Stock markets are halfway through second-quarter earnings season and entering August with a stark shift from the trends that have dominated the market over the past year and a half.

Technology stocks, led by the Magnificent Seven, drove the S&P 500 to record highs in early July, but a mild inflation report changed everything. The Magnificent Seven entered a correction later that month as investors sold off tech stocks due to concerns about slowing growth, overbought conditions, and unsustainable spending on artificial intelligence.

Meanwhile, the Russell 2000 small-cap index soared as investors bought into companies that would benefit most from a rate cut widely expected by the Federal Reserve for the first time in September.

Here are five companies with upcoming events in August that could spark big price moves.

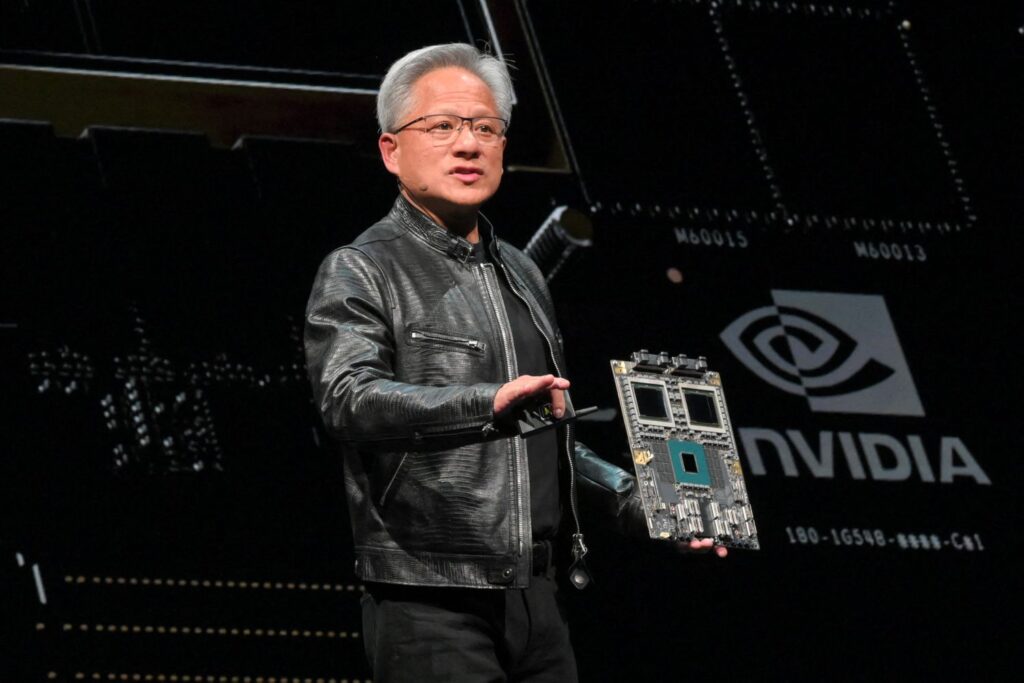

NVIDIA

Nvidia (NVDA) is due to report earnings at the end of the month, the results of which could have an impact on the broader market.

Nvidia’s AI boom has been going on for more than a year, making year-over-year comparisons for the chipmaker more difficult: Revenue and profit growth in the latest quarter are both expected to slow to their slowest pace since early 2023, according to analyst consensus estimates compiled by Visible Alpha. Still, revenue and profit are each expected to be more than double what they were last year.

Nvidia shares, like the rest of the Magnificent Seven, have lost some of their luster in recent weeks amid a shift from big tech stocks to smaller, mid-cap stocks, driven by a weak inflation report that bolstered confidence the Fed will soon cut interest rates, easing pressure on smaller companies with floating-rate debt.

Last week, Alphabet’s (GOOGL) earnings report raised concerns that cloud providers are overinvesting in artificial intelligence, fueling a selloff in tech stocks. Earnings from Meta (META) and Microsoft (MSFT) eased some of those concerns this week, but another strong report from Nvidia could reignite those concerns, putting more pressure on big tech stocks — or giving new energy to the AI trade.

Walmart

Walmart’s (WMT) earnings will provide some insight into the health of consumer finances.

Pressured by inflation and rising interest rates, Americans are prioritizing value, forcing retailers to slash prices en masse and fast-food chains to introduce value menus to retain customers.

Gabby Jones/Bloomberg/Getty Images

Walmart is one of the few companies benefiting from changing consumer behavior. The company in May reported first-quarter sales and profits that beat expectations. The company’s revenue has risen in recent quarters as more upper-income shoppers have struggled with rising prices. Also, continued inflation and economic uncertainty have led Americans to eat out less in recent quarters, helping support Walmart’s huge grocery business.

Wall Street expects Walmart’s revenue growth to slow in the second quarter but remain above pre-pandemic averages, with profit expected to hit the high end of previous guidance.

Home Depot

The second quarter is consistently Home Depot’s (HD) biggest quarter ever, but the world’s largest home improvement retailer is heading into its next earnings report in a precarious position.

Revenue and profits have fallen year-over-year for the past five quarters, and Wall Street expects the same to happen this quarter. Years of high inflation have curbed consumer discretionary spending, squeezing sales of appliances and other big-ticket items. At the same time, rising interest rates have cooled the U.S. housing market, prompting homeowners to put off renovations and upgrades.

Real estate agents and industry experts had hoped this spring’s home-buying season would reignite the U.S. housing market, but that didn’t happen: Existing home sales fell for the fourth consecutive month in June, while new home sales fell to the lowest level since November.

But there are some rays of hope: Mortgage rates have fallen in recent weeks as Wall Street grows more confident that the Federal Reserve will start cutting rates in September, pushing them further down. What’s more, housing inventory hit its highest level since 2008 in June, giving homebuyers plenty of options when they return to the market.

Investors and analysts will likely look to Home Depot’s guidance as evidence that management, like Wall Street, believes home improvement and sales activity could recover later this year.

CrowdStrike Holdings

CrowdStrike (CRWD) enters August with a focus on damage control.

The cybersecurity company caused a global technology outage when it released a software update for Windows on July 19. The disruption, which has caused havoc with airlines, banks and healthcare, is expected to cost Fortune 500 companies more than $5 billion. Delta Airlines (DAL) estimates its losses from the fiasco at $500 million and is reportedly preparing to sue the airline and Windows maker Microsoft for damages related to the outage.

CrowdStrike’s stock price plummeted by more than 11% on the day of the outage and has continued to fall since then.

CrowdStrike is scheduled to report second-quarter earnings later this month, with Wall Street predicting double-digit revenue and profit growth. But last quarter’s results may take a backseat in CrowdStrike’s earnings report as analysts focus on the outage and its impact on future revenue.

Paramount Global

Paramount’s (PARA) controlling shareholder National Amusements finally agreed to merge with David Ellison’s Skydance Media in July after months of negotiations.

The $8 billion deal, announced July 8, includes a 45-day “go-shop” period during which Paramount can solicit competing bids. The storied Hollywood studio received several competing offers during its negotiations with Skydance. Media mogul Byron Allen offered to buy the company’s outstanding shares for more than $14 billion in January, and private equity firm Apollo Management offered $11 billion in March to buy the company’s film and TV studios.

David Paul Morris/Bloomberg/Getty Images

Paramount’s board and controlling shareholder Shari Redstone may just want the process to be over after more than six months of acquisition talks, but the story has been full of twists and turns, including Redstone’s abrupt withdrawal from a deal that appeared to be in place with Skydance in June, and there could be another surprise in store in August.