Dow Jones futures will begin trading Sunday night along with S&P 500 futures and Nasdaq futures, with Apple (AAPL) and Nvidia (NVDA) in the spotlight.

Nvidia’s next-generation Blackwell AI chips will reportedly be delayed by months due to a design flaw, which could affect big buyers like Microsoft (MSFT), Google-parent Alphabet (GOOGL), and Meta Platforms (META).

Warren Buffett’s Berkshire Hathaway (BRKB) reported strong second-quarter profits on Saturday and also revealed that it had cut its holdings in Apple by nearly half.

↑

X

Palantir heads for gains as tech stocks remain under pressure

Indexes, major stocks sell

Stocks suffered a sharp and broad selloff last week as weak economic data, including Friday’s July jobs report, and Amazon.com Inc.’s (AMZN) warning of consumer headwinds stoked fears of a recession.

Fed Chairman Jerome Powell hinted on Wednesday that a rate cut was on the way, and by Friday markets were expecting a 50 basis point cut in September and at least 100 basis points by the end of the year.

The Russell 2000 and Dow Jones fell to key support levels along with many non-tech stocks, while the S&P 500 and Nasdaq fell well below key levels.

Amazon.com (AMZN) tumbled on declining profits, Nvidia and other semiconductor stocks suffered big losses, and Tesla (TSLA) fell to a key support, shedding much of its recent gains.

The silver lining? The contrarian market fear index has surged to its highest level in more than a year.

Apple shares rose slightly last week, surpassing a key level. Meta Platform also rose but is well off its highs. Ollie’s Bargain Outlet (OLLI) and Neurocrine Biosciences (NBIX) also showed resilience, and MercadoLibre (MELI) hinted at a buy point on Friday.

However, investors should be extremely cautious with new purchases while trimming loss-making stocks.

Dow Jones Futures Today

Dow Jones futures begin trading at 6pm ET on Sunday, along with S&P 500 and Nasdaq 100 futures. Market reaction to Buffett’s Apple sale and Nvidia AI chip delays will be key.

Bitcoin dipped well below $60,000 on Sunday and continued to fall amid risk aversion in financial markets.

Remember that overnight movements in Dow futures or any other stocks do not necessarily translate into actual trading in the next regular stock market session.

Future main earnings

Notable reports this week include Palantir Technologies (PLTR), Supermicro (SMCI), Caterpillar (CAT), and Embraer (ERJ), as well as pharmaceutical giants Eli Lilly (LLY) and Novo Nordisk (NVO).

But they all seem to be hurting. Palantir and Supermicro are big artificial intelligence stocks. Caterpillar and Embraer will provide insight into the industrial and aerospace markets, respectively. Eli Lilly and Novo are leaders in weight-loss drugs.

IBD experts break down major stocks and markets on IBD Live.

Stock market rise

It’s been a terrible week for the stock market rally, especially considering Wednesday’s bullish rally on AI optimism and the Fed meeting. Thursday’s selloff pretty much dashed market expectations, and the big selloff continued on Friday.

The Dow Jones Industrial Average fell 2.1% in the stock market last week. The Russell 2000, a small-cap index that hit a 30-month high on Wednesday afternoon, ended down 6.7%. Both indexes tested their 50-day lines on Friday but closed above those key levels.

The S&P 500 Index fell 2.1%, while the Nasdaq Composite Index fell 3.35%, both below their 50-day lines and below the previous week’s lows. The Nasdaq has entered traditional medium-term correction territory.

The Russell 2000 and Dow Jones Industrial Average, which have more “real economy” weightings than the tech-heavy Nasdaq, posted big gains in July as markets priced in a Fed rate cut, but as the focus shifts to recession fears, those indexes are falling, as are bank, industrial and aerospace stocks.

Defensive growth stocks in discount retail, insurance and health care held up, along with defensive utilities and consumer staples stocks.

Although the index closed off Friday’s lows, it is still down significantly, and the weekly chart shows no real rebound.

The 10-year Treasury yield fell 40 basis points for the week to 3.795%, nearly below its late December low. The 2-year Treasury yield fell 52 basis points to 3.87%, the biggest weekly drop for either bond since March 2023. The yield gap is the narrowest it has been inverted in two years.

U.S. crude oil futures fell 4.7 percent last week to $73.52 a barrel, hitting a two-month low on Friday.

Market fears soar

The CBOE Volatility Index (VIX) surged Friday to its highest level since March 2023, as the market’s measure of fear surpassed its October 2023 and April 2024 peaks.

While excessive fear may signal a market bottom, at least in the short term, it may not happen quickly or last long, and market fears could grow even more if recession fears continue to grow.

ETF

Among growth stock ETFs, the Innovator IBD 50 ETF (FFTY) fell 7.8% last week, while the iShares Expanded Tech-Software Sector ETF (IGV), which includes Palantir shares, fell 5.4%.

The VanEck Vectors Semiconductor ETF (SMH) plunged 9.1%, with Nvidia shares as its top holding.

The SPDR S&P Metals & Mining ETF (XME) fell 7.7% last week. The Global X U.S. Infrastructure Development ETF (PAVE) dropped 4.9%. The SPDR S&P Homebuilding ETF (XHB) lost 4.7%. The Energy Select SPDR ETF (XLE) fell 4.1% and the Healthcare Select Sector SPDR Fund (XLV) gained 0.6%. Eli Lilly stock was a big holding.

The Industrial Select Sector SPDR Fund (XLI) fell 2.8%, led by Caterpillar stock, while the Financial Select SPDR ETF (XLF) fell 3% and the SPDR S&P Regional Banking ETF (KRE) fell 9.2%.

Reflecting more speculative names, the ARK Innovation ETF (ARKK) plunged 9.9% last week to its lowest level since November, while the ARK Genomics ETF (ARKG) tumbled 9.7%. Tesla shares are major holdings across Ark Invest ETFs.

Timing the Market with IBD’s ETF Market Strategy

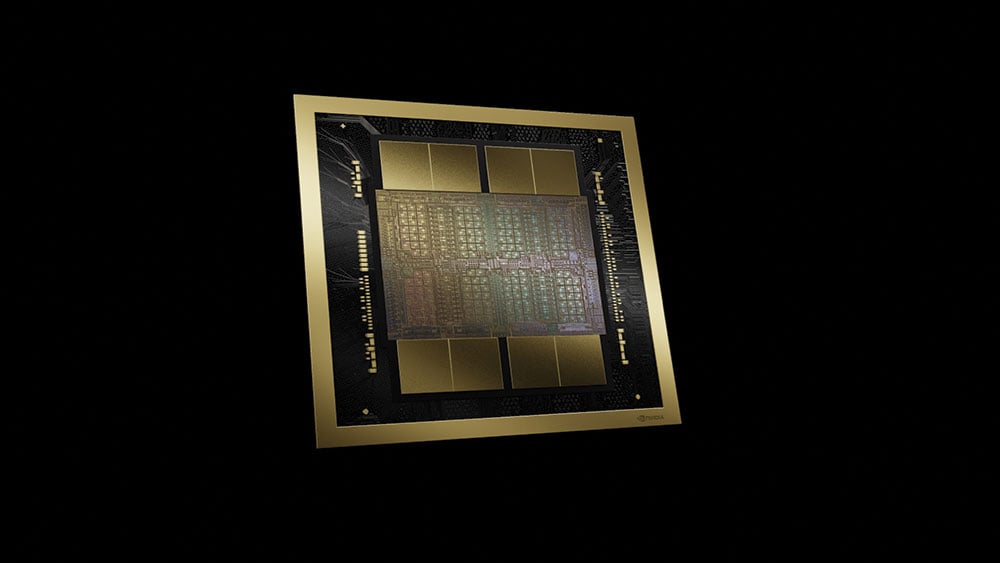

Nvidia AI chip launch delayed

Nvidia has told Microsoft and another major cloud customer that the launch of its Blackwell artificial intelligence chips will be delayed by at least three months due to a design flaw, The Information reported Saturday, citing Microsoft employees and other sources, which could affect the AI efforts of Microsoft, Google, Meta and others.

The delay to Nvidia’s next-generation chips could have a significant impact on its earnings in the coming months, and it could also be a boon for Advanced Micro Devices Inc., which was expected to again lag behind Nvidia’s chip performance.

NVDA shares fell 5.1% to $107.27 last week after multiple reports that the Department of Justice was investigating the semiconductor giant over its dominance in AI. The stock has rallied significantly since hitting an intraday low on Friday.

Nvidia reportedly delays launch of next-generation chips, with major impact on AI sector

Warren Buffett’s Berkshire Hathaway

Berkshire Hathaway’s after-tax operating profit rose 15.5% to $11.6 billion, driven by interest income from insurance underwriting and the company’s huge cash holdings.

Warren Buffett has sold nearly half of his vast Apple stake amid rumors he may reduce his holdings following some declines in AAPL over the past two quarters.

BRKB shares fell 2.1% last week to 428.51, falling below a 430 buy point on Friday.

Tesla stock

TSLA shares fell 5.5% last week to trade at 207.67, between its 50-day and 200-day lines. The stock has fallen 23% since hitting a 10-month high of 271 on July 11.

The Delaware Court of Chancery on Friday heard a case regarding Elon Musk’s 2017 compensation agreement that was invalidated earlier this year. Shareholders reapproved the agreement in June, but it’s unclear whether the court will give it legal effect.

Hot Stocks

Apple shares rose 0.9% this week to $219.86. The stock nearly touched its 10-week line before closing just below its 21-day moving average. The relative strength line, which tracks a stock’s performance against the S&P 500 index, is at a 2024 high.

It will be interesting to see how AAPL stock reacts to Warren Buffett drastically reducing his stake in the iPhone giant.

Meta shares rose 4.8% this week to 488.14, but closed below their 50-day line after surging on profits on Thursday.

Neurocrine shares rose 4.3% this week to 153.14, bouncing off its 10-week line before rising 8.2% on Thursday after earnings put it into a buy zone, according to MarketSurge analysis. The stock continued to hold up on Friday.

Ollie’s shares fell sharply on Friday morning but pared losses after testing the 50-day and 10-week lines. Shares were up 0.4% for the week at $96.41. Ollie’s shares are below the 21-day line and could become tradeable if they fall further, which would be nice if they could establish a new baseline.

MercadoLibre shares rose 7.5% this week to 1,776.14, bouncing off their 40-week line and re-topping their 50-day line. Friday’s 10.6% surge on impressive gains propelled MercadoLibre shares above trendline entries and an early entry of 1,764.50. The Latin American e-commerce and payments giant has an official cup-and-handle buy point at 1,792.05. Remember, in bad markets, it’s common for stocks to surge on gains and then fall.

What to do now?

The stock market rally took some serious damage last week. All of the major indexes seem to have taken some damage. Breakouts and setups have either failed or are under heavy pressure.

Investors should have reduced their exposure later in the week, especially if they had bought on Wednesday.

While market fear indices suggest a bottom is “near” the VIX and other sentiment indicators are secondary at best to the major indexes and flagship stocks.

Either way, don’t get excited about a strong market open or even a good day or two. Except for some stocks in the defensive and defensive growth sectors, the indexes and leading stocks need repairs.

Spend some time rebuilding your watchlist, which may have been pared down compared to the past few days.

Nvidia stock is on the leaderboard, MercadoLibre is on the flagship IBD 50 list.

Read The Big Picture every day to stay on top of market direction, leading stocks and key sectors.

For stock market updates and more, follow Ed Carson on Threads at @edcarson1971 and on X/Twitter at @IBD_ECarson.

You might also like:

Want to make quick profits and avoid big losses? Try SwingTrader

Best growth stocks to buy and watch

IBD Digital: Get IBD’s premium stock lists, tools, and analysis now

Copper prices are a bet you can’t miss. Why power-hungry AI and EVs will power FCX and TECK.

Apple leads 5 stocks near buy points