Analog Devices (NASDAQ: ADI) The company is less well known in the semiconductor industry than giants like Nvidia and Taiwan Semiconductor Corp., which have reported phenomenal growth as they ride the rapid expansion of artificial intelligence (AI) adoption. That’s why the chipmaker’s shares are up just 12% this year, lagging behind the phenomenal gains of its peers and the broader semiconductor industry.

However, a closer look at the company’s most recent quarterly earnings and management commentary suggests that the chipmaker is on the brink of a recovery. With its products used in a variety of end markets, including industrial, automotive, consumer, and aerospace and defense, buying this semiconductor stock now could be a smart move for the long term.

Analog Devices struggles, but there are signs of recovery

Analog Devices last month reported its financial results for the third quarter of fiscal year 2024 (the three months ending August 3). The company’s sales were down 25% year over year to $2.31 billion, and non-GAAP earnings were down 37% year over year to $1.58 per share.

The chipmaker’s poor year-over-year performance was due to weak demand across nearly all end markets. For example, its analog business, the company’s largest division, accounting for 46% of revenue, saw its revenue decline 37% year-over-year. This is not surprising, as the division has yet to recover from the effects of oversupply caused by weak demand last year.

Specifically, weak demand for smartphones, personal computers and data centers led to an 11% decline in global semiconductor industry revenue in 2024. AI has emerged as the savior of the semiconductor industry over the past year, but Analog Devices has been unable to capitalize on this trend because it doesn’t manufacture graphics processing units (GPUs) like Nvidia and AMD.

However, management noted that last quarter’s performance beat expectations and that the end markets it serves may soon begin to recover.

Analog Devices expects revenue of $2.3 billion to $2.5 billion and adjusted earnings per share of $1.53 to $1.73 for the current quarter. The company’s revenue was $2.72 billion in the same quarter last year, so Analog’s year-over-year revenue decline is expected to slow to 11% this quarter. The company’s earnings decline should slow as well.

These signals that ADI’s end-market inventory correction may be nearing an end. “Improving customer inventory levels and order momentum across most markets increases our confidence that the second quarter will represent a cyclical bottom for ADI,” CEO Vincent Roche said in the company’s latest earnings call.

The story continues

If there is a chance of a recovery, the stock price could rise further.

Consensus estimates call for ADI’s revenue to fall 24% to $9.38 billion in fiscal 2024, with earnings falling to $6.33 a share from $10.09 a year ago. But in fiscal 2025, revenue is expected to rise 10% to $10.35 billion, with earnings rising nearly 20% to $7.57 a share.

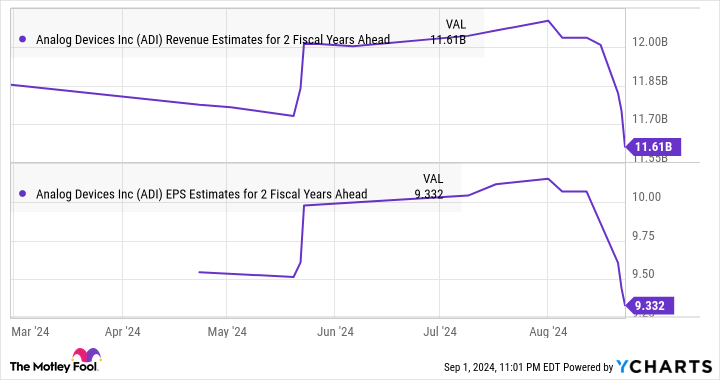

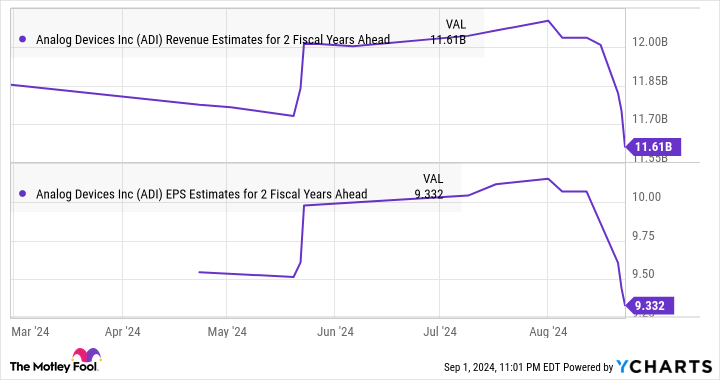

Although analysts are keeping their estimates for fiscal 2026 in check, they still expect Analog’s revenue and earnings growth to accelerate, as can be seen in the graph below.

Those estimates could rise further if Analog Devices’ results improve as end markets recover, giving the chipmaker a good chance to hit the gas and post even more profits in the coming years.

Should I invest $1,000 in Analog Devices right now?

Before you buy Analog Devices stock, consider the following:

The analyst team at Motley Fool Stock Advisor just identified the 10 best stocks for investors to buy right now, and Analog Devices wasn’t on the list. The 10 stocks selected are poised to generate big gains over the next few years.

Let’s look at April 15, 2005, when Nvidia made this list… if you had invested $1,000 at the time of our recommendation, you would have $630,099.!*

Stock Advisor offers investors an easy-to-follow blueprint for success, with portfolio construction guidance, regular updates from analysts and two new stock picks every month. Stock Advisor The service is More than 4 times S&P 500 Recovery Since 2002*.

View 10 stocks »

*Stock Advisor returns as of September 3, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool owns shares in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The article With a 12% Upside to 2024, This Semiconductor Stock You Might Want to Buy Before the Bull Market Started was originally published by The Motley Fool.