Nvidia (NASDAQ:NVDA) Following last year’s impressive performance, the company’s stock delivered another impressive return in 2024, but a closer look at the company’s stock price chart shows that it has lost momentum over the past three months.

Nvidia’s stock price has remained flat over the period due to questions surrounding the company’s artificial intelligence (AI) outlook and its ability to continue delivering impressive growth. Investors may be wondering whether to buy more of the semiconductor giant’s stock or start taking profits. But it wouldn’t be surprising if NVIDIA stock regains its momentum and delivers another bright year in 2025.

In this article, we’ll look at some of the reasons why buying Nvidia stock by 2025 is a no-brainer.

Nvidia is expected to ship more AI chips next year

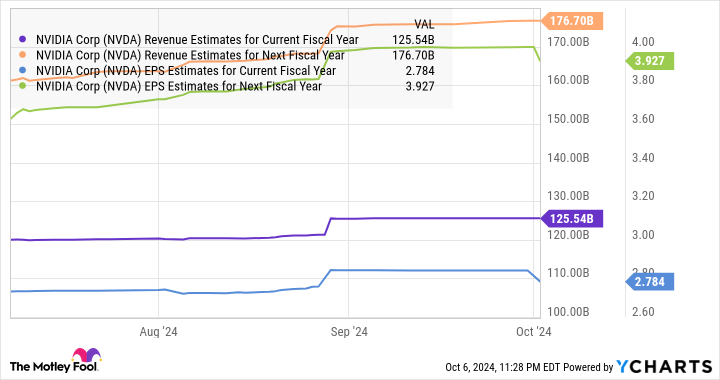

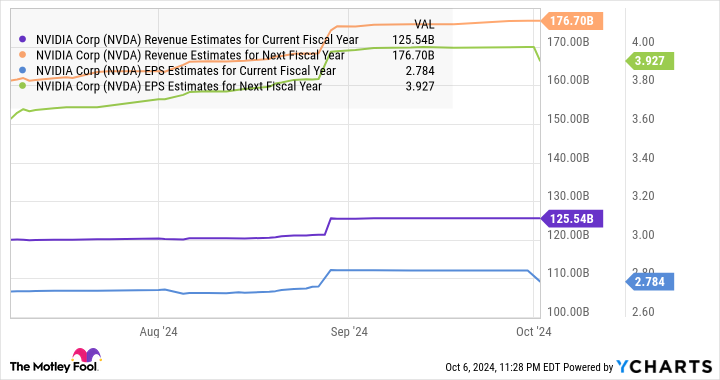

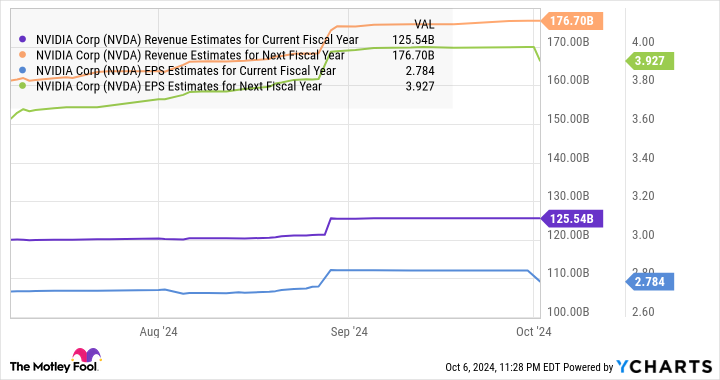

Analysts expect Nvidia to significantly increase shipments of AI graphics processing units (GPUs) in 2025. Market research firm TrendForce believes that Nvidia’s AI GPU shipments could increase by 55% next year, in 2025. The company’s next-generation Blackwell processor.

TrendForce predicts that 80% of Nvidia’s AI GPU shipments next year will be Blackwell. This means that shipments of Nvidia’s previous generation Hopper chips will remain strong in 2025. The good news is that TrendForce isn’t the only company expecting a surge in Nvidia’s AI GPU sales next year.

Japanese investment bank Mizuho has raised its 2025 AI GPU shipment forecast for NVIDIA by 8% to 10% compared to its previous forecast released in July of this year. Mizuho believes that this upward revision is due to improvements in its supply chain. Specifically, Nvidia’s foundry partner Taiwan Semiconductor Manufacturing Co., Ltd. (commonly known as TSMC) will reportedly double its advanced packaging capacity, allowing it to manufacture more AI GPUs.

Additionally, TSMC plans to continue expanding its advanced packaging capabilities next year and beyond. The foundry giant believes it can achieve at least 60% annual growth in chip-on-wafer-on-substrate (CoWoS) packaging capacity through 2026. This should put Nvidia in a good position to profit. Demand for AI chips is rapidly increasing.

Allied Market Research estimates that AI chip sales will grow at a 38% annual rate through 2032, reaching $384 billion in annual revenue. Nvidia is the dominant player in the AI chip market with an estimated 70% to 95% market share, but a closer look at its AI revenue compared to its competitors shows that its share is probably at the top . its range.

story continues

More importantly, TSMC’s improved production profile should help Nvidia maintain its dominance in the AI chip market. Therefore, increased AI GPU sales should lead to solid growth for Nvidia next fiscal year, while pricing power in this market should also lead to healthy revenue growth.

NVDA earnings forecast data for this year by YCharts

Valuation shouldn’t be a concern given potential growth

NVIDIA is currently valued at a very high price-to-earnings ratio (P/E) of 58x, which some might point out is higher than the average earnings multiple of 32x for the Nasdaq 100 index. But at the same time, NVIDIA has been able to justify its valuation with impressive growth. In fact, NVIDIA’s earnings multiple is currently lower than its five-year average P/E ratio of 72x.

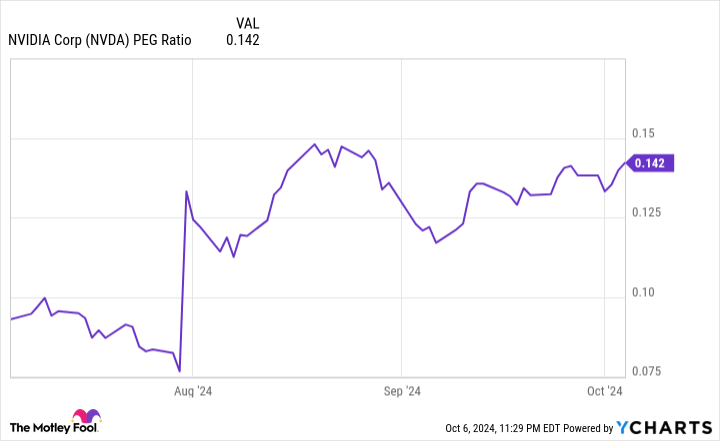

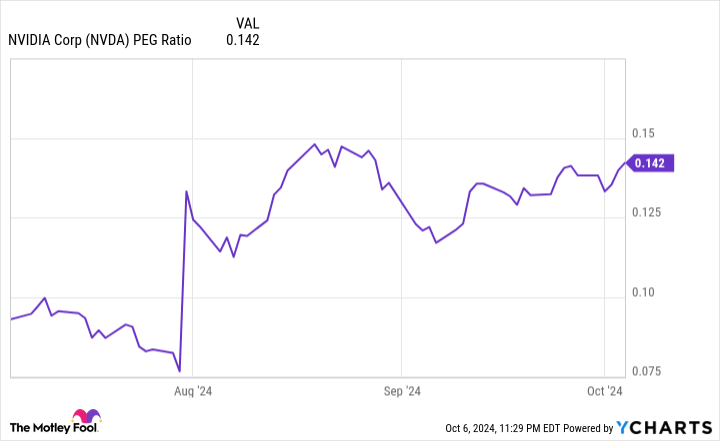

Additionally, NVIDIA’s price-to-earnings (PEG) ratio of just 0.14 means that its stock is highly undervalued considering the growth it is expected to achieve.

NVDA PEG Ratio Data by YCharts

The PEG ratio is a valuation metric that takes into account the potential earnings growth a company can achieve. A value less than 1 means the stock is undervalued. As a result, now is a good time for investors to stock up on NVIDIA stock before the company’s AI chip sales skyrocket in 2025 and the stock price skyrockets.

Should you invest $1,000 in Nvidia right now?

Before buying Nvidia stock, consider the following:

The Motley Fool Stock Advisor team of analysts identified the 10 best stocks for investors to buy right now…and Nvidia wasn’t one of them. These 10 stocks have the potential to generate impressive returns over the next few years.

Consider when Nvidia created this list on April 15, 2005… If you invested $1,000 at the time of recommendation, you would have earned $814,364.!*

Stock Advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month. of stock advisor For the service more than 4 times The resurgence of the S&P 500 since 2002*.

See 10 stocks »

*Stock Advisor will return as of October 7, 2024

Harsh Chauhan has no position in any stocks mentioned. The Motley Fool has a position in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

“Two Great Reasons to Buy Nvidia Stock by 2025” was originally published by The Motley Fool