Nvidia (NVDA) stock has soared to unprecedented heights, fueled by the AI boom and the company’s dominant position in the GPU market. On Friday, its market capitalization briefly reached $3.5 trillion. But this rapid rise has raised questions about that valuation. Is the future already priced into the stock, or is there still significant upside potential?

AI gold rush

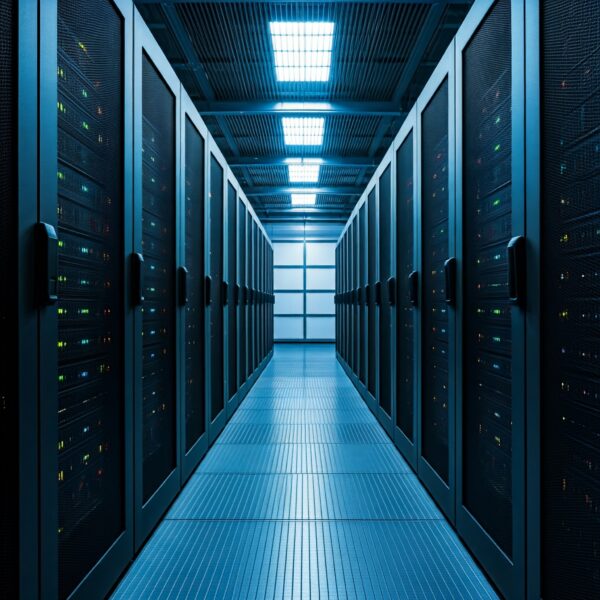

Nvidia’s GPUs have become the de facto standard for AI and machine learning applications. The company’s powerful chips are essential for training and running complex AI models, driving demand from both consumer and enterprise customers.

This surge in demand led to great financial performance for Nvidia. The company has consistently delivered strong revenue and profit growth, driven by the AI boom.

Evaluation questions

While Nvidia’s growth prospects are undoubtedly strong, its valuation has reached stratospheric levels. The company’s price-to-earnings ratio (P/E) is significantly higher than the industry average and the broader market. That makes sense for a fast-growing stock. Assume that NVDA becomes a more mature stock within a few years and continues to grow at the same rate as the overall stock market. Mature but growing companies typically have a price-to-earnings ratio of around 20. So, NVDA’s current stock price means that if the company maintains its dominance in the chip industry, it could generate after-tax profits of $175 billion annually.

Over the past 12 months, NVDA generated sales of $96 billion and net income of $53 billion. So investors are essentially assuming that NVDA can triple its sales and profits until it becomes a more mature company.

If that happens, the return on NVDA stock will be 0%. Investors who are currently buying NVDA stock assume that NVDA will do even better than tripling sales and profits. I personally own NVDA, and I’m not sure if the company can deliver on these high expectations.

Nvidia’s future looks promising, but investors should exercise caution and consider the risks associated with its lofty valuation. It’s important to assess whether the current price reflects the long-term growth potential of the company, or if a bubble is forming.

While I see NVDA’s potential as an investment, I believe other AI stocks have a better chance of delivering higher returns in a shorter time frame. If you’re looking for AI stocks with more promise than NVDA, but trading at less than 5x earnings, check out our report on the cheapest AI stocks.

Read next: BlackRock’s 8 Best Widemot Stocks to Buy Now and 30 Most Important AI Stocks. Disclosure: Long NVDA. This article was originally published on Insider Monkey.