(Bloomberg) — Nvidia Inc., whose chip has become the technology industry’s hottest commodity, Chief Executive Jensen Huang said the scramble for limited supplies is frustrating some customers and raising tensions.

Most read articles on Bloomberg

“There’s so much demand in this space, everybody wants to be first, everybody wants to be number one,” he told an audience at the Goldman Sachs Group Inc. technology conference in San Francisco. “We’re seeing more emotional customers today, and rightly so. They’re nervous. We’re trying to do our best.”

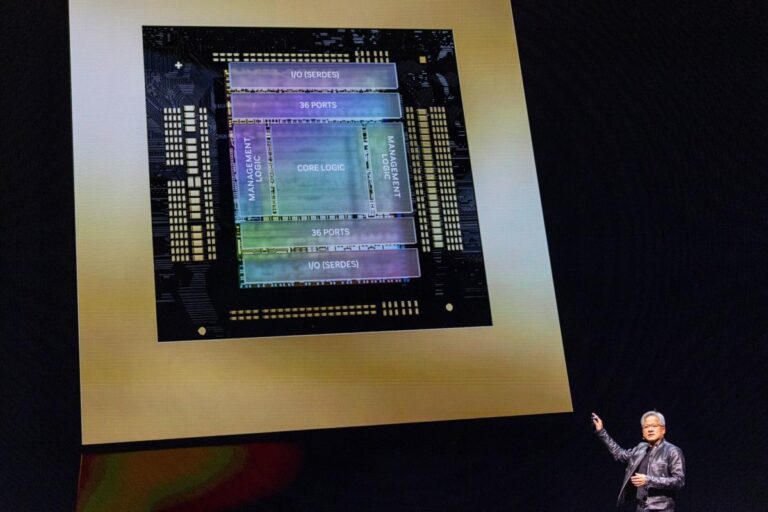

Huang told the audience that demand is strong for the company’s latest generation of chips, known as Blackwell. The Santa Clara, California-based company outsources the physical manufacturing of its hardware, and Nvidia’s suppliers are playing catch-up, he said.

Nvidia’s chips are used by data-center operators to develop and run artificial intelligence models, and frenetic demand for those services has sent the company’s revenue and stock price soaring, which has more than doubled this year after rising 239% in 2023.

But the company relies on a small number of customers, including Microsoft Corp. and data center operators like Meta Platforms, for most of its revenue.

Huang was asked whether the huge spending on AI is delivering a return on investment for clients, which has been a concern amid the tech industry’s AI boom.

But he said companies have no choice but to embrace “accelerated computing.” He said Nvidia’s technology not only speeds up traditional workloads (data processing), but can also handle AI tasks that older technologies can’t handle.

Huang noted that Nvidia relies heavily on Taiwan Semiconductor Manufacturing Co. (TSMC) to make its most important chips because the company has a huge advantage there. But geopolitical tensions are raising risks. China considers the island of Taiwan, where TSMC is based, a lawless region, and there are growing concerns that the country could try to retake the territory, which could cut Nvidia off from a key supplier.

Hwang said Nvidia develops much of its technology in-house, which should enable it to switch orders to other suppliers, but he said such a change would likely result in lower quality chips.

The story continues

TSMC’s “agility and ability to serve our needs has been just incredible,” he said. “TSMC is great, so we use them, but of course we can always use other companies if we need to.”

(Updates with further comments from the meeting in sixth paragraph.)

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP