Key Takeaways

Semiconductor stocks could recover in the fourth quarter as seasonal headwinds abate, according to analysts at Bank of America Securities.

Chipmakers are off to a tough start to the third quarter amid growing volatility as recent jobs data raises concerns about the U.S. economy and expectations of an interest rate cut from the Federal Reserve change.

The iShares Semiconductor ETF (SOXX) is down about 14% so far in the third quarter of the calendar year, compared with about 2% for the S&P 500. But despite the recent decline, the exchange-traded fund that focuses on semiconductor stocks is up more than 11% since the start of the year, while the S&P 500 is up just over 12% in the same period.

The SOX Semiconductor Index rose about 0.7% on Monday but is still down 13% since the start of the third quarter.

Historically weak period for markets and semiconductor stocks

“If history is any guide, SOX could see a rebound starting in October,” the analysts said, noting that the fourth and first quarters on a calendar year basis have delivered average returns of 7% to 10.5% since 2010, beating the S&P 500 by about 400 basis points.

Semiconductor stocks may not be the only ones trying to pull out of a seasonally tough stretch: For the broader S&P 500 index, August and September have historically been its weakest months, while November and December are its strongest.

Bank of America warned that the U.S. election and geopolitical tensions could increase uncertainty later in the year, but historical data also shows markets tend to rally in presidential election years.

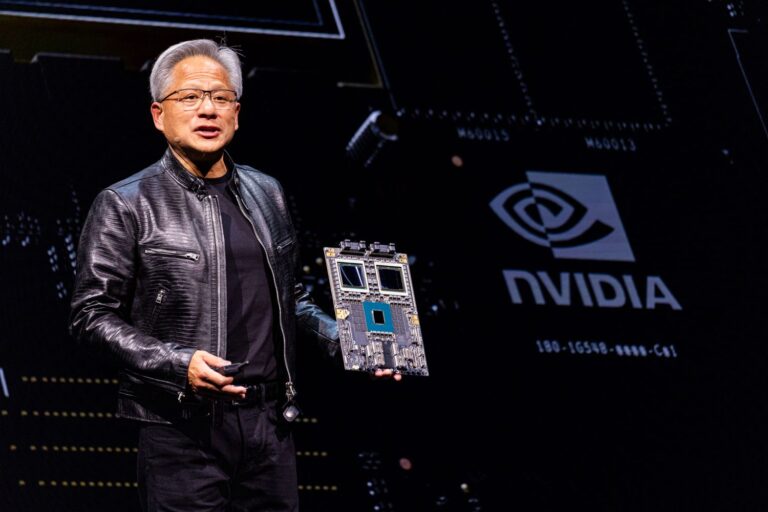

Nvidia, Broadcom among BofA’s top picks

Analysts said big chipmakers with heavy exposure to the data center market, such as Nvidia (NVDA) and Broadcom (AVGO), would be in a stronger position in their base case because cloud-computing giants such as Microsoft (MSFT) and Amazon (AMZN) are expected to increase spending on infrastructure.

Bank of America named Nvidia, Broadcom, and KLA (KLAC) the top semiconductor stocks overall, citing “they are consistent performers in their respective subsectors.”

Nvidia’s partners ARM Holdings (ARM), Micron Technology (MU) and ON Semiconductor (ON) could also be particularly well-positioned to benefit from a better-than-expected recovery based on their potential to rapidly expand sales if demand rises more quickly than expected, analysts said.

But if demand proves weaker than expected, analysts have turned their attention to Broadcom, Synopsys (SNPS) and Cadence Design Systems (CDNS), among other chip stocks, based on past performance.