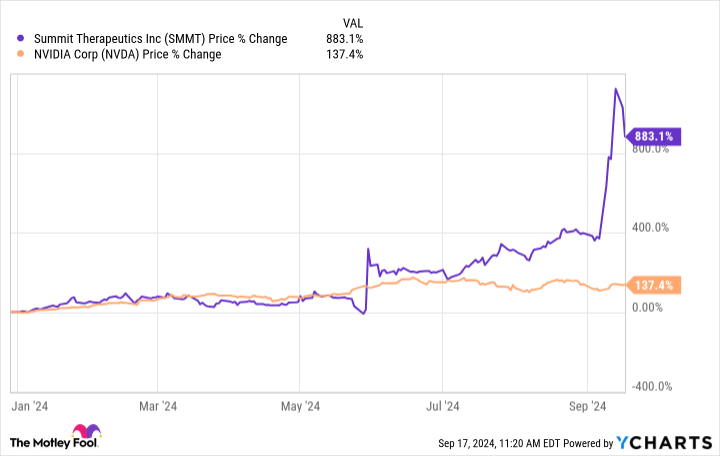

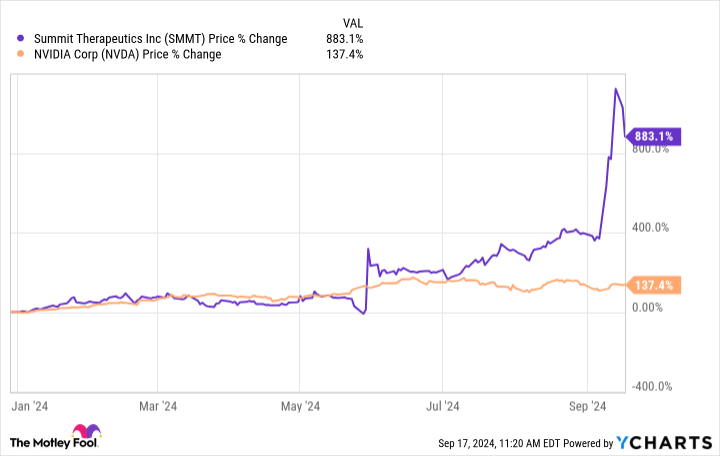

Few companies have attracted as much attention this year as Nvidia. The chipmaker is doing well thanks to rapid developments in artificial intelligence, and its revenue, profits, and stock price continue to grow at an incredible rate. Nvidia shares are up 137% this year.

Some companies have done even better, including one that many investors may never have heard of: Summit Therapeutics. (Nasdaq: SMMT)The biotech’s performance this year has made Nvidia’s look mediocre, with Summit shares up about 900% year to date.

So what’s driving this performance? Is Summit Therapeutics stock still attractive? Let’s find out.

Summit takes on the giants

Summit is focused on developing cancer drugs, and as is the case with any pharmaceutical company experiencing such rapid growth, the company’s recent success is due to strong clinical progress with its lead pipeline candidate, ibonecimab.

The drug was originally developed by a China-based company called Akeso, and Summit entered into a deal with the company to license the drug in certain countries, including the U.S., in exchange for an upfront payment, development and sales milestones, and royalties. Ivonesimab is already approved in China for certain mutated forms of lung cancer.

Ivonesimab recently achieved excellent results in a domestic Phase 3 clinical trial aimed at treating another type of non-small cell lung cancer (NSCLC), in which it competed against Merck’s Keytruda, the standard treatment for NSCLC and the world’s best-selling drug since last year.

In the study, ivonecimab achieved a median progression-free survival of 11.14 months compared with 5.82 months for Keytruda, and ivonecimab also reduced the risk of disease progression or death by 49% compared with Keytruda, with a similar safety profile.

According to Summit, ibonecimab is the first drug to show superior clinical results to Keytruda in a Phase 3 trial for NSCLC.

The potential of ibonesimab

Keytruda has gained dozens of indications around the world, but NSCLC is undoubtedly one of its biggest growth drivers. According to the World Health Organization, lung cancer is the second most common cancer in the world as of 2020. However, it is also the leading cause of cancer deaths.

Approximately 85% of lung cancer cases are non-small cell lung cancer (NSCLC). In 2017, approximately 40% of Keytruda’s sales came from various indications in the treatment of NSCLC, although this number is likely changing as the drug’s indications expand.

But on that basis, Keytruda generated $25 billion in sales last year, of which roughly $7 billion to $10 billion could have come from the NSCLC indication. If ivonesimab is approved in the U.S., Canada, Japan, and other countries where Summit holds licensing rights, it could capture much of that revenue and redirect it into Summit’s coffers.

The story continues

The drug is also being studied for other indications, including colorectal cancer, the second leading cause of cancer deaths worldwide.

Should I buy Summit?

There’s no question that Summit has found a winner with Ivonecimab. The drug could become a “pipeline drug” like Keytruda. The problem for investors is that some of Ivonecimab’s success is already priced into the stock price. The company has a market cap of $17 billion, despite not having a single drug on the market. At this level, any problems with its key pipeline candidate could send the stock plummeting.

The good news is that raising capital is likely not an issue: Summit ended the second quarter with $325.8 million in cash and cash equivalents, which the company said would keep it going through the fourth quarter of 2025. Since then, the company has been using ivonecimab’s recent success to raise more capital.

Summit Therapeutics certainly seems a bit risky, but ivoncimab’s potential could make it worthwhile for biotech investors who can stomach the risk. If the company can continue to deliver ivoncimab-related profits, its stock could deliver big gains over the long term.

Should you invest $1,000 in Summit Therapeutics right now?

Before buying Summit Therapeutics shares, consider the following:

The analyst team at Motley Fool Stock Advisor just identified the 10 best stocks for investors to buy right now, and Summit Therapeutics isn’t on the list. The 10 stocks selected have the potential to generate big gains over the next few years.

Let’s look back at April 15, 2005, when Nvidia made this list… if you had invested $1,000 at the time of our recommendation, you would have $710,860.!*

Stock Advisor offers investors an easy-to-follow blueprint for success, with portfolio construction guidance, regular updates from analysts and two new stock picks every month. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

View 10 stocks »

*Stock Advisor returns as of September 16, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool owns shares in and recommends Merck, Nvidia, and Summit Therapeutics. The Motley Fool has a disclosure policy.

This Stock is Outperforming Nvidia This Year: Is It Too Late to Buy? was originally published by The Motley Fool.