As GenAI continues to advance, concerns are growing that many jobs could be at risk as this revolutionary technology offers a more efficient and cost-effective way to carry out tasks traditionally performed by humans.

But one big name on Wall Street doesn’t share this gloomy outlook: Citadel founder and CEO Ken Griffin remains skeptical that AI will surpass humans in many areas.

“Some people are convinced that within three years, almost everything that humans do will be done in some form by JDs or other AI tools,” said Griffin, who has a net worth of $37.3 billion. “For a number of reasons, I’m not convinced these models will achieve such a breakthrough in the near future.”

Griffin said certain scenarios, like a car driving through snow or adapting to a “regime-changing world,” aren’t well suited to machine learning models.

Meanwhile, Griffin has taken a contrasting approach to big AI companies: In the second quarter, he decided to sell most of his Nvidia (NASDAQ:NVDA) shares, but at the same time, he increased his stake in Palantir (NASDAQ:PLTR).

So let’s take a closer look at these names and see what’s behind Griffin’s latest moves, and with the help of TipRanks database, we can also find out how the Street analyst community feels about his selections.

NVIDIA

When talking to market watchers about the AI-fueled rise that’s driving the current bull market, the conversation naturally turns to Nvidia. Once known primarily as a maker of GPUs for gamers, the midsize company has established itself in recent years as the undisputed king of AI chips. The reason is quite simple: Nvidia’s chips are the best.

The company has been so successful that it briefly became the most valuable company in the world earlier this year, and a look at the company’s most recent quarterly results shows a recent trend of consistent outperformance.

The company’s first-quarter (April quarter) revenue was $26 billion, up 262.2% year over year, beating market expectations by $1.45 billion. Bottom line results were similarly impressive, with adjusted EPS of $6.12, beating expectations by $0.54. And, as has become customary for semiconductor companies of late, future guidance again beat expectations, with Nvidia expecting second-quarter revenue of $28 billion (plus or minus 2%) compared to market expectations of $26.84 billion.

But Griffin doesn’t seem to be waiting to see if Nvidia will release another stellar report at the end of the month (August 28): During the second quarter, he reduced his holdings by 80%, selling 2,421,072 shares for a total of $299 million.

Griffin’s move may be prescient: The billionaire believes the stock has peaked and that the future may not be as good as it has been in the past year and a half. Indeed, the company has recently faced some problems, with a design flaw delaying shipments of new Blackwell AI chips.

DA Davidson analyst Gil Luria said investors should keep a close eye on how the situation unfolds. “We believe the Blackwell delivery delays will be short-lived and have limited impact, but they certainly change the NVIDIA story,” Luria explained. “We expect record performance for the remainder of the year given the significant increases reported by mega-cap customers, but are more cautious about subsequent years, especially FY26, as consensus expectations suggest NVIDIA’s mega-cap customers will give up margin expansion for good. While the Blackwell shipment delays could cause a short-term blip, we need to evaluate this carefully and not mistake it for an inevitable cycle turn.”

Luria also took a cautious stance, rating the stock Neutral, but his $90 price target suggests the stock could fall 27% over the next year. (To watch Luria’s track record, click here)

However, Griffin and Luria’s views don’t align with most of the Street. The stock has a strong buy consensus rating, based on a combination of 37 buys and 4 holds. The average price target of $144.17 suggests the stock could rise another 17% from here. (See NVDA stock price forecast)

Palantir (PLTR)

From one big AI company to another: Palantir is another company relevant to the hot trend right now, and its stock has benefited greatly from all the hype, with shares more than doubling in value over the past year.

Palantir, known as a big data analytics company, provides a software platform that helps organizations integrate, manage, and analyze vast amounts of data. Since its founding in 2003, Palantir’s products have primarily been used by government agencies, including intelligence and defense agencies, but the company is aggressively trying to expand into the commercial sector.

That’s where AI comes in. Last year, Palantir launched its Artificial Intelligence Platform (AIP), a suite of tools and technologies designed to streamline the development, deployment, and management of AI models and applications. It integrates various AI capabilities, including machine learning, natural language processing, and data analytics, into the platform, helping organizations efficiently leverage AI capabilities.

And the product is gaining momentum, as evidenced by the company’s recent Q2 report. U.S. commercial revenues increased 55% year over year, well above guidance of 45%, while total revenues reached $678.13 million, up 27.2% overall and beating expectations by $25.71 million. Meanwhile, adjusted EPS was $0.09, beating analysts’ expectations by $0.01. Looking ahead, for the third quarter, the company expects revenues to be in the range of $697 million to $701 million, which is above the consensus estimate of $680.2 million.

Griffin must have loved every bit of it: In the second quarter, he bought 5,680,767 shares of PLTR stock, now worth more than $176.1 million.

Wedbush analyst Daniel Ives, a big fan of the company, also praised the latest results, saying, “The company has many skeptics in the market, but this was a ‘show me what you can’ quarter that validates the company’s expanding partner ecosystem. The company is gaining share as more use cases for its products grow, demand for enterprise-scale generative AI solutions grows across industries, and the AI revolution reaches its second, third, and fourth derivatives. This was an important validation quarter/outlook for Palantir and the broader AI revolution thesis.”

In fact, Ives is the Street’s most prominent PLTR bull, rating the stock Outperform (i.e. Buy), while his $38 price target implies a roughly 22% upside for the stock over the next 12 months. (To watch Ives’ track record, click here.)

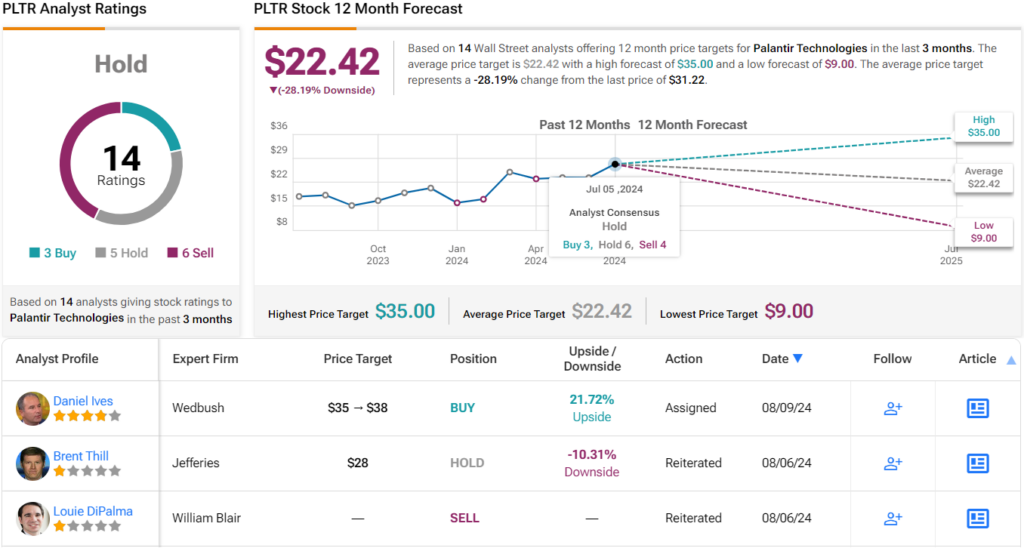

However, Griffin and Ives are in the minority here, as the stock only asserts a Hold consensus rating, based on a combination of 5 Holds, 6 Sells, and 3 Buys. Furthermore, the average target price of $22.42 has investors bracing for a 28% downside over the next year. (See PLTR Stock Forecast)

To find great ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, our tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is for informational purposes only. It is extremely important that you conduct your own analysis before making any investment.