(Bloomberg) — Semiconductor stocks, including Nvidia Inc., will be in for a tough ride if Friday’s U.S. jobs report signals a hard landing for the world’s largest economy, according to strategists at Bank of America Corp.

Most read articles on Bloomberg

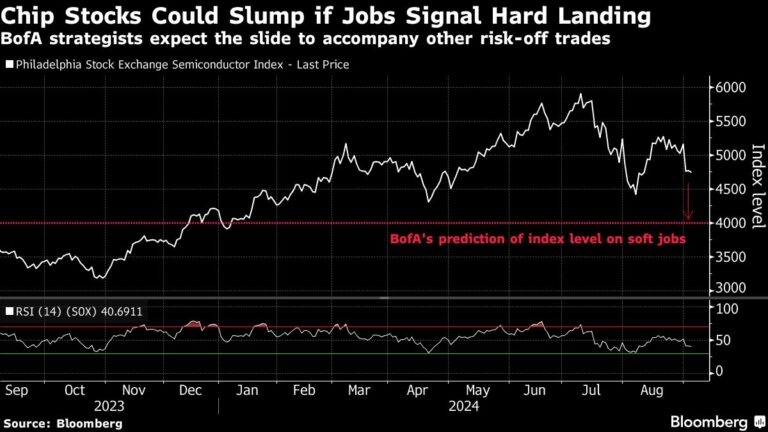

Strategists led by Michael Hartnett wrote in a note that if the death toll falls below 100,000 and the unemployment rate rises above 4.4%, stocks would fall sharply and the Philadelphia Semiconductor Index, which includes Nvidia, Broadcom (AVGO), and Advanced Micro Devices (AMD), would fall to around 4,000, a drop of 16% from current levels.

Concerns about a potential U.S. recession have weighed on global stock markets recently, and traders will be looking for signs of caution in the August jobs report. Economists surveyed by Bloomberg expect payrolls to rise by 165,000 jobs and the unemployment rate to fall to 4.2 percent. But whispers of the so-called jobs report among Bloomberg terminal users suggest payrolls rose by just 150,000.

In a hard landing scenario after the jobs report, the Federal Reserve would likely respond with a 50 basis point interest rate cut later this month, which would send the 10-year Treasury yield down to 3% from about 3.7% currently, Bank of America strategists predict. The dollar would fall against major currencies such as the yen and euro, and oil prices would plummet from around $70 a barrel to near $60.

In contrast, a “perfect” payroll number of 150,000 to 175,000 would signal a soft landing and trigger a reversal of the recent strength of defensive stocks, which would benefit technology and energy stocks.

Nvidia shares have risen 116% this year and have been on a roller-coaster ride in recent months, making them a key driver of the S&P 500. In addition to worries about economic growth, traders are also worried that the artificial intelligence boom that has powered Nvidia’s stock rally may be overblown.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP