(Bloomberg) — While the tech giants’ results have largely disappointed this earnings season, there was also plenty of good news for Nvidia.

Most Read Articles on Bloomberg

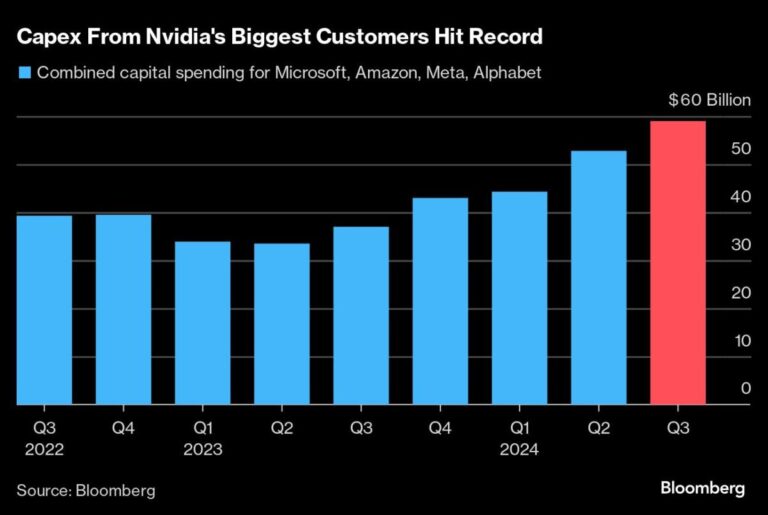

The company’s biggest customers, including Microsoft Corp., Alphabet Inc., Amazon.com Inc. and Meta Platforms Inc., have all pledged to further increase their capital spending over the coming year. The four companies spent a combined $59 billion on data center equipment and other fixed assets in the third quarter, a record high for the quarter, according to data compiled by Bloomberg.

“If you own Nvidia, the big buyers have to keep buying and buying more every quarter,” said Mike Bailey, director of research at Fulton Blakefield Broeniman. “You can check that box.”

The tech giant’s spending plans were exactly what bulls were looking for to keep Nvidia’s stock price rising. The stock has nearly tripled this year and rose 4.1% to close at a record high on Wednesday amid a general stock market rally following Donald Trump’s election victory. The Santa Clara, California-based AI chip maker overtook Apple Inc. this week to once again become the world’s most valuable company.

Earnings at big tech companies are also painting a rosy picture ahead of NVIDIA’s own earnings report, scheduled for November 20th. NVIDIA stock lost nearly $900 billion in market value from its June high to its August low amid questions about return on investment in AI and delays in new products. blackwell chips. The company has since recovered, helped by reassurances from CEO Jensen Huang that Blackwell’s production is on track. Concerns have been further allayed by the latest evidence that AI spending is robust.

Wall Street analysts are overwhelmingly positive about Nvidia, with 67 of the 75 analysts tracked by Bloomberg rating the stock a “buy.” The company also continues to raise its estimates, with its profit forecast for next year increasing by about 10% over the past three months, according to data compiled by Bloomberg. This has helped keep Nvidia’s valuation in check, currently trading at about 39 times forward earnings, down from its peak of more than 60 times last year.

William Blair analysts Sebastian Nagy and Jason Ader were among those who raised their forecasts for fiscal 2026, writing in a recent note that “NVIDIA’s ability to maintain its market-leading position in AI infrastructure” Our confidence in this will only grow stronger.” The AI appears to be “going full throttle,” they said.

story continues

UBS Wealth Management predicts that annual spending on AI by big tech companies will increase by 50% this year to $222 billion, and by another 20% in 2025.

“Microsoft, Alphabet, Amazon and Meta account for nearly half of all AI spending, and their strong balance sheets and investment appetite will continue to support strong growth in AI spending,” said UBS Global’s Chief Investment Officer, Americas. said Solita Marcelli. wealth management.

Investors should “take advantage of short-term volatility to build sufficient exposure to quality AI stocks,” he said.

Today’s technology chart

Lyft’s new strategy to attract more commuters appears to be working. Shares of the ride-hailing service rose more than 20% in premarket trading Thursday after the company issued strong guidance for both the current quarter and the full year. The results came as a relief to investors after major rival Uber Technologies Inc. reported disappointing results in late October.

top technology stories

Arm Holdings, a chip design company that went public last year, said its sales forecast for the current fiscal year was disappointing, suggesting that the still-recovering smartphone market could overshadow growth driven by artificial intelligence.

Qualcomm Inc., the world’s largest seller of smartphone processors, gave a bullish outlook for sales this fiscal year and pointed to bright spots in the mobile device industry. Shares soared in early trading Thursday.

Hours after Donald Trump was elected US president for the second time, Taiwan should devote more resources to advancing chip technology and expanding supply chain expertise to maintain global leadership said the most valuable company executive.

Earnings are paid on Thursday

pre-market

data dog

dyna trace

bentley systems

EPAM system

macom

ACI Worldwide

Nova

clear secure

Appia

Lightspeed Commerce Co., Ltd.

N possible

NCR Voyix Corp

commscope

scan source

Ceva

big commerce

B.C.

warner bros discovery

liberty broadband

endeavor group

nextstar media

Quebecor

Millicom

cogent communication

playtika

Tegna

tabula

Cars.com

advantage solution

vivid seat

shenandoah telecom

Thrive Holdings Co., Ltd.

iheartmedia

Town Square Media

After marketing

Arista Networks

motorola solutions

fortinet

cloudflare

Akamai

drop box

unity software

BILL Holdings Co., Ltd.

lumen

DXC technology

black line

jayfrog

Envest Net

ring central

diode

synapse

alarm.com

abe point

five nine

jamfu holding

SEMrush

Meridian Link Co., Ltd.

sprout social

Adair Co., Ltd.

PDF solution

Arlo Technologies

A10 Networks

Oro Co., Ltd.

indie semiconductor

consensus cloud

on24

pouch group

live person

trade desk

pinterest

News Corp

global star

Cargurus

grinder

Yelp

cable one

Ziff Davis Co., Ltd.

Magnite Co., Ltd.

Getty Images

event bright

system 1

Skills Co., Ltd.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP