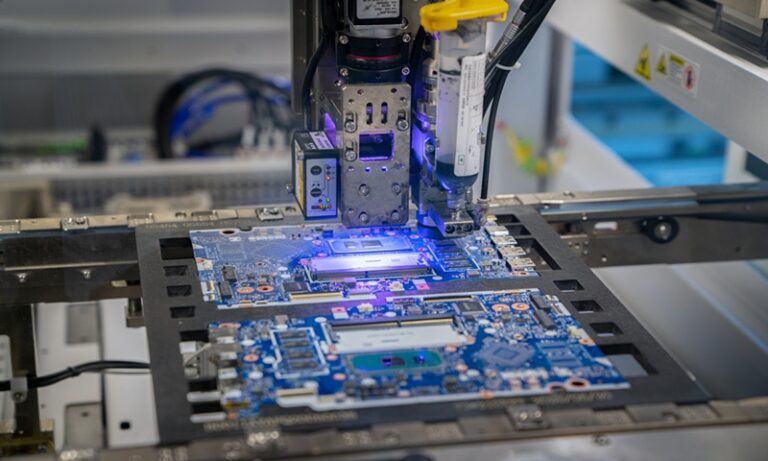

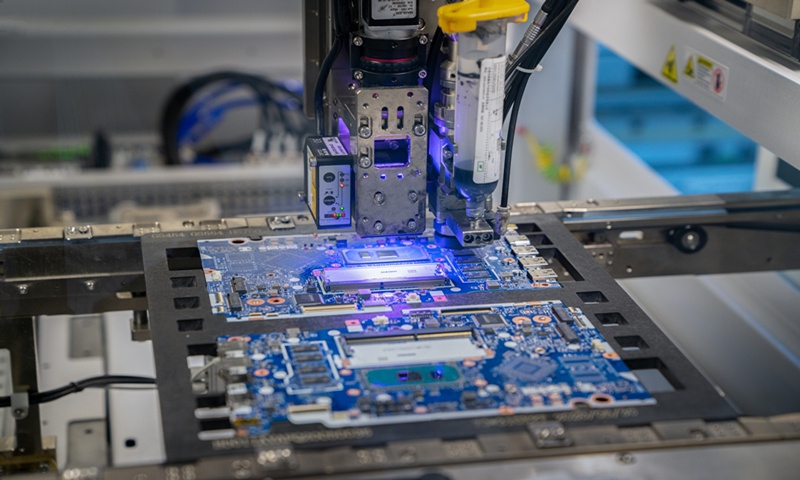

Chip manufacturing machine Photo: VCG

Chinese semiconductor companies posted impressive profits in the first half of the year as the global semiconductor industry showed a strong recovery.

Chinese analysts said on Wednesday that despite a reckless U.S. crackdown, Chinese semiconductor companies have made great strides towards self-reliance and become more visible in the global semiconductor industry.

Of the 68 semiconductor companies that released their first-half financial reports, 40 reported revenue increases of more than 50 percent, the Securities Times reported on Wednesday. There are 157 A-share listed companies in China’s semiconductor industry chain, according to Citic.

Companies that make storage chips, contact image sensor chips and system-on-a-chip products saw impressive gains, according to a Securities Times report.

The report provides insight into the current state of China’s semiconductor industry, which is benefiting from a revival of the domestic and international consumer electronics markets.

“Despite the harsh US sanctions in recent years, China’s semiconductor industry has not only survived but also thrived. It has seen significant growth in production capacity, especially in mature processes, and exports have soared, especially to Southeast Asian markets such as Vietnam, Malaysia and Indonesia,” Ma Jihua, a veteran telecoms industry observer, told the Global Times on Wednesday.

“This expansion has lowered costs, increased accessibility and generally stimulated innovation, becoming a key driver of the recovery of the global home appliances industry,” Ma said. “China’s contributions to this sector are undeniable.”

Wang Peng, an associate researcher at the Beijing Academy of Social Sciences, told the Global Times on Wednesday that the domestic semiconductor sector is expected to maintain an upward trend until 2025 due to several factors, including technological innovation, recovering market demand and policy support.

For example, Apple’s original equipment manufacturing partner, Foxconn, is significantly expanding its workforce at its manufacturing facility in Zhengzhou, Henan province in central China, to ramp up production ahead of the launch of Apple’s new iPhones.

Domestic media outlet Caijing estimated in a report on Monday that about 84.8% of Apple’s annual smartphone production of 230 million units will be assembled in China, with Foxconn’s Henan factory playing an irreplaceable role.

Christophe Fouquet, CEO of Netherlands-based lithography systems provider ASML, also said he believes the world needs “legacy chips” made in China, according to German business news outlet Handelsblatt.

Legacy chips are those made using older, less advanced technology, and analysts say the bulk of global demand for chips is still for legacy chips, due to a pyramidal structure.

Ma pointed out that fears of potential U.S. sanctions have led many Chinese companies to choose Chinese-made chips, a change that has expanded the market and greatly promoted the growth of China’s semiconductor industry.

“China’s advantages in mature semiconductor nodes are growing due to improved yields and lower production costs, leading many U.S. companies to become more reliant on Chinese products,” Ma said.

“Despite facing pressure, China’s semiconductor industry has not only withstood the challenges but is thriving, with a strong momentum for even faster growth in the future,” Ma said.

In the first seven months of 2024, China’s semiconductor exports reached 640.91 billion yuan ($89.85 billion), up 25.8% from a year earlier and a new record, official data showed.