A look at revenues shows that not all semiconductor companies are benefiting from the artificial intelligence boom, highlighting the complexity of the semiconductor supply chain. Companies like NVIDIA and AMD are benefiting from companies training AI models, and semiconductor manufacturers like TSMC are also getting a boost. But Arm and Qualcomm, which have less exposure to AI, have not seen the same dramatic revenue growth as the others.

Not all semiconductor companies are benefiting from the artificial intelligence boom, according to the earnings reports, highlighting the complexity of the semiconductor supply chain and how some companies have an advantage over others in different parts of the industry.

Many semiconductor companies have announced their results for the April-June quarter, with some results far exceeding expectations and others disappointing, providing a glimpse into how expectations for AI are affecting companies’ profits.

Currently, interest in artificial intelligence revolves around two keywords: large-scale language models (LLMs) and generative AI. LLMs require huge amounts of computing resources and data to train, and are the basis of generative AI applications such as chatbots from Google and OpenAI.

Big tech companies that train law students aren’t cutting spending. Mehta said Wednesday it expects capital expenditures to increase “significantly” in 2025 “to support our AI research and product development efforts.” Microsoft said this week that its capital expenditures rose nearly 80% year-on-year to $19 billion in the June quarter.

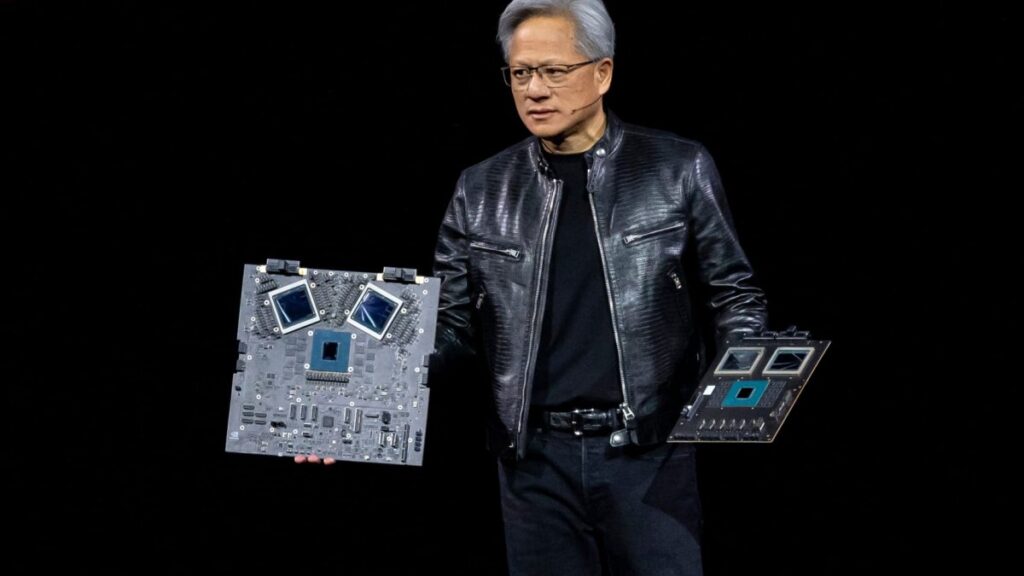

As tech giants continue to add computing resources, these spendings are a big boost for Nvidia, as its graphics processing units (GPUs) are used to train these LLMs.

But Nvidia’s rival AMD has brought its own chip to market for AI use, called the MI300X AI chip, and that’s starting to pay off. AMD said Tuesday it expects data center GPU sales to exceed $4.5 billion in 2024, up from the $4 billion it predicted in April. The company reported second-quarter profit and sales that beat market expectations.

Chip-making and tool companies also appear to be benefiting from the AI boom. TSMC, the world’s largest semiconductor maker, reported financial results last month that beat market expectations, with second-quarter net profit up more than 36% from the same period last year.

Meanwhile, ASML, which makes the specialized tools needed to manufacture the world’s most advanced semiconductors, announced last month that its net orders for the second quarter increased 24% year-on-year, citing notable demand from companies such as semiconductor manufacturer TSMC. Samsung announced that its second-quarter operating profit jumped 1,458.2% year-on-year.

However, not all semiconductor companies are benefiting from the increased investment in AI, because at the current stage of AI technology development, semiconductor companies are not very involved in AI technology.

Qualcomm and Arm saw their shares fall on Wednesday after both companies provided weak outlooks for the current quarter.

While both companies tout the importance of AI applications, the reality is that exposure to the technology remains very limited.

Arm designs the blueprints on which many companies base their chips, and its semiconductors are in most of the smartphones in the world. While many electronics companies talk about AI-enabled smartphones, this has not translated into underlying growth for chip designers.

The British company still derives most of its revenue from consumer electronics, rather than data centers, where AMD and Nvidia have had success, and analysts have previously told CNBC that Arm could benefit from AI as more devices incorporate the technology.

Qualcomm’s chips are in devices like smartphones made by Samsung, and the company still makes a lot of its money from those devices. Like Arm, Qualcomm’s silicon isn’t found in the type of data centers where law students train.

The company’s chips are scheduled to be used in Microsoft’s next AI PC, but this too is a long-term commitment for Qualcomm.