Consider how Nvidia’s GeForce 8800 chip, released in 2006, changed the world of gaming. Almost 20 years later, Nvidia continues to make strides with Blackwell, designed to change the world of artificial intelligence.

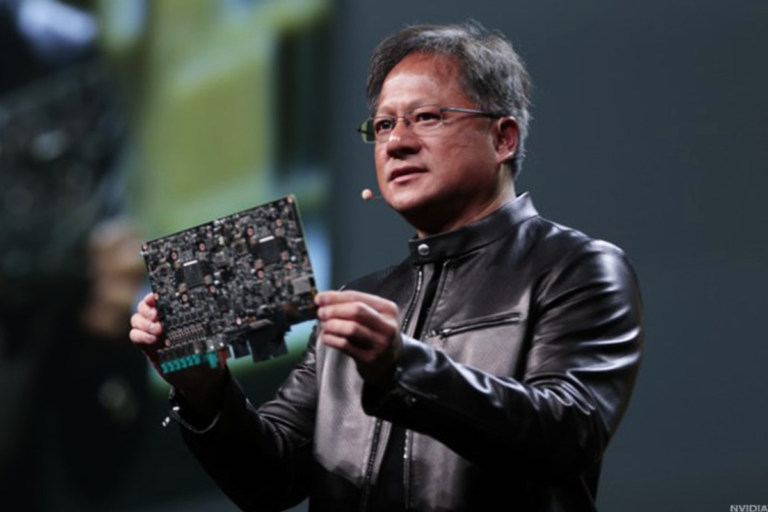

Nvidia CEO Jensen Huang recently said demand is “insane.” Major cloud providers such as AWS, Azure, and Google Cloud integrate Blackwell into their infrastructure to support high-performance AI workloads.

Related: Nvidia CEO Jensen Huang tells investors what’s next for the AI chipmaker

Oracle announced on October 2 that it will require 131,072 Nvidia Blackwell GPUs as part of a $6.5 billion investment to establish a new public cloud region in Malaysia. This is also evidence of the strong need for advanced AI processing capabilities.

Blackwell is a platform launched by Nvidia in March that allows organizations to run real-time generative AI on models with trillions of parameters. These large-scale language models are trained on extensive datasets to understand human language and generate responses.

“Blackwell is running at full capacity,” Huang said in an interview with CNBC. “The demand for Blackwell is insane. Everyone wants to have the most, and everyone wants to be the best.”

Buyers of hyperscalers like Amazon (AMZN) Microsoft (MSFT) and alphabet (Google) According to Bernstein analysts, approximately $160 billion is expected to be spent on AI infrastructure in 2024. Prices for the Blackwell are expected to range from $30,000 to $40,000 each.

Huang emphasized the importance of continually updating NVIDIA’s AI infrastructure, as Nvidia releases new platforms every year. “If we can improve performance, like we did with Hopper and Blackwell, we can effectively increase revenue or throughput for our customers on these infrastructures by two to three times each year,” Huang said. I added.

Nvidia’s financial performance exceeds expectations

Nvidia’s latest earnings report further solidified the company’s strong position in the AI market.

On Aug. 28, the company posted earnings of 68 cents per share, beating Wall Street expectations of 64 cents. Revenue rose 122% to $30.04 billion, beating expectations of $28.7 billion.

Nvidia projects revenue of $32.5 billion for the current quarter, an 80% increase from a year ago.

Related article: Veteran traders target NVIDIA amid falling stock price

Nvidia plans to ship Blackwell GPUs to customers in the fourth quarter of this year, with consumer release expected in 2025. “We expect to ship billions of dollars in Blackwell revenue in the fourth quarter,” Nvidia Chief Financial Officer Colette Kress said on an earnings call in August. Earnings calls.

the story continues

Nvidia stock has soared more than 150% this year, following an impressive 240% rise in 2023. The company is now worth more than $3 trillion, making it one of the world’s most valuable companies after Apple and Microsoft.

Analysts see NVIDIA’s ‘compelling’ growth and valuation

JPMorgan remains confident in Nvidia’s prospects, maintaining its Overweight rating and $155 price target, thefly.com reports.

“NVIDIA is on track to ship its next-generation Blackwell graphics processing unit platform in high-volume production in the fourth quarter,” the analyst told investors in a research note on Oct. 2. added that there is no need to pay too much attention to recent developments. Sell-side noise on rack-scale portfolio changes.

TF International Securities analyst Ming-Chi Kuo said on October 1 that NVIDIA will discontinue development of the dual rack 72-way GB200-based NVL36x2.

Last month, Bank of America reiterated a buy rating and $165 price target on Nvidia, also calling it a top pick in the sector.

Company warns of several near-term headwinds, including Blackwell delays and gross margin pressure, potential Justice Department investigation, competition, AI monetization, cloud capex, weak seasonality, and US election did.

Other AI stocks:

However, this could also create a buying opportunity. The analyst said the company’s stock is trading within a quarter of its lowest valuation in five years.

The company highlighted NVIDIA’s “attractive growth” and said it believes a supply chain update in the coming weeks will confirm shipments of Blackwell products, which it believes is a key driver of the recovery. said.

Related article: 10 best investment books from stock market professionals