It’s been a wild year for tech investors, no doubt. By July 10, the Nasdaq Composite Index had risen by more than 26%. Fueled by the investment community’s enthusiasm for artificial intelligence (AI), stocks in the sector have posted truly astounding returns, with flagship stock Nvidia posting a staggering 180% return over the same period.

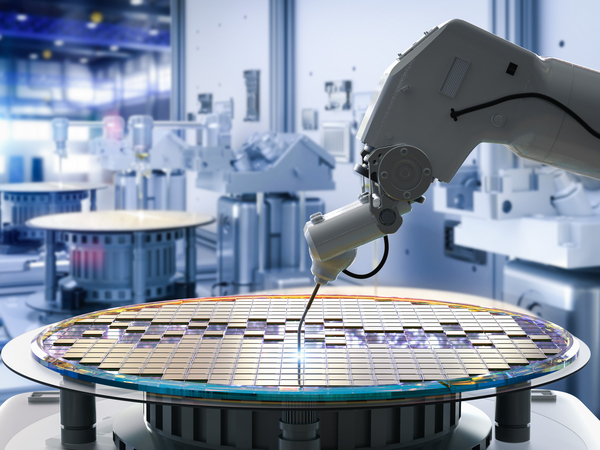

Nvidia is a semiconductor company, involved in creating computer chips. The ultra-advanced versions they design are the linchpin of the AI industry, and without them AI as we know it wouldn’t be possible. That’s why they, and other semiconductor companies, are so valuable.

The market has since cooled as investors consider current valuations and the possibility of a not-so-soft landing for the economy in the near future. Nevertheless, AI remains a promising future, and if you believe in its long-term thesis, now may be the best time to invest, with stocks discounted from their peaks just a month ago.

But where do you invest, say, $1,000? Instead of cherry-picking individual stocks (which is perfectly valid if done wisely), you can opt for exchange-traded funds (ETFs). These are bought and sold just like individual stocks. However, owning one allows you to invest in several companies at once, which is a great way to quickly and easily diversify your holdings. There are a variety of ETFs out there, but thematic ETFs are one of the more interesting ETFs that focus on a specific sector or market area, such as semiconductors. Let’s take a look at my favorite semiconductor ETF and one alternative.

This is the best performing semiconductor ETF this year and my favorite.

The best performer this year by a sizeable margin has been the largest semiconductor ETF, the VanEck Semiconductor ETF. (SMH 0.80%)This ETF has returned 40% so far this year. A large part of this success is due to the ETF’s heavy bias towards Nvidia. Over 20% of the ETF is invested in the company. This chart shows the top 5 stocks. Note the sharp drop from 2nd to 3rd place.

Company % of net worth Nvidia 20.8 Taiwan Semiconductor Manufacturing 13.8 Broadcom 8.5 Texas Instruments 4.9 Advanced Micro Devices 4.9

Now, this has to do with how VanEck invests its funds, or the index that the ETF is designed to track. The fund is passively managed, meaning that the fund manager does not actively buy or sell assets at his discretion. Instead, it mimics a specific index, in this case the MVIS US Listed Semiconductor 25 Index (MVSMH). It tracks the 25 largest semiconductor companies that generate at least half of their revenue from semiconductors or semiconductor equipment. This index has proven to be a success for VanEck. Let’s take a look at its returns over the past three years compared to its two major competitors:

SMH data by YCharts

This ETF has consistently outperformed its competitors. Although there is a management fee (this is true for all ETFs), it is low at just 0.35%, or $35 per year per $10,000 invested. This is quite cheap for an ETF. The main issue with this ETF is its concentration. The ETF is heavily weighted towards just a handful of companies. This is one of the reasons why this ETF has higher returns than some of its competitors, but it also comes with higher risk.

There are options out there that offer a bit more diversification, like the iShares Semiconductor ETF. The iShares offering invests in about 10 more companies, with less concentrated weighting at the top. Of course, this is only slightly less concentrated. These are very targeted ETFs, after all. They are meant to be held as part of a broad, diversified portfolio.

Johnny Rice has no position in any of the stocks mentioned. The Motley Fool owns shares in and recommends Advanced Micro Devices, Nvidia, Taiwan Semiconductor Manufacturing, Texas Instruments, and iShares Trust – iShares Semiconductor ETF. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.