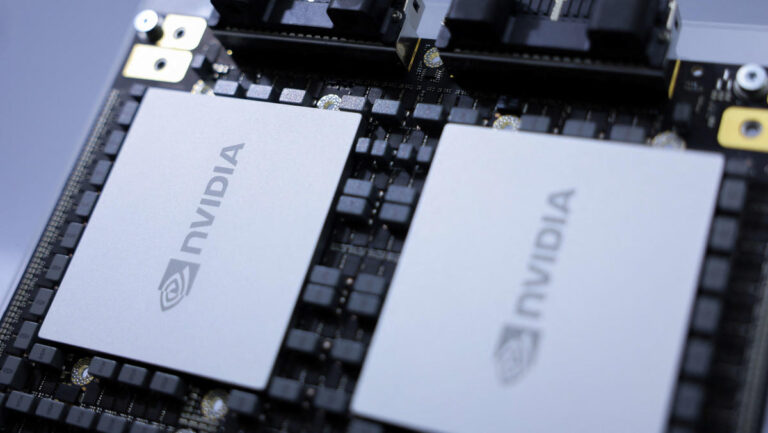

As AI competition heats up, Lumida Wealth Management CEO Ram Ahluwalia joins Catalysts to discuss how competition could impact Nvidia (NVDA).

“I think we’re still in the early days for NVIDIA. NVIDIA is clearly capturing the majority of the value capture in this space and industry,” Ahluwalia told Yahoo Finance. He expects NVIDIA stock to reach $150 by the end of 2024, especially as hyperscalers plan to spend $50 billion to $100 billion on GPU computing.

Ahluwalia believes there is “no question” that Nvidia is the first company to reach a $4 trillion valuation. “Earlier this year, we called out that NVIDIA would become the world’s most valuable company. The company reached that milestone yesterday, and demand for GPU chips is strong,” he said. We’re starting to see some ROI (return on investment from early adopters) — Meta (META) is seeing ROI on their CapEx spending, and Nvidia is starting to get some ROI from early adopters. We think there is plenty of room to grow.”

Among the Magnificent Seven players, he sees Nvidia as the AI winner, along with Alphabet’s Google (GOOG, GOOGL) and Meta.

For more expert insights and analysis on the latest market trends, check out More Catalysts here.

This post was written by Melanie Leal