NVIDIA The company reported profits that beat Wall Street expectations after the close and gave a better-than-expected outlook for the current quarter.

Nvidia shares fell 3% in after-hours trading.

Here’s how the company performed against consensus estimates for LSEG:

Earnings per share: Adjusted 68 cents (64 cents) Revenue: $30.04 billion vs. expected $28.7 billion

Nvidia expects revenue of about $32.5 billion for the current quarter, well above the $31.7 billion that analysts were expecting, according to StreetAccount, and would represent an 80% increase from the same period last year.

The chipmaker’s revenue continues to soar, increasing 122% year over year in the quarter after three consecutive quarters of year-over-year growth of more than 200%.

Net income more than doubled to $16.6 billion, or 67 cents a share, from $6.18 billion, or 25 cents a share, in the same period last year.

Nvidia is one of the biggest beneficiaries of the ongoing artificial intelligence boom: Nvidia shares are up more than 150% this year after soaring nearly 240% in 2023. The company’s market capitalization recently surpassed $3 trillion, making Nvidia the world’s most valuable publicly traded company at one point, but it’s now second only to Apple.

Revenue from NVIDIA’s data center business, which includes its AI processors, rose 154% year over year to $26.3 billion, making up 88% of total sales, and also beat the $25.24 billion Street accounts were expecting.

Not all of the revenue came from chips: Nvidia said Wednesday that $3.7 billion of its revenue came from its networking products.

Much of the company’s business is with a handful of cloud service providers and consumer internet companies, including Microsoft, Alphabet, Meta and Tesla. Nvidia’s chips, such as the H100 and H200, are used in the majority of generative AI applications, including OpenAI’s ChatGPT.

Many customers are eagerly awaiting Nvidia’s next-generation AI chip, Blackwell. Nvidia said it shipped samples of the Blackwell chip during the quarter and made changes to the product to make manufacturing more efficient.

“We expect several billion dollars of sales from Blackwell in the fourth quarter,” Nvidia CFO Colette Kress said in prepared comments.

But Nvidia said it expects total shipments to increase over the next two quarters thanks to its current generation of chips, called Hopper.

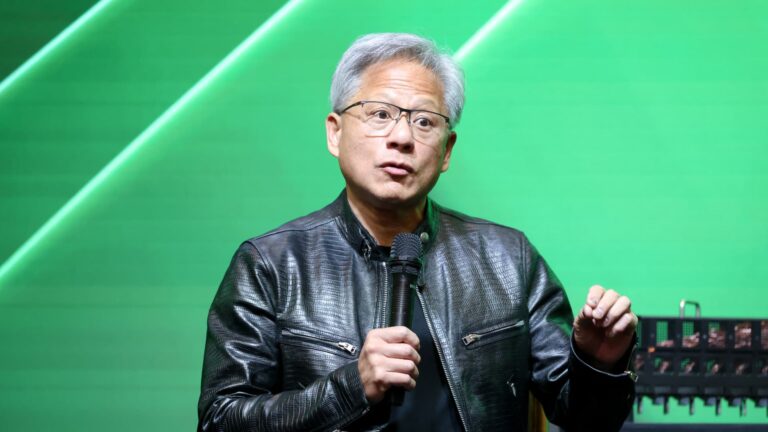

“Demand for Hopper remains strong and our expectations for Blackwell are incredibly high,” NVIDIA CEO Jensen Huang said in a press release.

Nvidia said its gross margin fell to 75.1% from 78.4% in the prior quarter, but was still up from 70.1% in the same period last year. For the full year, the company expects gross margin to be in the “mid-70% range.” Analysts had been expecting full-year gross margin of 76.4%, according to Street Accounts.

Before the data center took off, Nvidia’s gaming business was its bread and butter. Gaming revenue rose 16% year over year to $2.9 billion, beating StreetAccount’s forecast of $2.7 billion. The company attributed the increase in part to rising shipments of PC gaming cards and a rise in “gaming console SOCs.” Nvidia supplies chips for Nintendo’s consoles.

Nvidia makes chips for high-end graphic designers as well as cars and robots. Its graphics business grew 20%, to revenue of $454 million. Nvidia reported auto and robotics revenue of $346 million, beating expectations of $344.7 million.

Nvidia also announced that it has authorized $50 billion in share repurchases.