Investors haven’t been buying semiconductor stocks fast enough over the past few years, in large part because advanced chips called graphics processing units, or GPUs, are one of the core power sources for artificial intelligence (AI) applications such as machine learning and self-driving cars.

Demand for chip stocks is likely to remain strong as AI-related buzz continues to drive the market higher. At the moment, Nvidia is widely considered the market leader among AI-enabled chip companies. However, Nvidia has just informed investors that its new Blackwell series GPUs will be delayed due to a design flaw.

I’m not one to take joy in other people’s misfortune, but I believe NVIDIA’s setback is a once-in-a-lifetime event for its biggest rival, Advanced Micro Devices. (NASDAQ: AMD)Let’s examine the current situation as a whole and evaluate how AMD can take advantage of Nvidia’s slump.

A tale of two chip companies

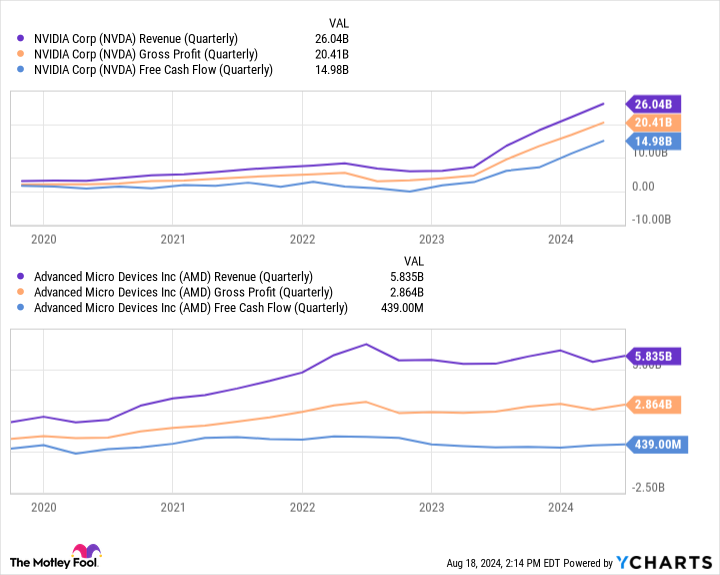

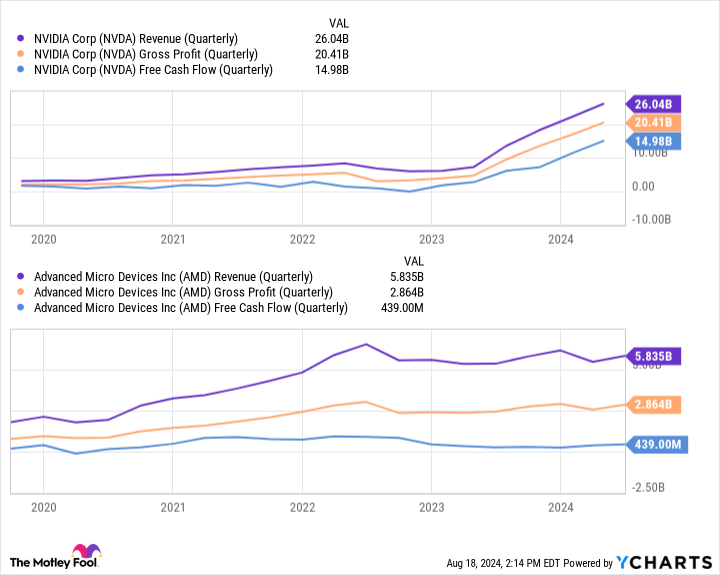

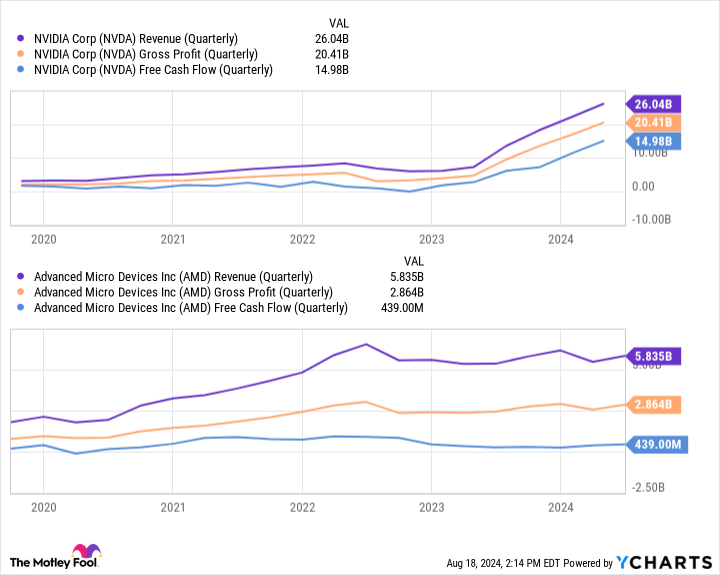

The chart below shows some key financial metrics for Nvidia and AMD.

On the one hand, Nvidia’s revenue and profits have been steadily increasing, as shown by the increasingly steep colored lines in the chart below. But on the other hand, Nvidia’s biggest rival is exhibiting notable inconsistencies in its operations.

The trends outlined above clearly indicate that chip buyers not only prefer Nvidia, but are willing to pay top dollar for it. While Nvidia has been the premier semiconductor company since the AI revolution began, AMD now has a fantastic opportunity to overtake Nvidia.

Why this is a defining moment for AMD

Wall Street analysts estimate that NVIDIA controls about 80% of the market for AI-enabled chips. While AMD has done all it can to match NVIDIA’s breakneck pace of innovation, the company has attempted to distract investors from NVIDIA’s commanding lead, primarily through a series of questionable acquisitions.

In my opinion, AMD is running out of time and cannot afford to rely on acquisitions as a source of product development and inorganic growth. The only saving grace for AMD at this point is that their MI300X accelerator GPU is the fastest product in the company’s history to reach $1B in sales.

Demand for AMD’s GPUs is clearly high, but not as high as Nvidia’s, and with Blackwell shipments potentially delayed until next year, AMD has an opportunity to seize the opportunity.

The story continues

It’s important to keep your feet on the ground

Blackwell’s delays are never good news, but investors need to be realistic: Some companies will likely opt for alternative solutions to Blackwell for the time being, but Nvidia shouldn’t have a hard time selling these chips once it eventually fixes its design flaws.

So while it’s unlikely that AMD will suddenly gain overwhelming market share and completely crush Nvidia, I think the company has an opportunity to raise its profile by disrupting Nvidia’s momentum.

For now, it’s nearly impossible for investors to know if AMD is penetrating the market while Nvidia is focused on turning around Blackwell. A wise move would be to monitor press releases from major AI developers like Microsoft, Amazon, Alphabet, and Oracle to see if they’re forming new partnerships with AMD or buying more MI300X chips.

While I don’t currently own any AMD shares, I’m intrigued by current trends in the chip market and view the company as a hedge against Nvidia and as a sort of long-term call option in the broader AI market.

But investors with a higher risk tolerance might consider buying AMD now, and given that the company is second to Nvidia, it’s hard to imagine a scenario in which AMD falls behind in this Blackwell situation.

Another strategy is to wait a few months until AMD releases its next earnings report to see if the company experienced unusual growth compared to the previous quarter. Investors should also listen to management’s commentary on new business sources.

Either way, I’m optimistic that AMD will be able to capitalize on Nvidia’s failure to create the catalyst it needs for sustained long-term growth as the two companies continue their fierce chip competition.

Should you invest $1,000 in Advanced Micro Devices right now?

Before buying Advanced Micro Devices shares, consider the following:

The analyst team at Motley Fool Stock Advisor just identified the 10 best stocks for investors to buy right now, and Advanced Micro Devices wasn’t among them — all of which have the potential to generate big gains over the next few years.

Let’s look back at April 15, 2005, when Nvidia made this list… if you had invested $1,000 at the time of our recommendation, you would have $758,227.!*

Stock Advisor offers investors an easy-to-follow blueprint for success, with portfolio construction guidance, regular updates from analysts and two new stock picks every month. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

View 10 stocks »

*Stock Advisor returns as of August 22, 2024

Suzanne Frey, an Alphabet executive, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has invested in Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool has invested in and recommends Advanced Micro Devices, Alphabet, Amazon, Microsoft, Nvidia, and Oracle. The Motley Fool recommends long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

AMD’s breakout moment has arrived: Why now is the chance of a lifetime to buy the company’s stock. This article was originally published by The Motley Fool.