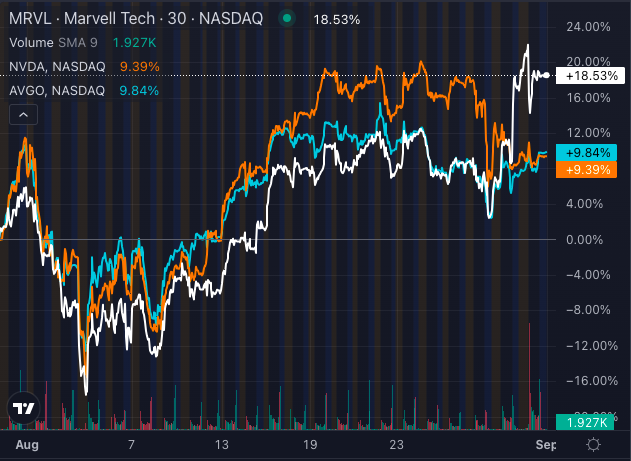

Marvel Technology Inc. MRVR The company has been a standout performer in the semiconductor sector, outperforming larger rival Nvidia. NVDA and Broadcom Inc. AVGO During August 2024.

Chart created using Benzinga Pro

Marvell’s stock price has risen by an astounding 18.53% in the last month, followed by Broadcom and NVIDIA, which have risen by 9.84% and 9.39%, respectively. This strong performance has attracted the attention of investors who want to take advantage of growth opportunities in the semiconductor industry.

Marvell’s Strong Market Positioning

Marvell’s strong performance stems from its strategic focus as a fabless chip designer with a large presence in wired networking. With the second-largest market share in this space, Marvell serves a variety of end markets, including data centers, automotive, and consumer electronics. Its portfolio of processors, switches, and storage controllers positions the company well to capitalize on growing demand across these sectors.

Related article: Marvell Technology shares rise in Q2, Q3 guidance strong

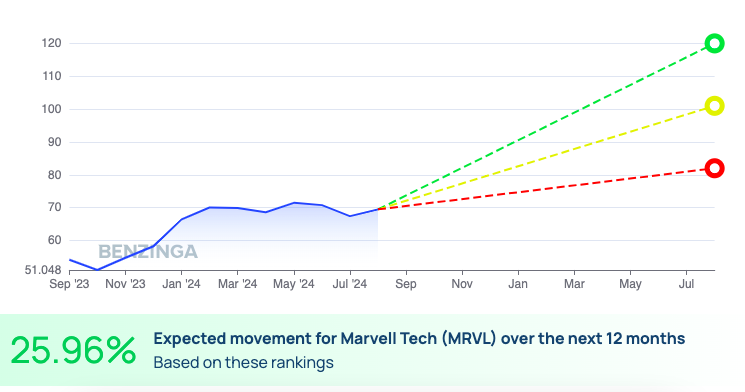

Benzinga Reports on Marvel Technology

Analysts remain bullish on Marvel, with a 12-month price target range of $82.00 to $120.00, and an average price target of $101.00. This suggests a potential upside of 25.96% over the next year, reflecting confidence in the company’s growth trajectory and market positioning.

Related article: Marvell Technology reports first better-than-expected profit growth in five quarters; analysts focus on ‘solid AI story’

Broadcom remains a strong competitor

In contrast, Broadcom, the world’s sixth-largest semiconductor company, has been expanding beyond its core semiconductor business into software in an effort to diversify its revenue streams. With annual revenues of more than $30 billion and a broad product portfolio across wireless, networking, and storage markets, Broadcom remains a strong contender in the semiconductor space.

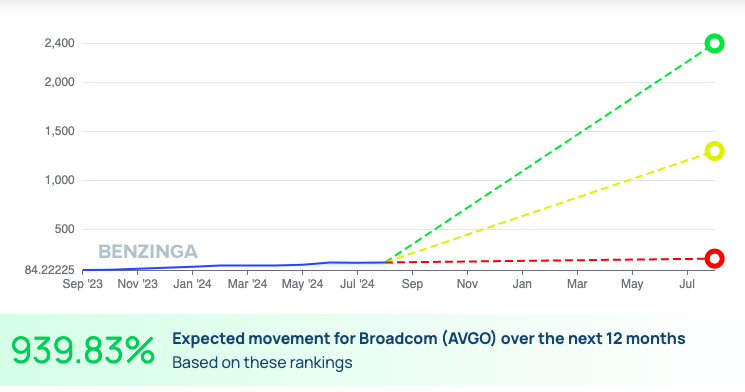

Benzinga’s report on Broadcom

Analysts have set a 12-month target price range for Broadcom of $200.00 to $2,400.00, with an average target of $1,300.00, suggesting an upside potential of 939.83%. Despite these encouraging numbers, Broadcom’s August performance was more modest than Marvell, suggesting that investors may currently prefer pure-play semiconductor stocks with strong market share and focused strategies.

Nvidia’s expanding footprint in AI

Nvidia, known for its dominance in the GPU market and growing foothold in AI and data center networking, delivered strong results in August but fell short of Marvell’s gains.

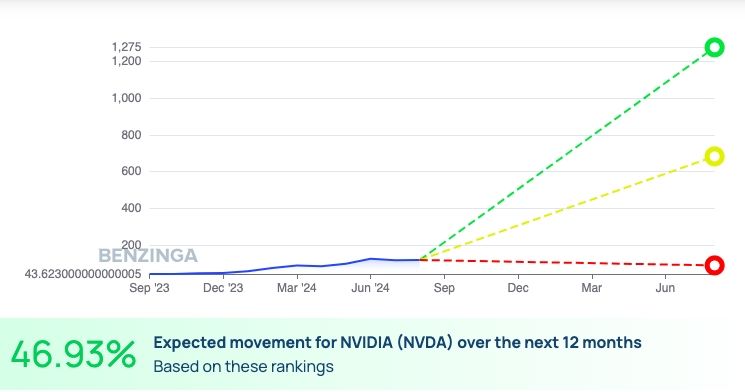

Benzinga report on Nvidia

Analysts have projected 12-month target price ranges for Nvidia ranging from $90.00 to $1,275.00, with the average being $682.50, implying an upside of 46.93%. Nvidia’s long-term growth prospects remain strong due to the increasing adoption of AI technology.

In the near term, however, investors may be wary due to the stock’s relatively weak upside compared to Marvel.

For semiconductor investors, Marvell’s recent strong performance is a signal to consider a stock with a focused market strategy and high growth potential.

Broadcom and Nvidia remain strong players, but Marvell’s agility and strong market positioning make it an attractive option for companies looking to take advantage of short-term gains in the semiconductor industry.

Read next:

Market news and data provided by Benzinga API

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.