Goldman Sachs isn’t scared of Nvidia’s (NVDA) recent selling.

Nvidia shares fell nearly 10% on Tuesday, shedding about $400 billion in market capitalization last week. The tech stock was one of the biggest contributors to the S&P 500 Index’s (^GSPC) worst start to September since 1953, according to Bespoke Investment Group, but recovered some of its losses on Monday.

Despite the selloff, Goldman Sachs lead analyst Toshiya Hari maintained his buy rating on the chip giant. Asked if he thought the Goldman team had oversold Nvidia shares, Hari said “yes.”

“Despite the recent lackluster performance, we remain constructive on the stock,” Hari told Yahoo Finance at the Goldman Sachs 2024 Communacopia technology conference. “First of all, the demand for high-speed computing remains very strong. We tend to spend a fair amount of time with the hyperscalers — companies like Amazon, Google and Microsoft — but the demand profile is broadening out to enterprises, even in sovereign nations.”

The Nvidia selloff began after Wall Street wasn’t satisfied with the better-than-expected profit the company reported on Aug. 28. Nvidia’s sales beat Wall Street expectations by 4.1%, but that was the company’s smallest margin since the fourth quarter of fiscal 2023.

The big debate surrounding Nvidia is whether the company’s revenue momentum is sustainable, and Hari said investors are questioning whether that will be the case not just in 2025 but in 2026.

Goldman’s equity research team wrote in a recent note that investor sentiment toward artificial intelligence has “flipped nearly 180 degrees” since the start of 2023. Investors’ patience is running thin, and they want to see AI-driven revenue streams and margin gains in action, not be told about them.

Still, the Goldman team writes that when it comes to a significant generational technology shift like AI, “it would be futile to base decisions on short-term cost and revenue economics.”

The focus is on the long game: Goldman predicts that generative AI will start contributing significantly to the sector’s growth by the second half of 2025.

“We think their competitive position remains very strong,” Hari said of Nvidia. “We believe they are the go-to company for commercial silicon and have an advantage in terms of speed of innovation versus custom silicon.”

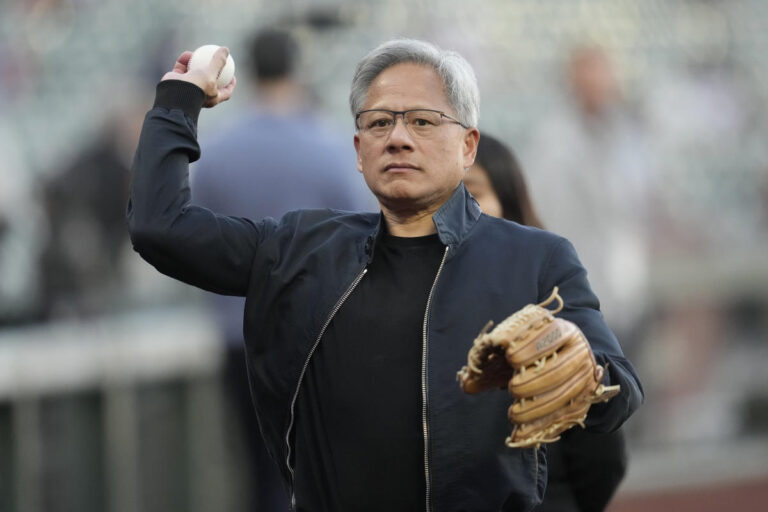

Nvidia CEO Jensen Huang is scheduled to speak at the conference Wednesday morning.

The story continues

For the latest technology news impacting the stock market, click here

Read the latest financial and business news from Yahoo Finance