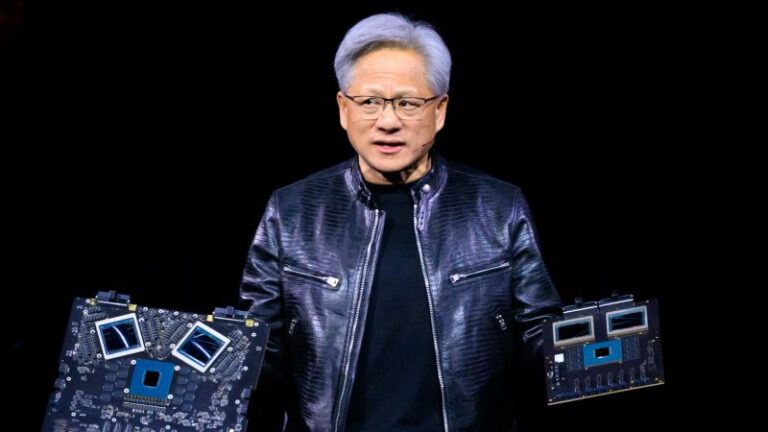

Nvidia’s largest individual shareholder (fifth overall if you include institutions like BlackRock), CEO Jensen Huang, personally lost $10 billion in Nvidia’s selloff on Tuesday.

The company’s market capitalization topped $3.3 trillion on June 18, the highest ever for a publicly traded company, but has been declining since then. Investors have grown skeptical of the inflated valuations of Nvidia and other AI stocks as the U.S. economy begins to show signs of stress. Stock traders worry that a potential weakening of the economy could discourage companies from investing in promising but still risky and unproven technologies.

Despite last week’s impressive earnings, Nvidia’s somewhat muted outlook disappointed investors who were hoping for further gains, sending the stock price lower.

Nvidia shares have fallen more than 20% from their peak on June 18. Microsoft, which has invested heavily in AI technology, is down 12% from its recent high. Shares of Nvidia’s semiconductor manufacturer, TSMC, have fallen 18% since mid-July.

Meanwhile, Intel, once the world’s largest chipmaker, has seen its shares fall 59% this year and faces unique challenges reinventing itself and entering the AI space.

But Nvidia could face another problem: The government is reportedly investigating the company for possible antitrust violations.

A large part of Tuesday’s stock price plunge was due to the Department of Justice sending the company a subpoena as part of an antitrust investigation, according to Bloomberg. CNN could not independently verify the subpoena, and the Justice Department declined to comment directly on a potential antitrust investigation.

Nvidia announced Wednesday afternoon that it had not received a subpoena from the Department of Justice.

“We have reached out to the U.S. Department of Justice but have not received a subpoena,” an Nvidia spokesperson said in a statement. “That said, we are happy to answer any questions regulators have about our business.”

The Biden administration has been going hard on big tech companies, launching investigations and lawsuits against companies like Apple, Google, and Amazon. It’s unclear whether the administrations of Kamala Harris and Donald Trump will continue those lawsuits, but both administrations have criticized tech companies for a variety of reasons during their election campaigns.

Nvidia slid another 1.7% on Wednesday. The Nasdaq Composite Index, which fell more than 3% on Tuesday, was down 0.3% on Wednesday.

Still, AI bulls continue to believe in Nvidia. The company’s shares have risen 118% this year, giving it a market capitalization of $2.7 trillion, third behind Apple and Microsoft. Huang said last week that demand for the company’s latest AI chips, Blackwell, “far exceeds supply.” And even as competition heats up, demand for Nvidia’s chips is growing.

And so far, at least, the investment is paying off, Huang argues.

“Those investing in Nvidia infrastructure are seeing immediate benefits,” Huang said last week, noting that the company’s new graphics processing units, or GPU chips that power AI, process data so efficiently that they can immediately save customers money.

That’s why bulls like Wedbush’s Dan Ives see Nvidia’s stock price drop as a buying opportunity.

“NVIDIA has transformed the technology and global landscape with its GPUs becoming the new oil and gold for the IT industry,” Ives said in a note to investors on Tuesday.

–CNN’s Ramisha Maruf contributed to this report

Correction: Correction: An earlier version of this article misstated the relationship between TSMC and Nvidia. TSMC makes chips for Nvidia.