Nvidia’s stock has been extremely volatile in recent months as investors look to the future, and the evidence is clear.

There’s no escaping it: The emergence of artificial intelligence (AI) early last year has been a huge boon for chipmaker Nvidia. (NVDA -1.78%)The company’s graphics processing units (GPUs) have long been the gold standard in video games, data centers and the nascent fields of AI.

Adoption of generative AI is set to take off in earnest in early 2023, and Nvidia has been the hottest company to watch. The company controls about 92% of the data center chip market (where most of generative AI resides), according to IoT Analytics, and its stock price has risen nearly 700% in that time. But all of this gains haven’t been in a straight line, and Nvidia’s stock price plummeted 23% in the last three weeks of July.

The stock’s slump stems from concerns that AI adoption may soon fade. Though the company has delivered triple-digit revenue and profit growth over the past year, investors are beginning to wonder if the end is in sight. The evidence is starting to pile up, providing a clear answer to the classic investor question: Is it too late to buy Nvidia stock?

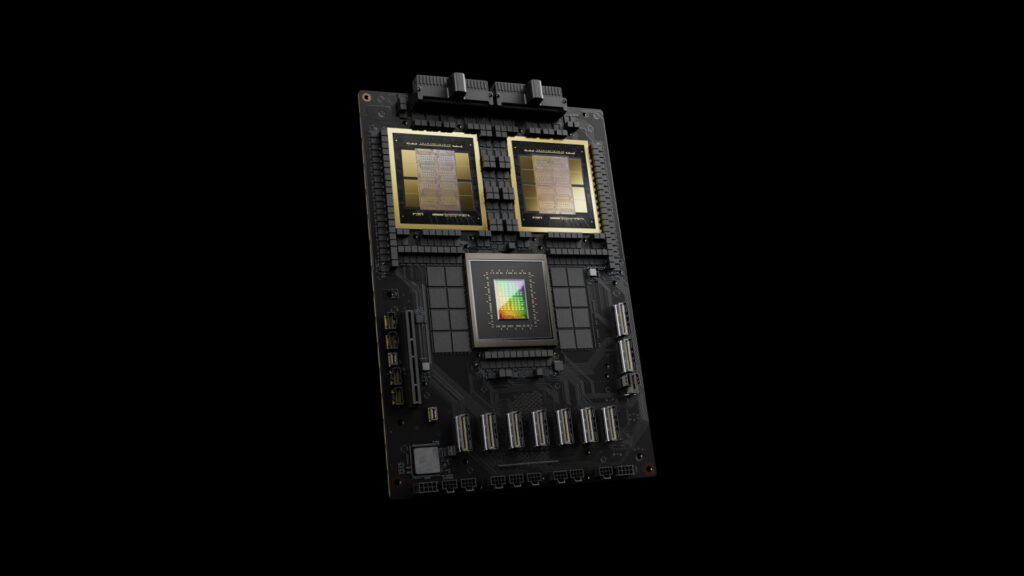

Nvidia’s GB200 Grace Blackwell superchip. Image source: Getty Images. https://nvidianews.nvidia.com/multimedia/search?origin=multimedia&keywords=gb200

Demand Issues

Generative AI requires massive amounts of computing power to run the large language models (LLMs) that underpin the technology. This, combined with the sheer volume of data required, has meant that AI is primarily the preserve of the world’s largest technology companies, which also happen to be Nvidia’s largest customers. As these tech giants begin reporting their quarterly earnings, they are providing investors with insight into the state of AI adoption. And the evidence is compelling.

Alphabetical (Google -2.40%) (Google -2.35%) During the company’s second-quarter earnings call, CEO Sundar Pichai said of AI, “We’re in the early stages of what I believe is a very transformative space, and we’re investing aggressively up front in what will be defining spaces.” Indeed, the company’s $13.2 billion in capital expenditures (capex) exceeded many expectations, and Alphabet plans to spend roughly $12 billion per quarter for the rest of the year, with that spending “overwhelmingly” on servers and data centers needed for AI.

Microsoft has announced that in the fourth quarter of fiscal year 2024 (ending June 30), (MSFT -2.07%) The company also acknowledged that it is committed to AI-centric spending, with $19 billion in capital expenditures. CFO Amy Hood noted that “cloud and AI-related spending represents nearly all of our total capital expenditures.” Hood further noted that capital expenditures in fiscal 2025 are “expected to be higher than fiscal 2024.”

Meta Platform (Meta -1.93%) The company spent more than $8.1 billion on capital expenditures in the second quarter and now forecasts spending of $37 billion to $40 billion for the full year, with “significantly increasing capital expenditures in 2025 to support our AI research and product development efforts,” according to CFO Susan Li.

Nvidia’s biggest customer

These capital expenditure figures and accompanying executive commentary make it clear that big tech companies plan to continue investing heavily in AI in the future. Moreover, the fact that much of this spending will be on servers and data centers suggests that Nvidia will be a beneficiary of this spending.

Nvidia hasn’t disclosed the identities of its largest customers, but Wall Street has done some digging. Analysts at Bloomberg and Barclays crunched the numbers and concluded that Nvidia’s four biggest customers, which account for about 40% of its revenue, are:

Microsoft: 15% Metaplatform: 13% Amazon: 6.2% Alphabet: 5.8%

Three of the four have been forthcoming about their AI spending, and by the time you read this Amazon’s results will be out, leaving no doubt that its AI spending will be similarly strong.

The proof is in the results

The past year has been a whirlwind for Nvidia investors. After achieving triple-digit growth last year, the company is off to a record start this fiscal year. In the first quarter of fiscal 2025 (ended April 28), Nvidia delivered record revenue, up 262% year over year to $26 billion, driven by record data center revenue of $22.6 billion (up 427%). Profits also soared, with diluted earnings per share (EPS) increasing 629% to $5.98.

Nvidia is scheduled to report its second-quarter results after the market closes on Aug. 28, and if comments from customers of major tech companies are any indication, the company could have another strong announcement in store.

The company expects revenue of $28 billion, up 107% year over year, with margins rising accordingly. It’s worth noting that Nvidia has beaten its own expectations before, so it could be even higher.

Finally, at about 38 times forward earnings, Nvidia is trading at a slight premium, but that’s not surprising given the company’s triple-digit growth.

In my opinion, the majority of the evidence is clear: Nvidia stock remains a buy.

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and public relations at Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Danny Vena owns shares of Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool owns shares of and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.