(Bloomberg) — Taiwan Semiconductor Manufacturing Co. Ltd.’s sales rose 33% last month, a positive signal for investors betting on a recovery in the smartphone market and sustained demand for Nvidia Corp.’s AI chips.

Most read articles on Bloomberg

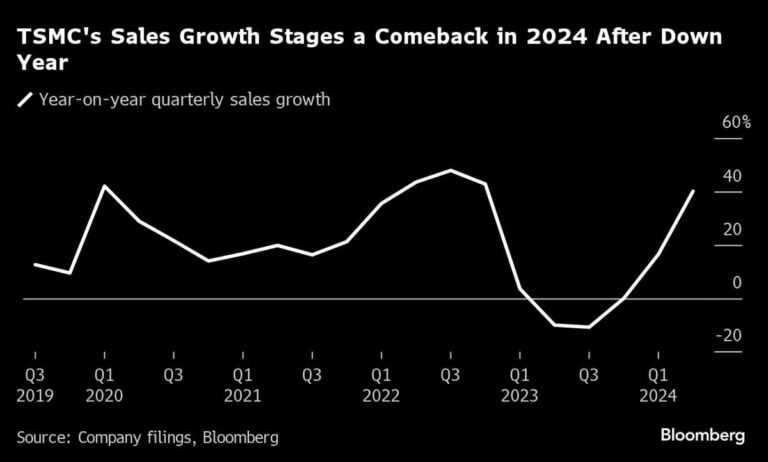

Revenue in August was NT$250.9 billion ($7.8 billion), slowing from a 45% increase in the previous month. Analysts expect TSMC’s third-quarter sales to rise 37% and continue its recovery from the post-COVID-19 nadir in 2023.

Though it’s just a one-month snapshot, the results could ease concerns that the market is overestimating the durability of AI infrastructure spending. Nvidia shares fell about $279 billion on Sept. 3, its biggest one-day drop on record, after the company reported profits that missed the highest expectations.

Taiwan’s largest companies now derive more than half of their revenue from high-performance computing, a business segment driven by demand for AI.

Nvidia, the flagship chipmaker, is also the primary maker of the iPhone’s main processor. Apple on Monday unveiled the iPhone 16, which is designed “from the ground up” for AI, though features will be added gradually through software updates. Wall Street is banking on a recovery in demand for mobile devices.

What Bloomberg Intelligence Says

Apple’s adoption of Wi-Fi 7 in the iPhone 16 and 16 Pro should accelerate adoption of the technology and drive demand for TSMC’s N6 (7-nanometer) and N4 (5-nanometer) nodes, which are already used by Broadcom, MediaTek, and others to produce Wi-Fi 7 chips. The performance gains in the A18 and A18 Pro processors are in line with our expectations and support the positive outlook for revenue growth for TSMC’s N3E node.

– Charles Shum, Analyst

Click here for the survey.

TSMC offered an optimistic assessment of its business and outlook when it last reported earnings. In July, the world’s largest contract chipmaker raised its full-year growth outlook to above its previous maximum of a mid-20% range.

As markets improve, CEO CC Wei is spearheading a major global expansion.

The company has reported early progress on an expansion project in Arizona, is considering building a third factory in Japan and just broke ground on a €10 billion factory in Germany.

Most read articles on Bloomberg Businessweek

The story continues

©2024 Bloomberg LP