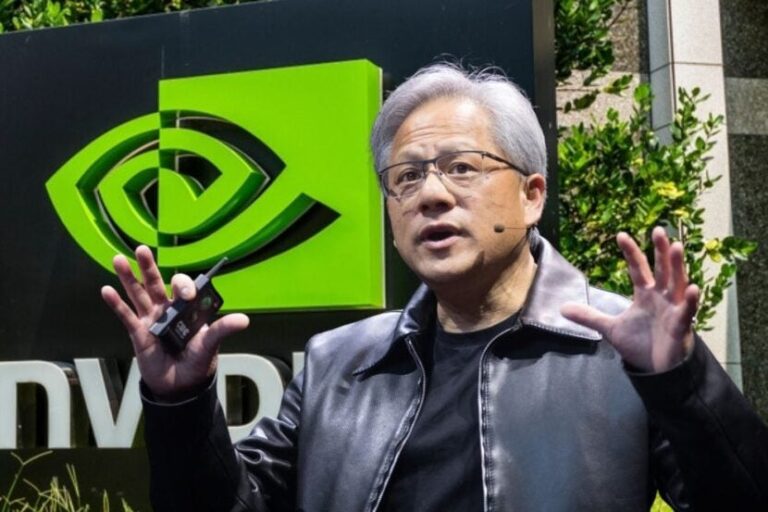

NVIDIA Inc. NVDA The artificial intelligence (AI) market is expected to soar to a $10 trillion valuation, according to Beth Kindig, principal technology analyst at I/O Fund, who highlighted the potential of NVIDIA’s next-generation AI chip, Blackwell.

What happened: Kindig believes Nvidia’s Blackwell chips will significantly increase the company’s value, despite recent investor concerns about valuation and production delays, Kindig said in an interview with Yahoo Finance on Thursday.

Nvidia shares fell more than 6% on Thursday after the company reported second-quarter profit slightly above expectations.

Kindig stressed that Nvidia’s growth trajectory will become clearer once Wall Street upgrades its financial outlook, and he predicts that Blackwell’s shipment volume data in 2025 will be a key moment for the company.

“It’s like fireworks, is how I would put it. The absolute, ultimate fireworks for Blackwell will come in the first quarter with their second-quarter guidance,” Kindig said. “The fireworks will come again for Nvidia early next year, and we’ll be well on our way to $10 trillion.”

Related story: Dollar General says the majority of shoppers at its stores “feel worse off financially” than they did six months ago due to rising prices and lower employment levels

Why it matters: Hopes for Nvidia’s Blackwell chips aren’t new. Recently, Wedbush analyst Dan Ives likened Nvidia’s market dominance to the early career of LeBron James, highlighting the company’s long-term growth potential.

Moreover, NVIDIA’s efforts to maintain its lead in AI chips also include developing larger, more complex processors. As analysts have noted, these new chips are nearly twice the size of their predecessors and contain 2.6 times as many transistors, creating significant manufacturing challenges and impacting profit margins.

Despite these obstacles, demand for Nvidia’s AI chips remains strong. A slight delay in Blackwell’s production likely won’t dampen cloud-service providers’ focus on AI, said JPMorgan analyst Harlan Sah, who added that demand for Blackwell could outstrip supply until at least mid-2025.

Additionally, the market has evolved beyond the “Magnificent Seven” stocks that include Nvidia, according to Piper Sandler analyst Craig Johnson.

Price Action: NVIDIA shares closed at $119.37 on Friday, up 1.51% for the day. In after-hours trading, shares were down slightly 0.12%. Year-to-date, NVIDIA shares are up 147.81%, according to data from Benzinga Pro.

Read next:

Image courtesy of Shutterstock

This story was produced with Benzinga Neuro and edited by Kaustubh Bagalkote.

Market news and data provided by Benzinga API

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.