Those interested in Navitas Semiconductor Corporation (NASDAQ:NVTS) will know that co-founder Daniel Kinzer recently sold $465k worth of stock in the company at an average price of $3.10 per share. However, the good news is that the sale only reduced his holding by 3.3%, which doesn’t mean much on its own.

Check out our latest analysis for Navitas Semiconductor

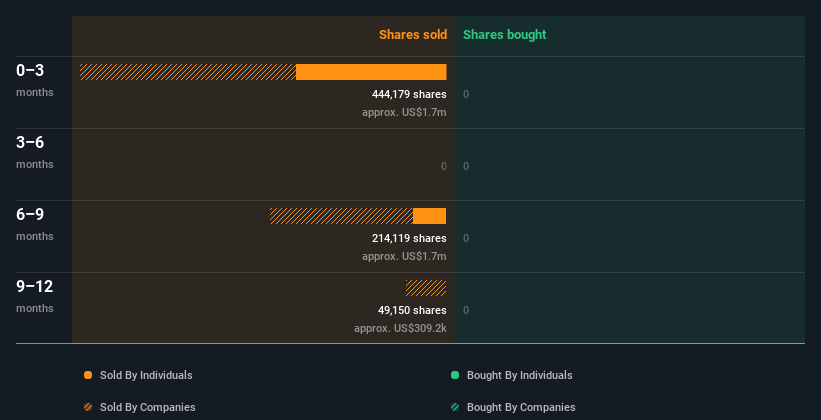

Insider transactions at Navitas Semiconductor in the last 12 months

In fact, the recent sale by Daniel Kinser was the largest insider sale of Navitas Semiconductor shares in the last 12 months, according to our records. We don’t generally like insider selling, but the lower the sale price, the more concerned we become. Fortunately, the sale was made at above the most recent price (US$2.58), therefore it’s difficult to draw any firm conclusions from this sale.

Navitas Semiconductor insiders haven’t bought shares in the last year. The chart below shows insider transactions (by companies and individuals) over the past year: You can click on the chart to see all the individual transactions, including the stock price, individual, and date.

If you’re like me, then you will not want to miss this free list of small cap stocks that are not only being bought by insiders, but also have attractive valuations.

Navitas Semiconductor Insider Ownership

For common shareholders, it’s worth checking how many shares are held by company insiders. Typically, the higher the insider ownership, the more likely they are incentivized to grow the company in the long term. It’s great to see that Navitas Semiconductor insiders own 19% of the company, worth about US$108m. We like this level of insider ownership as it increases the likelihood that management has shareholders’ best interests in mind.

So what does this data tell us about Navitas Semiconductor insiders?

Insiders have recently sold, but not bought, Navitas Semiconductor shares. Looking back over the last 12 months, our data doesn’t show any insider buying. High insider ownership is good to see, but insider selling makes us wary. It’s good to know what’s going on with insider ownership and transactions, but we also make sure to consider the risks a stock is facing before making any investment decisions. Every company has risks, and Navitas Semiconductor has 5 warning signs (of which 1 is significant!) you should know about.

Of course, you may find great investments by looking elsewhere, so take a peek at this free list of interesting companies.

For the purposes of this article, insiders are individuals who report their transactions to the relevant regulatory body. Currently, we count only open market transactions and private dispositions of direct interests, not derivative transactions or indirect interests.

Valuation is complicated, but we’re here to simplify it.

Through a detailed analysis including fair value estimates, potential risks, dividends, insider transactions, financials, and more, we determine whether Navitas Semiconductor is undervalued or overvalued.

Access free analysis

Have feedback about this article? Concerns about the content? Please contact us directly or email us at editorial-team (at) simplywallst.com.

This article by Simply Wall St is of general nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodology, and our articles are not intended as financial advice. It is not a recommendation to buy or sell a stock, and does not take into account your objectives or financial situation. We aim to provide long-term analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned herein.