Key Takeaways

Nvidia shares were on track to finish one of their best weeks this year on Friday, recovering from a two-week slump that saw the advanced chipmaker lose more than 20% of its market capitalization.

Nvidia shares have been volatile in recent weeks as Wall Street enthusiasm for AI waned and the company’s quarterly earnings report fell short of high expectations.

Demand for AI and Nvidia’s chips that enable it is expected to remain strong, according to analysts, with the majority of analysts still bullish on the company’s shares despite the recent loss of momentum.

In a note earlier this week, Bernstein analysts reiterated that Nvidia is one of their top semiconductor stocks, calling it “the best way to harness AI.”

Nvidia (NVDA) shares posted one of their best weeks this year on Friday and were on track to recoup most of last week’s losses as investors heeded analyst recommendations and bought on the dip.

Nvidia shares were little changed as of midday Friday, marking the second big rebound for the chipmaker’s stock in a volatile month, and it has risen nearly 16% this week.

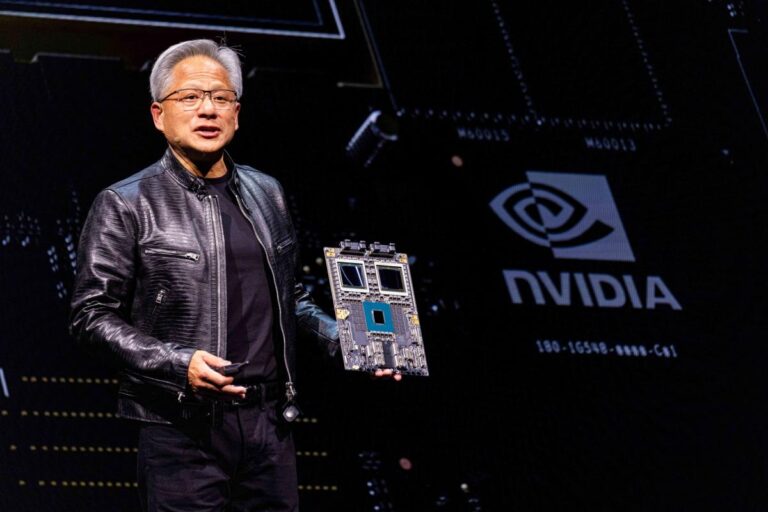

Nvidia’s shares rose earlier this week after CEO Jensen Huang called demand for its products “incredible” and touted the size of the company’s market opportunity at a Goldman Sachs conference.

“Generative AI isn’t just a tool. It’s a skill,” Huang told Goldman Sachs CEO David Solomon at the event. “That’s why people think AI will expand beyond trillion-dollar data centers and IT into the world of skills.”

The rebound follows a more than 20% drop in Nvidia’s shares over the past two weeks as Wall Street’s optimism about AI in general faded and the company’s quarterly earnings report beat official expectations but fell short of investors’ lofty hopes.

But the turmoil appears to have more to do with market sentiment than the strength of the chip makers’ businesses.

Reports that Nvidia’s next-generation Blackwell system would be delayed due to a design flaw led to a sharp sell-off in early August, but analysts believe the delay won’t have a significant impact on quarterly sales.

One reason is that demand for Nvidia’s chips is so strong that customers will take whatever they can get.

Cloud hyperscalers Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOG, GOOGL) each announced in their latest earnings reports that they will continue to increase spending on AI infrastructure this year and next as they build out their AI capabilities. A significant portion of that spending will be on NVIDIA chips. Elon Musk, CEO of electric car maker Tesla (TSLA), estimates that the company will spend $3 billion to $4 billion on NVIDIA chips this year, which would represent 40% of the company’s total AI spending.

The story continues

What analysts think about Nvidia stock

Strong demand is one of the main reasons analysts still have Nvidia at the top of their buy lists, even as the stock has lost steam recently. In a note earlier this week, Bernstein analysts reiterated that Nvidia is one of their top semiconductor stocks, calling it “the best way to harness AI.”

“Indeed, the numbers are so good (and rising so sharply) that investors are concerned about sustainability,” the analysts wrote, “but with margins expected to improve next year as Blackwell’s sales grow, now is clearly not the time to worry.”

Analysts at Bank of America Securities echoed that sentiment late last week, arguing that Nvidia’s selloff presents a “good buying opportunity.”

Of 63 Nvidia analysts tracked by FactSet Research, 50 rate the company’s shares with the highest rating of “buy.” Only four analysts gave it a neutral rating, and none recommended investors sell.

Read the original article on Investopedia.