(Bloomberg) – Biden administration officials are discussing restricting sales of advanced AI chips from Nvidia and other U.S. companies by country, people said. This will limit some countries’ artificial intelligence capabilities.

Most Read Articles on Bloomberg

The new approach would place limits on export licenses to certain countries for national security reasons, the people said, speaking on condition of anonymity to discuss private discussions. Officials said they are keeping an eye on Persian Gulf countries, where there is a growing demand for AI data centers and deep pockets to fund them.

Discussions are in the early stages and remain fluid, the people said, noting that the idea has been gaining momentum in recent weeks. The policy is based on a new framework that eases the licensing process for shipping AI chips to data centers in countries such as the United Arab Emirates and Saudi Arabia. Commerce Department officials announced these regulations last month and said more regulations are planned.

The agency’s Bureau of Industry and Security, which oversees export controls, declined to comment. Nvidia, the market leader in AI chips, also declined to comment, as did Advanced Micro Devices. Representatives for Intel, which also makes similar processors, did not respond to requests for comment.

A White House National Security Council spokesperson declined to comment on the meeting, but pointed to a recent joint statement by the United States and the UAE on artificial intelligence. In it, both countries acknowledged the “enormous potential that AI brings for good” and the “challenges and risks of this emerging technology, as well as the critical importance of security measures.”

Setting country-based caps would tighten regulations originally targeting China’s ambitions in artificial intelligence, as the U.S. government considers the security risks of AI development around the world. The Biden administration has already restricted the shipment of AI chips from companies like Nvidia and AMD to more than 40 countries in the Middle East, Africa and Asia, citing concerns that their products could be diverted to China.

At the same time, some U.S. officials have come to see export licenses for semiconductors, particularly Nvidia chips, as a lever to achieve broader diplomatic goals. This could include asking major companies to reduce their ties to China in order to gain access to U.S. technology, but concerns extend beyond the Chinese government.

the story continues

“We need to talk to countries around the world about how we plan to use these capabilities,” Tarun Chhabra, senior director of technology at the National Security Council, said at a forum in June. He did not mention it, but said: “If we’re talking about countries that have really robust domestic surveillance equipment, we have to think about how exactly we use these capabilities to enhance that kind of surveillance. and what that will look like.”

There’s also the question of how global AI developments could affect U.S. intelligence operations, said Maher Bitar, another NSC official. “What are the risks, not only for human rights reasons, but also from a security and counterintelligence standpoint for personnel around the world?” Vitale said at the same event.

It is unclear how major AI chip makers will react to additional U.S. regulations. When the Biden administration first issued comprehensive chip regulations for China, Nvidia redesigned its AI products to continue selling to that market.

If the administration moves forward with country-specific caps, it could make it difficult for President Joe Biden to come up with comprehensive new policies in the final months of his term. Such rules could be difficult to enforce and would be a major test for U.S. foreign relations.

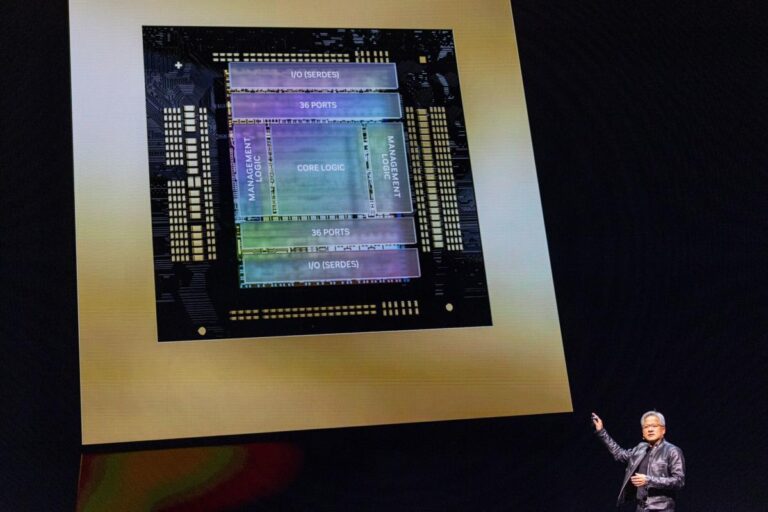

Governments around the world are pursuing so-called sovereign AI, the ability to build and run their own AI systems, and that pursuit is a key driver of demand for advanced processors, according to Nvidia Chief Executive Officer Jensen Huang. It is said to be the driving force. Nvidia’s chips are the gold standard for data center operators, making it the world’s most valuable chipmaker and the biggest beneficiary of the AI boom.

Meanwhile, China is working to develop its own advanced semiconductors, but they still fall short of America’s top-of-the-line semiconductors. Still, there is a sense among U.S. officials that one day Huawei or another foreign manufacturer could shape the global AI landscape if it offers a viable alternative to Nvidia chips, perhaps on fewer terms. There are concerns that US capabilities could be weakened.

Some U.S. officials argue that that is only a remote possibility and that given the current negotiating position, the U.S. government should adopt a more restrictive approach to global AI chip exports. There is. Some warn that if China grows in power and wins customers, it will become too difficult for other countries to buy American technology.

Officials are debating the best approach, but licensing approvals for mass AI chips to places like the Middle East have been delayed. But there are signs that things could be moving soon. Under new rules for shipping to data centers, U.S. authorities will vet and pre-approve certain customers based on companies and governments’ security practices, paving the way for easier licensing in the future. It’s going to happen. .

–With assistance from Ian King and Jenny Leonard.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP