In this article, we evaluated two semiconductor stocks: Nvidia (NVDA) and Advanced Micro Devices (AMD). A closer look reveals that in the long term, we are bullish on Nvidia and have a neutral view on AMD.

Both companies make semiconductors, but Nvidia focuses on applications such as artificial intelligence, gaming, cryptocurrency, electric vehicles and robotics. AMD is also trying to get into the AI space, but it also targets server, gaming and embedded chip markets, healthcare, laptops and desktop computers.

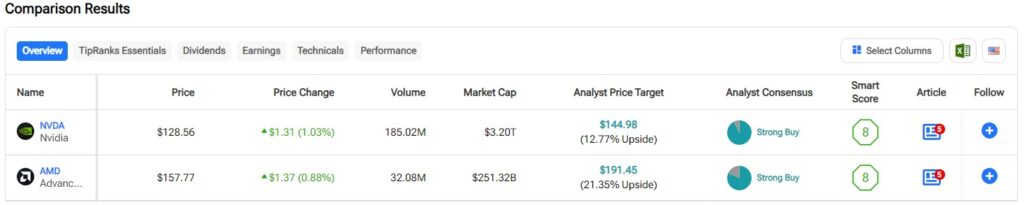

Nvidia shares are up 149% year to date and 162% over the past year, while AMD shares are up 3% year to date and 38% over the past year.

Given that Nvidia has risen significantly so far this year and AMD has barely risen, it may be a bit surprising that NVDA is valued at a fraction of AMD’s. We compare the price-to-earnings (P/E) ratios of the two companies to gauge their valuations and the industry as a whole.

By comparison, the semiconductor industry’s price-to-earnings ratio (PER) is 63.3, compared with an average of 36.3 over the past three years.

NVIDIA

At 75.2x earnings, Nvidia trades at a premium within its industry, which is unsurprising given the significant growth the company has achieved. Its forward price-to-earnings ratio of 42.5x is even more attractive and inspires a long-term bullish view on Nvidia.

There’s no question that Nvidia has a significant lead over AMD in AI, and it’s too cheap to ignore given its current multiple and long-term stock price growth: The company’s shares have traded near the middle to low end of a normalized P/E range of 37x to 107x since November 2019, excluding the March-September 2023 spike.

Nvidia shares have returned 3,080% over five years and about 26,800% over 10 years, making it a stock worth buying and holding for the long term.

One word of caution for investors: Nvidia is scheduled to report its second-quarter earnings next week, and if the results are disappointing, the stock could be volatile. However, this could be a great buy-in opportunity to add to or establish a new position.

Last quarter, Nvidia reported explosive year-over-year growth in revenue of more than 260% and net income of more than 628%, so the bar is set pretty high. However, investors could miss out on this stock if it spikes after the second-quarter earnings report — at least until the next dip.

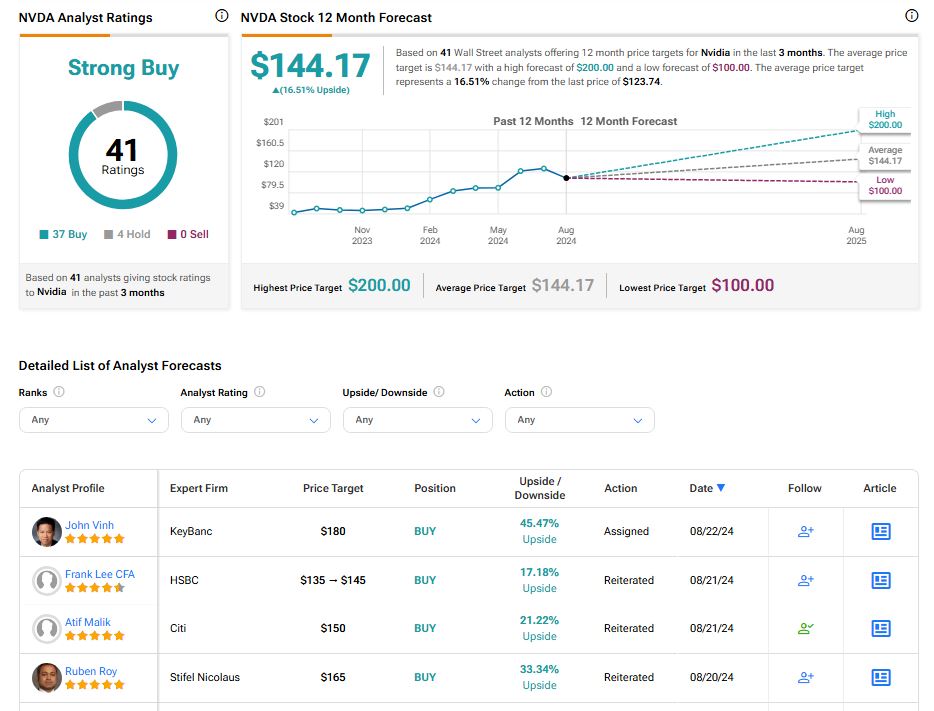

What is your price target for NVDA stock?

Nvidia has a strong buy consensus rating based on 37 buy, 4 hold, and 0 sell ratings in the past three months. NVDA’s average price target is $144.17, suggesting an upside potential of 16.51%.

See more NVDA analyst reviews

Advanced Micro Devices

Advanced Micro Devices is trading at a P/E of 189.9, well above the industry and Nvidia, despite being a laggard in the AI space. The company is catching up, but concerns are growing that it may be too late. AMD’s forward P/E of 35.9 is attractive, but there is no guarantee the company will deliver the results needed to achieve that. Therefore, a neutral view seems appropriate until we see real results in this space.

First, AMD reported that its latest quarterly revenue grew just 9% year over year, which is paltry compared to Nvidia’s growth, and its net income soared 881%, but only amounted to a paltry $265 million on billions of dollars in sales.

AMD reported record growth in its data center division and accelerating AI sales, but these gains have yet to positively impact its bottom line. The company launched new AI chips in June, and next quarter’s results will be key. But I’d like to see more tangible results before taking a more positive stance on this stock.

A big concern is the growing debate that AI investments could take years to recoup. If this debate becomes more widespread, AMD may end up lagging behind. For example, Goldman Sachs recently reported that tech giants are expected to spend more than $1 trillion on AI capital expenditures over the next few years.

If true, this could benefit AMD in the short term, but experts including MIT’s Daron Acemoglu and Goldman Sachs’ Jim Covello are skeptical that all the money invested will pay off.

Moreover, AMD’s focus on the data center could be problematic, as revealed by a recent Ernst & Young (EY) AI Pulse survey, which found that executives are pouring money into AI but not into the infrastructure needed to support it (exactly what AMD currently offers).

Some analysts at Goldman Sachs are optimistic about the potential benefits of AI investments, but there may be concerns that AMD shares are too late to jump on the trend. But there seems to be room in the semiconductor industry for two big AI companies, so AMD isn’t necessarily doomed in the long run. At current valuations, the stock just looks too expensive.

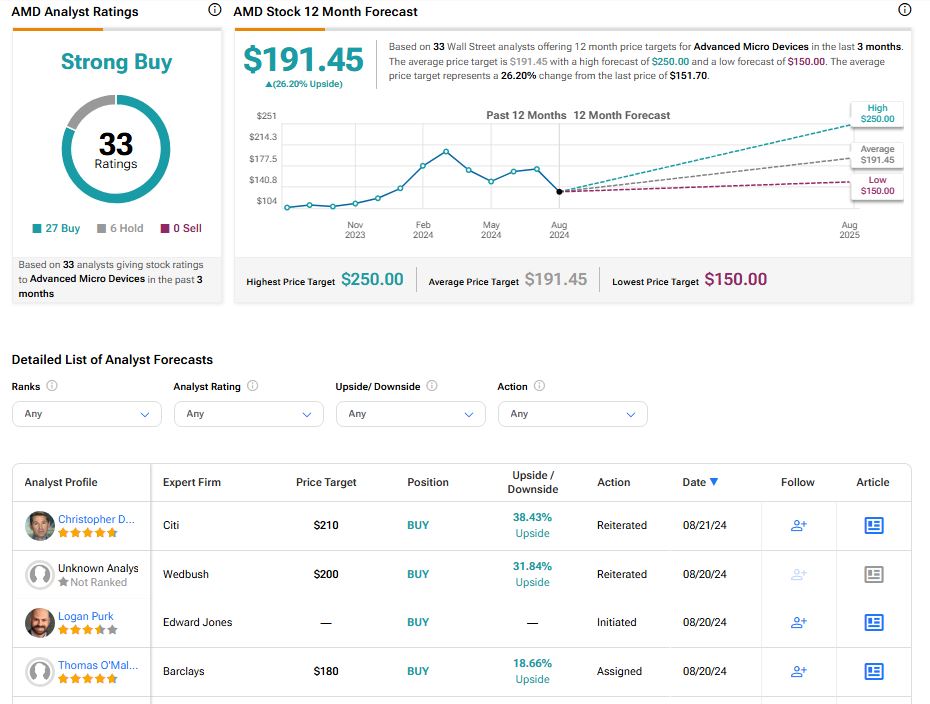

What is your price target for AMD stock?

Advanced Micro Devices has a Strong Buy consensus rating based on 27 Buy, 6 Hold, and 0 Sell ratings over the past three months. The average price target for AMD is $191.45, suggesting an upside potential of 26.20%.

See more AMD analyst reviews

Conclusion: NVDA Bullish, AMD Neutral

Nvidia and Advanced Micro Devices have been competing in the semiconductor space for years, with one outperforming the other at different times. This is Nvidia’s time to shine, but its current valuation isn’t necessarily enough. As for AMD, I’ll wait and see how their AI chips stack up against Nvidia’s.

Disclosure