No doubt about it: AMD (NASDAQ: AMD) Losing to Nvidia (NASDAQ: NVDA) In the artificial intelligence (AI) arms race, AMD is rushing to close the gap, but Nvidia is still far ahead.

AMD recently announced the acquisition of ZT Systems, another attempt to close the gap with Nvidia, but Nvidia still has some key advantages, so I don’t think AMD is the best choice for investors.

The AMD acquisition is smart, but is it too late now?

AMD’s $4.9 billion acquisition of ZT Systems will enable it to better design systems with thousands of graphics processing units (GPUs). That’s important because Nvidia has long dominated that space. It could help AMD compete with Nvidia by improving its offerings to major cloud computing companies and other businesses looking for industry-leading supercomputers dedicated to training AI models.

But the hole AMD has to dig itself out of may be too deep.

In the second quarter, AMD’s data center division (the segment that encompasses the hardware most relevant to AI model development) generated a record $2.8 billion in revenue, growing 115% year over year — a stellar result that should please most investors.

But the problem is, those numbers pale in comparison to Nvidia’s.

Nvidia’s data center revenue for the first quarter of fiscal 2025 (ended April 28) grew 427% year over year to $22.6 billion. Frankly, AMD is being swamped by Nvidia, and its data center business is only one-tenth the size of Nvidia’s.

Another issue is that Nvidia has already proven their product and established relationships with many customers and end users, so they have built some barriers to switching costs. AMD needs to prove that their product either outperforms Nvidia’s or offers a much better value proposition. If they can’t do that, Nvidia will just keep eating away at AMD’s share.

While the ZT Systems acquisition is a step in the right direction, it’s not expected to close until the first half of 2025, meaning Nvidia will continue to extend its existing lead.

This doesn’t bode well for AMD investors, and at this point I see no reason to buy AMD over Nvidia stock, especially considering valuation.

There is no significant difference in stock prices at the moment.

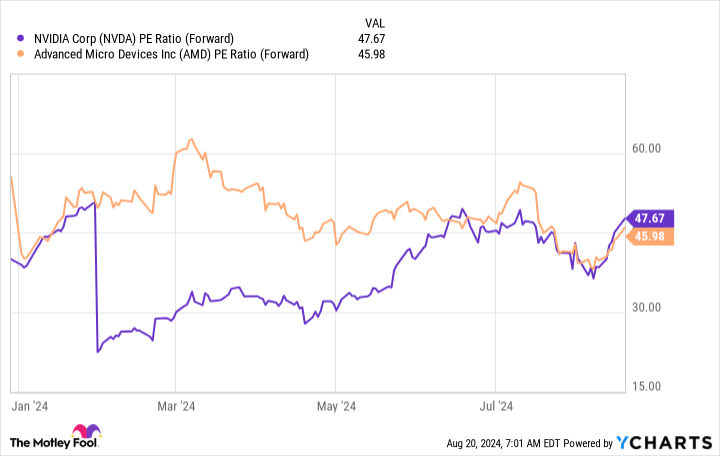

Typically, when two companies compete in the same industry and one company dominates the other, that company will command a price premium. But that’s not the case here.

The story continues

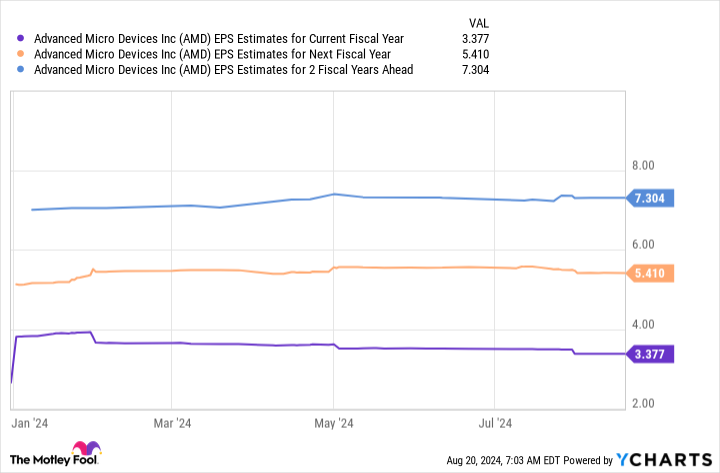

Nvidia and AMD trade at roughly the same price on a forward P/E basis, in part due to the weakness of AMD’s related businesses and the fact that its data center business has not grown significantly compared to other segments, which is why AMD’s revenue is expected to grow significantly over the next few years.

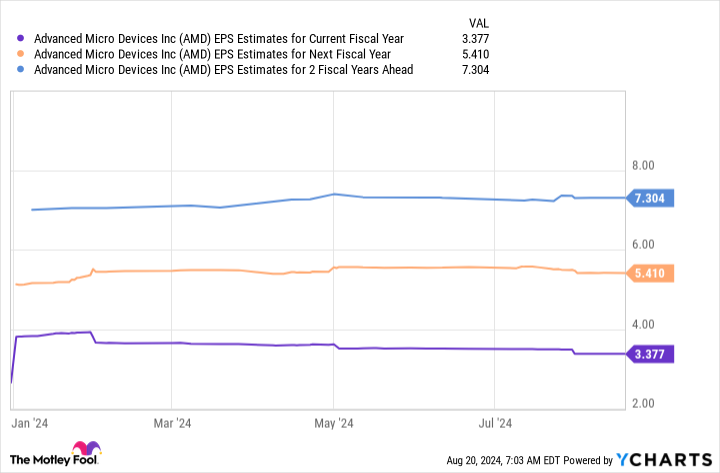

So, taking into account analysts’ projections for earnings in 2026, AMD’s stock is trading at 21 times those forecast earnings — a steep price considering it would take about two and a half years to achieve that.

If we run the same analysis on Nvidia stock, it has a two-year P/E ratio of 30.2, which is also very expensive. However, the difference between AMD and Nvidia is that Nvidia has proven it can generate big growth by acquiring the biggest customers.

AMD is still working on this, and it may be a while before it can go toe-to-toe with Nvidia.

Considering the two companies are trading at roughly the same price, I’d have to go with Nvidia, as AMD is too far behind to justify the investment, even if it looks cheaper two years from now.

Should you invest $1,000 in Advanced Micro Devices right now?

Before buying Advanced Micro Devices shares, consider the following:

The analyst team at Motley Fool Stock Advisor just identified the 10 best stocks for investors to buy right now, and Advanced Micro Devices wasn’t among them — all of which have the potential to generate big gains over the next few years.

Let’s look back at April 15, 2005, when Nvidia made this list… if you had invested $1,000 at the time of our recommendation, you would have $792,725.!*

Stock Advisor offers investors an easy-to-follow blueprint for success, with portfolio construction guidance, regular updates from analysts and two new stock picks every month. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

View 10 stocks »

*Stock Advisor returns as of August 22, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.

Here’s why Nvidia beats AMD as the best choice for artificial intelligence (AI) investors. This was originally published by The Motley Fool.