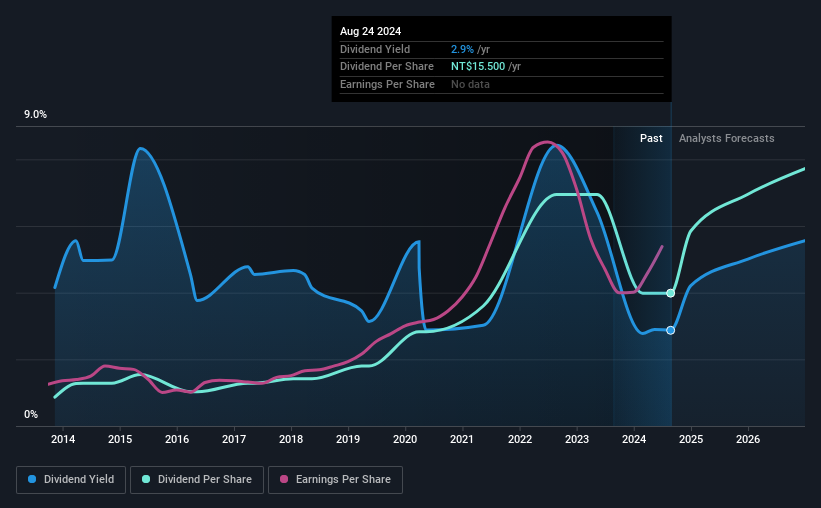

Realtek Semiconductor Corp. (TWSE:2379) announced that it will pay a dividend of NT$15.50 on October 4, down from the equivalent dividend paid last year. Despite the reduction, the dividend yield of 2.9% is still in line with other companies in the industry.

View our latest analysis for Realtek Semiconductor

Realtek Semiconductor Payout Delivers Strong Profit Coverage

A stable dividend yield is nice, but it’s not really useful if the payments aren’t sustainable. Based on the last payment, Realtek Semiconductor was fairly well-earned enough profits to cover its dividend, suggesting that much of the earnings are being reinvested into the business to fuel growth.

Over the next year, EPS is forecast to grow 71.3%. Assuming the dividend continues along recent trends, the dividend payout ratio could be 45% by next year, which is a fairly sustainable range.

Dividend fluctuations

The company has been paying dividends for many years, but has not done well with past dividend cuts. Annual dividends over the past 10 years have been NT$3.37 in 2014 and NT$15.50 in the most recent fiscal year. The compound annual growth rate (CAGR) over this period is approximately 16% per year. Realtek Semiconductor has rapidly increased its dividend despite having cut it at least once in the past. Companies that cut their dividends often do so again, so I would be cautious about buying this stock solely for the dividend income.

Dividends are likely to increase

With a relatively unstable dividend, it’s even more important to see if earnings per share are growing. Realtek Semiconductor has grown its earnings per share at 16% per year over the past five years, which is good to see. As the company is paying out a reasonable amount of profit to shareholders and is growing its earnings at a decent rate, we think it could be a decent dividend stock.

Realtek Semiconductor Looks Like a Great Dividend Stock

Overall, we think Realtek Semiconductor could be a great dividend investment choice, but we would have preferred if the dividend had not been cut this year. Cutting the dividend would have relieved pressure on the balance sheet and potentially stabilized the dividend in the future. Overall, this checks off many of the boxes we look for when picking an income stock.

Market movements prove how a consistent dividend policy is valued compared to a more unpredictable one. Still, investors need to consider a range of factors beyond dividend payments when analysing a company. Taking the discussion a bit further, we’ve identified 1 warning sign for Realtek Semiconductor that investors should be aware of going forward. If you’re a dividend investor, you might also want to check out our curated list of high dividend stocks.

New Feature: AI Stock Screener and Alerts

Our new AI stock screener scans the market daily to find opportunities.

• Companies with strong dividend yields (yields of 3% or more)

• Undervalued small cap stocks due to insider buying

• Fast-growing technology and AI companies

Or you can build your own indicator from over 50 available.

Try it free now

Have something to say about this article? Do you have any questions about the content? Contact us directly or email us at editorial-team (at) simplywallst.com.

This article by Simply Wall St is of general nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodology, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives or financial situation. We aim to provide long-term analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned herein.