The artificial intelligence (AI) industry has lost some luster lately. Shares of the industry’s three largest companies — Alphabet (GOOG, GOOGL), Amazon (AMZN), and Microsoft (MSFT) — have all fallen in the last month, with Google-parent Alphabet down 14%, Amazon down about 8%, and Microsoft down more than 7% as of Thursday.

The stock moves come after the two companies, along with hyperscaler Meta (META), confirmed they will continue to pour billions of dollars into building out AI infrastructure over the next few quarters, but have offered little insight into when they plan to realize revenue from all that spending. This, combined with recent market turmoil, has sent AI company stocks tumbling.

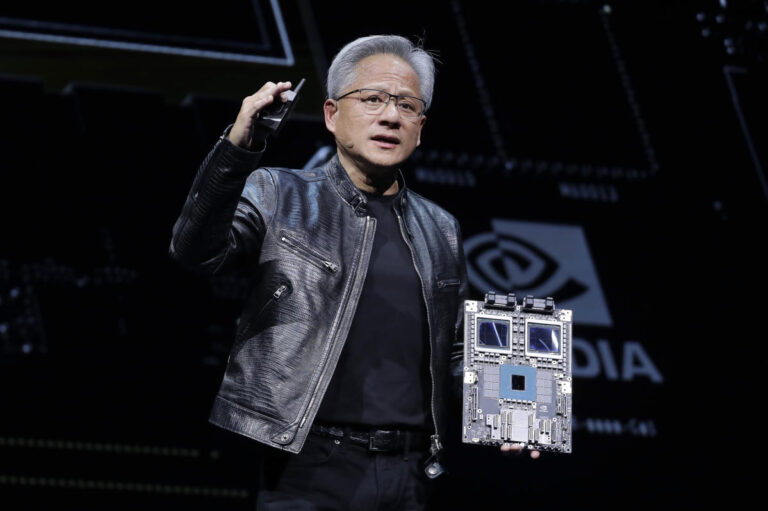

But the most important component of the AI industry, Nvidia (NVDA), has yet to announce its earnings. The chip company’s performance could turn the AI industry around more than any of the hyperscalers. Unlike these software companies, earnings are not an issue for Nvidia. Still, if it fails to meet Wall Street’s already sky-high expectations, the AI trend could also decline.

Nvidia’s big year-over-year growth won’t last forever

While AI investments from Alphabet, Amazon and Microsoft may give investors pause, they’re helping to boost profits for Nvidia, whose Hopper AI chips are the most popular on the market and the company plans to start ramping up production of its Blackwell line later this year.

According to Reuters, the company controls 80% to 95% of the market for high-performance AI chips, which means that whenever a company says it’s investing in AI capabilities, that company is likely buying up, or at least using, Nvidia processors.

But Nvidia’s second-quarter report also marks the beginning of a tough period for comparing year-over-year revenue growth over the next few quarters. The company’s second-quarter fiscal 2024 revenue was $13.5 billion, up 101% year-over-year, while data center revenue was more than $10.3 billion, up 141%.

In each subsequent quarter, the semiconductor giant has seen even more impressive year-over-year growth. But this momentum won’t last forever: In its most recent quarter, Nvidia reported revenue of $26 billion, a 262% increase from the $7.19 billion the company reported a year earlier.

Wall Street analysts expect the company to report second-quarter revenue of $28.6 billion, up 112% from last year. While that would still represent a significant increase in sales, it’s not as spectacular as the growth the company has achieved in previous quarters, which may scare some investors away.

Nvidia remains a bright spot in the AI industry

That doesn’t mean Nvidia won’t continue to make cash, or that Wall Street is discounting the company. As of Thursday, 66 analysts had recommended buying Nvidia’s stock, compared with just seven with a hold recommendation and one with a sell recommendation.

The story continues

It’s fair to say Wall Street is confident about the company’s prospects: As UBS analyst Timothy Arcuri pointed out in a recent investor note, TSMC, the semiconductor manufacturer that makes Nvidia’s chips, reported strong quarter-over-quarter results for its high-performance computing division, which should signal that another stellar quarter for Nvidia is on the way.

Nvidia also benefits from the fact that, unlike software companies, its products are currently delivering real, tangible benefits to customers. Hyperscalers are deploying the company’s chips as fast as they can to develop and operate AI models. But AI-powered software is still in a hazy testing phase. Companies are implementing AI enterprise software, but the impact on employee productivity isn’t going to skyrocket overnight.

Moreover, experts say it will be years before AI-powered software like Microsoft’s Copilot and Google’s Gemini can truly benefit enterprise customers, and while those companies are busy improving their products, Nvidia will continue to sell its hardware.

So while AI trading may have taken a hit last month, the biggest winners will likely continue to rally strong forward.

Contact Daniel Howley at dhowley@yahoofinance.com and follow him on Twitter: @DanielHowley.

For the latest earnings reports and analysis, earnings rumours and forecasts, and company earnings news, click here.

Read the latest financial and business news from Yahoo Finance.