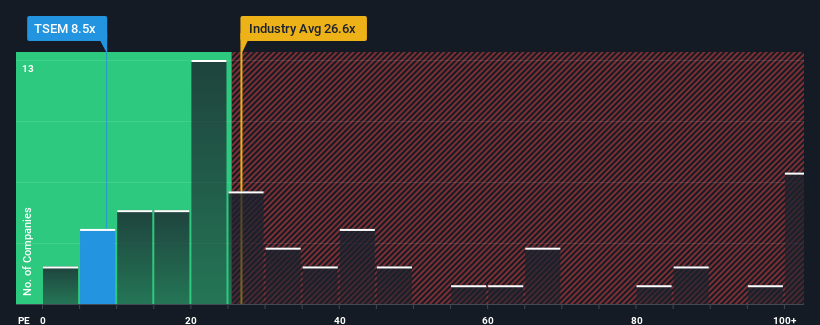

Considering that almost half of U.S. companies have P/E ratios above 18, and P/Es above 32 are not uncommon, Tower Semiconductor Ltd. (NASDAQ:TSEM) has a price-to-earnings (P/E) ratio of 8.5x that may be sending a very bullish signal at the moment. However, there may be a reason why the P/E is quite low, and further investigation is needed to determine if it is justified.

It’s good news for Tower Semiconductor recently, as the company’s earnings have been rising even as market earnings have been declining. One possibility is that the price-to-earnings multiple is low because investors believe the company’s earnings will soon decline like other companies. If this is not the case, existing shareholders have reason to be quite optimistic about the future direction of the stock.

Read our latest analysis for Tower Semiconductor

Want the full picture of analyst forecasts for the company? Our free report on Tower Semiconductor can help shed light on what the future holds.

Is the growth worth the low P/E?

The only time we’d be truly comforted by a stock with a sluggish price-to-earnings ratio like Tower Semiconductor’s is if the company’s growth is clearly on track to lag the market.

Looking back, the company saw its earnings per share grow by an impressive 78% last year, and over the last three years, its EPS grew by an impressive 355% overall, buoyed by short-term performance, so shareholders would likely have welcomed this medium-term earnings growth.

Looking ahead, EPS is expected to languish, declining 20% each year for the next three years, according to the four analysts who follow the company — a disappointing result considering the market is expected to grow at 11% per year.

Given this information, it’s not surprising that Tower Semiconductor’s P/E ratio is lower than the market. However, declining profits are unlikely to translate into a stable P/E ratio over the long term. If the company doesn’t improve its profitability, its P/E ratio could fall to even lower levels.

Final Words

While you should generally be careful not to overinterpret price-to-earnings ratios when making investment decisions, sometimes price-to-earnings ratios can reveal a lot about what other market participants think about a company.

As expected, a look at Tower Semiconductor analyst forecasts reveals that the outlook for declining earnings is impacting the company’s low P/E ratio. At this stage, investors feel that the potential for earnings improvement is not great enough to justify an increase in the P/E ratio. In this climate, it is difficult to see the stock price rising significantly in the near future.

Additionally, you should be aware of 2 warning signs we’ve spotted with Tower Semiconductor (and 1 which is a bit unpleasant)

It’s important to find great companies and not just the first idea you see, so take a peek at this free list of interesting companies with strong recent earnings growth (and low P/E ratios).

Valuation is complicated, but we’re here to simplify it.

Through a detailed analysis including fair value estimates, potential risks, dividends, insider trading, financials, and more, we determine whether Tower Semiconductor is undervalued or overvalued.

Access free analysis

Have feedback about this article? Concerns about the content? Please contact us directly or email us at editorial-team (at) simplywallst.com.

This article by Simply Wall St is of general nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodology, and our articles are not intended as financial advice. It is not a recommendation to buy or sell a stock, and does not take into account your objectives or financial situation. We aim to provide long-term analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned herein.