We recently published a list of 10 companies that reflect Wall Street’s downturn. In this article, we’ll take a look at where ON Semiconductor, Inc. (NASDAQ:ON) stands relative to other companies reflecting Wall Street’s downturn.

Wall Street’s main indexes ended the shortened trading week in negative territory, helped by much stronger-than-expected labor market data. The news raised concerns that the Federal Reserve would not cut interest rates again.

On Friday, the Dow Jones and Nasdaq Composite both fell 1.63%, while the S&P 500 fell 1.54%.

The 10 companies reflected broader market weakness in a series of catalysts that dampened investment appetite. This article explores the reasons behind its decline.

Friday’s Biggest Decliners only considered stocks with a market capitalization of at least $2 billion and a daily trading volume of $5 million or more.

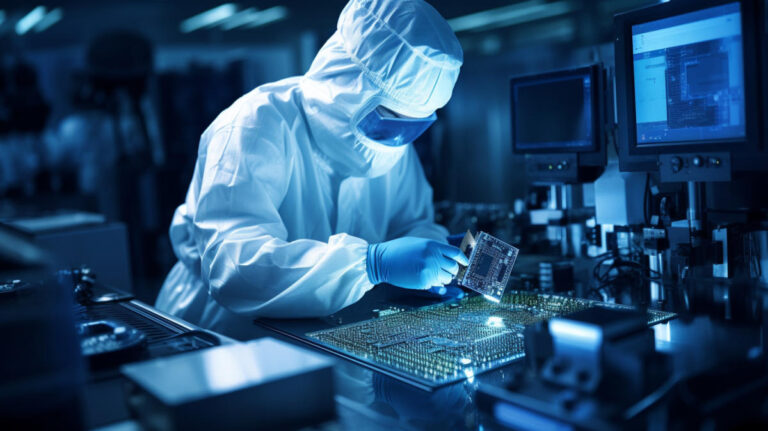

A semiconductor engineer analyzes cutting-edge semiconductor products in a cutting-edge laboratory.

ON Semiconductor Corporation (NASDAQ:ON)

ON Semiconductor (ON) neared a new 52-week low on Friday, declining 7.49% to close at $53.94 per share, after analysts at Trust Inc. revised down their targets for the company. Ta.

In its latest report, Trust downgraded ON Semiconductor’s rating to “hold” and set a new price target of $60, 29% lower than its initial estimate of $85. The analyst cited worsening demand trends and management’s focus on exiting certain business areas this year.

Separately, Bank of America also lowered its price target for ON Semiconductor (ON) from $90 to $75 per share, but maintained its Buy rating on the company. The adjustment follows the company’s less optimistic outlook during the 2025 Consumer Electronics Show in Las Vegas.

Specifically, concerns about recovery prospects both in the short term and in calendar year 2025 are leading to a reduction in estimated forward EPS for the coming years.

Overall, ON ranks No. 9 on Wall Street’s list of companies reflecting the economic downturn. While we recognize ON’s potential as an investment, we believe AI stocks are more likely to deliver higher returns and do so in a shorter time frame. If you’re looking for AI stocks that are more promising than ON but are trading at less than 5x earnings, check out our report on the cheapest AI stocks.

Read next: 8 Best Widemot Stocks to Buy Now and 30 Most Important AI Stocks, According to BlackRock

Disclosure: None. This article was originally published on Insider Monkey.