Although 2024 was a successful year for the market, not all companies did so well. Perhaps even more surprising is that companies essential to the semiconductor supply chain underperformed in 2024. However, I think it is ripe for a comeback in 2025.

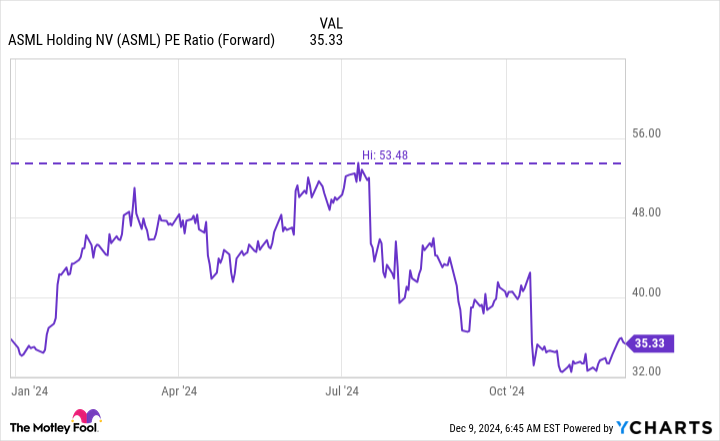

ASML Holding (NASDAQ: ASML) may be one of the most important companies on the planet, but few people know about it or what it does. The stock is currently down about 5% since the beginning of the year, but has risen as much as 45% in July. So why were investors turned off by ASML? It all has to do with the 2025 forecast.

ASML manufactures the machinery essential to manufacturing tiny chips. Uses extreme ultraviolet (EUV) lithography. These machines space the electrical traces on the chip just 3 nanometers (billionths of a meter) apart, and chip companies are working to get that spacing even closer. Without ASML devices, the smartphones, laptops, or GPUs driving AI models wouldn’t be as fast as they are today.

Moreover, the company has no competitors in this field. The company is the only one manufacturing these devices and no one can duplicate it. Catching ASML would require billions of dollars of investment and years of research, effectively securing ASML’s status as a legitimate technology monopoly. These businesses are fairly rare in the market, so whenever you have the opportunity to invest in these businesses, you should.

But ASML’s monopoly was on the government’s radar not for antitrust reasons. Western governments such as the United States and the Netherlands (where ASML is based) do not want this equipment to fall into the hands of China or its allies, so they have banned the export of the most advanced equipment and have already Denying a license to service equipment. In China.

As a result, sales to China are expected to decline. Additionally, the expansion of chip manufacturing capacity may also be put on hold as the Chinese economy is currently not doing well. This doesn’t bode well for ASML, as 47% of its sales went to China in the third quarter. However, management expects sales in that country to account for approximately 20% of total revenue in 2025, which the company notes is a more normal level of exposure historically. Masu.

Still, the impact led management to lower its 2025 revenue outlook from 30 billion to 40 billion euros to 30 billion to 35 billion euros. This caused investors to dump the stock, which fell 20% after the results were announced.

While some of this decline was to be expected, this reaction was short-sighted and I believe the depth of the decline is a buying opportunity for investors.

the story continues