(Bloomberg) — It’s the story of many a stock-market frenzy: A groundbreaking technology fuels a few companies, more questionable ones follow, Wall Street buys them all, and then time separates the real from the fake.

Most read articles on Bloomberg

Artificial intelligence is the latest example that has driven the S&P 500 Index’s recent surge as stocks of anything even remotely related to technology soared, to the point that some investors are no longer betting against some of AI’s darlings, including Supermicrocomputer Inc. and Lumen Technologies Inc., whose shares have risen more than 250% this year.

“We’re separating the winners from the losers,” said Ken Mahoney, CEO of Mahoney Asset Management.

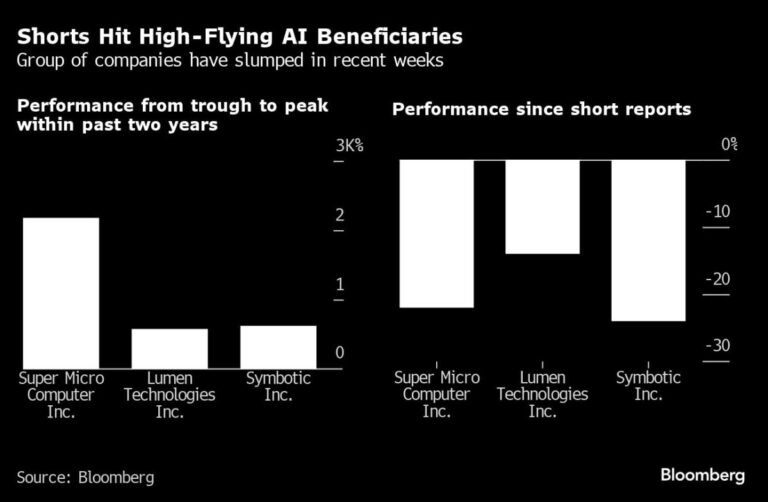

Supermicro (SMCI), Lumen (LUMN) and Symbotic (SYM) saw their shares fall in late August after being targeted by bearish research reports that called their valuations into question. Silicon Valley server maker Supermicro started last week with a market cap of about $36 billion but ended with a market cap of about $26 billion after a report released Tuesday by activist short seller Hindenburg Research cited “clear accounting red flags” and other issues, setting off a corporate governance blunder.

That’s not to say that AI won’t help transform the economy and create opportunities for hundreds of companies, as JPMorgan Chase President Jamie Dimon suggested in April. But AI is not stock market magic, and if history repeats itself, the path to success will be bumpy.

The angry reaction to Nvidia’s (NVDA) earnings last week shows how volatile things can get. The semiconductor giant beat analysts’ expectations, sending its shares down 6.4%. Why? Because investors, who have watched its stock soar more than 700% since the beginning of 2023, have grown accustomed to Nvidia not just beating expectations, but crushing them. And Mahoney said the $3 trillion company was preparing for a $200 billion offering because its shares were “perfectly priced.”

Still, Mahoney was quick to point out that Nvidia and the other big AI companies in the Magnificent Seven have seen generally consistent performance and growth, which he said sets them apart from “sporadic” companies like Supermicro.

Predictably unpredictable

That unpredictability and the stock’s rapid rise make the company especially vulnerable to shocks from short-sellers. About 24 hours after the Hindenburg report on Supermicro broke, the San Jose, California-based company said it needed more time to evaluate its internal controls over financial reporting. That’s why investors dumped the company’s shares.

The story continues

Tuesday was also a tough day for Lumen Technologies, as Kellisal Capital announced it was shorting the social media platform X due to “deteriorating revenue and margin trends amid a significant debt burden.” Shares of the fiber-optic networking company, which skyrocketed in July, going from about $1 a share to more than $6.50 in just a few weeks, plummeted following the news and are now trading at around $5.

Meanwhile, SoftBank Group Corp. (SFTBY)-backed Symbotic saw its shares fall 23% in just under two weeks after a brief report was circulated in which investors claimed drone footage showed nothing happening at some of the company’s worksites. The warehouse robotics company has positioned itself as a beneficiary of AI, having struck a joint venture deal with SoftBank last July to buy the AI-powered systems when its shares were trading at more than double Friday’s closing price.

A Supermicro spokesman told Bloomberg News the company “does not comment on rumors or speculation,” while a Lumen representative said the growth of AI will increase demand for the company’s fiber network.Symbotic did not respond to an emailed request for comment.

Meanwhile, Hindenburg struck again on Thursday, releasing a report accusing iLearning Engines Holdings, which describes itself as an “applied AI platform for learning and task automation,” of falsifying financial figures. Shares plummeted 53%, and the company said in a release that it believed the report contained misleading statements.

Too far, too fast

From the invention of radio to the development of the internet, these fluctuations occur when markets latch onto new technologies.

“The stock market always tends to go through a period of digestion after it moves too much or too quickly,” John Belton, a portfolio manager at Gabelli Funds, said in an interview. “We’re in a healthy period of digestion right now for a lot of companies.”

The benefits of AI are yet to be discovered. Valuations of privately held artificial intelligence companies are skyrocketing, as seen in OpenAI’s latest funding round. And the impact is also rippled through the stock market, where there are a limited number of publicly traded companies offering exposure to AI technology. The result is a momentum that fuels enthusiasm and skyrocketing valuations.

This isn’t the first time investors have targeted a company whose stock price has soared on AI hopes: In March, Hindenburg bet against data center owner Equinix, and in July, Culper Research questioned bitcoin miner Iris Energy’s AI ambitions.

Seen in that light, the drop in share prices of some of the biggest AI success stories this summer and the questioning of valuations for companies linked to the technology suggest that investors are starting to wonder how much all of this will ultimately be worth, and which companies will survive long enough to find that value.

“We don’t know how big this will be, and market conditions like this could lead to a small overhang forming,” Belton said. “We’re still in the generative AI investment cycle, and it’s hard to know what the shape of the cycle will be in the long term.”

—With assistance from Peyton Forte and Ryan Vlastelica.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP