This story also appears in CNN Business’ Nightcap newsletter: Sign up for free here to get it delivered to your inbox.

new york

CNN

—

Nvidia, the world’s leading AI chip manufacturer, just released an impressive earnings report that would be the envy of most companies. Second-quarter revenue grew 122%. Profits doubled. What’s the outlook for the current quarter? Positive.

In short, the numbers were great.

But Nvidia (NVDA) shares fell 7% after reporting earnings Wednesday night and continued to fall on Thursday, which is hardly cause for concern for a stock that’s up more than 150% this year.

But the drop says more about Wall Street than it does about Nvidia.

Here’s the problem: Wall Street has been on a roll with the AI hype for the past 18 months, with investors putting money into any area where they see potential AI benefits.

Once a relatively niche computer chip maker, Nvidia has been one of the biggest beneficiaries of this investment rush: its stock price has risen by about 3,000% over the past five years. The company (pronounced en-VID-eeyah) has ridden the frenzy to become one of the most valuable brands on the planet, with a market capitalization of $3 trillion, putting it on par with giants like Apple and Microsoft.

Given Nvidia’s central place in the AI narrative, the company’s quarterly earnings reports have taken on Super Bowl-like qualities, spawning their own viewing parties, memes, and endless, rapturous commentary. Over the past year-plus, the company has managed to far surpass expectations with each report, essentially training Wall Street to expect the unexpected.

But when Nvidia’s earnings were released on Wednesday afternoon, a somber mood began to settle in. Sure, Nvidia beat expectations. But we know what that means, better than expected was expected. And did it really beat everyone’s expectations as expected?

It was as if everyone on Wall Street had bought tickets to the hottest show on Broadway, only to find that all the lead roles had been played by understudies. A great show, a parade of incredible talent onstage, deserving of all the applause, but none of the magic of the original cast.

But this disappointment wasn’t the only thing weighing on Nvidia investors.

As the initial buzz around AI begins to fade, Wall Street is (finally) getting a bit clearer about what the technology is actually worth, and more importantly, how the companies driving it will actually generate revenue.

As my colleague Claire Duffy wrote earlier this month, big tech companies are spending billions of dollars on AI, yet seeing little results, and investors are starting to get nervous.

ChatGPT and Google Gemini are impressive enough, but not as groundbreaking as they’re being touted: What everyone really wants from AI these days is to make mundane tasks a little easier, but tech companies keep pushing products that delegate to bots the fun parts of being human, like writing fan mail or making music or drawings with your kids.

There’s good news and potential bad news for Nvidia investors.

While some on Wall Street suspect that AI is a bubble ready to burst, Nvidia itself is not a startup promising an AI revolution.

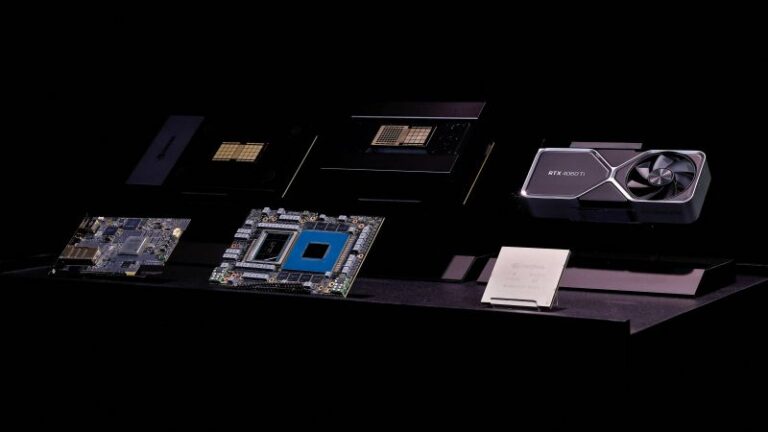

If you think of the AI boom as a kind of gold rush, Nvidia is the company that makes the axes and shovels. Their products were useful before the AI boom. Nvidia’s chips have been a hit with gamers for decades, and their products will be useful no matter what AI becomes. (The next Internet? The next dot-com bubble? The Fourth Horseman of the Apocalypse? The adventure is up to you.)

Nvidia’s chips are used not only in AI chatbots but also in ad targeting systems, search engines, robotics and recommendation algorithms, CEO Jensen Huang said in a conference call with analysts on Wednesday. The company’s data center business continues to account for about 90% of its total revenue.

That could be bad news. Nvidia makes incredibly complex and hard-to-replicate hardware, which is why even some of the tech giants, like Google and Amazon, rely on the company. But that won’t always be the case: Those big customers could eventually become big rivals, as virtually every one of them is racing to develop their own AI chips.