(Bloomberg) — Daron Acemoglu wants to make it clear right now that he has nothing against artificial intelligence. He gets the potential. “I’m not an AI pessimist,” he declared seconds into the interview.

Most Read Articles on Bloomberg

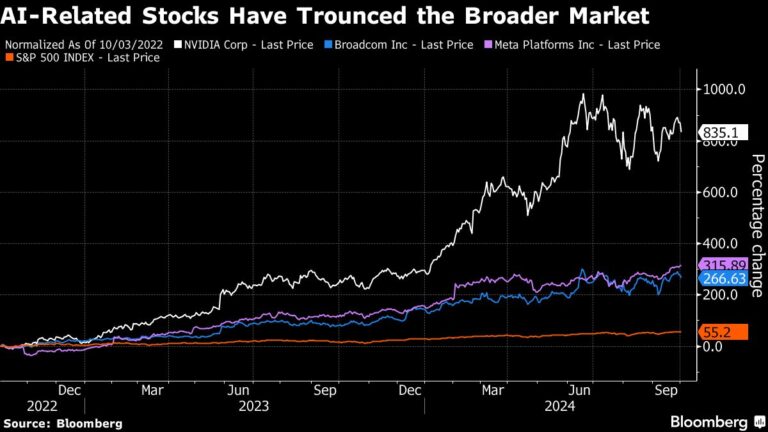

Acemoglu, a renowned professor at the Massachusetts Institute of Technology, appears to be a prophet of the growing economic and financial crisis to come, given the constant hype surrounding the technology and its potential investment boom. It appears to be fueling a furious rise in tech stocks.

AI may be promising, but it’s unlikely to live up to the hype, Acemoglu says. According to his calculations, only 5% of all jobs will be taken over or at least significantly assisted by AI over the next 10 years. That’s certainly good news for workers, but very bad news for companies that are pouring billions into technology in hopes of improving productivity.

“A lot of money will be wasted,” Acemoglu said. “There will be no economic revolution from that 5%.”

Acemoglu has become one of the more high-profile figures on Wall Street and among executives across the country warning that the AI frenzy has gone too far. Mr. Acemoglu, an Institute Professor, the highest ranking on MIT’s faculty, first rose to prominence beyond academia a decade ago as co-author of the New York Times bestselling book “Why Nations Fail.” It has become. The emergence of AI and broader new technologies has had a notable impact on his economics research over the years.

Bulls argue that as technology continues to advance, AI will allow companies to automate many work tasks and spark a new era of medical and scientific advances. Jensen Hwang, CEO of Nvidia, whose very name has become synonymous with the AI boom, says that the growing demand for the technology’s services from a broader range of businesses and governments has led to as much as $1 trillion being spent on data center equipment upgrades. We anticipate that expenditures will be required. In the next few years.

Skepticism about these kinds of claims is starting to grow, in part because investments in AI are driving up costs far faster than revenues for companies like Microsoft and Amazon, but most investors remains willing to pay a hefty premium for stocks likely to ride the AI wave.

Acemoglu envisions three ways the AI story could play out over the next few years.

story continues

The first, and by far the most benign scenario, calls for the hype to gradually subside and investment in “modest” uses of the technology to take root.

In the second scenario, the frenzy continues for another year or so, leading to a crash in tech stocks and investors, executives, and students becoming disillusioned with technology. He calls this “the spring of AI followed by the winter of AI.”

The third, and most frightening, scenario is that this mania goes unchecked for years, leading to mass layoffs and hundreds of billions of dollars of investment in AI, with companies “not understanding what they’re going to do with it.” It’s about connecting and ultimately being left behind. When technology doesn’t work out, there’s a rush to rehire workers. “There is now a negative impact across the economy.”

What is most likely? He believes this is a combination of the second and third scenarios. Inside the C-suite, the fear of missing out on the AI boom is too great to imagine the hype machine slowing down anytime soon, and that even as the hype intensifies, the decline will be gradual. “It’s unlikely,” he said.

The second quarter numbers show the extent of the spending frenzy. Microsoft, Alphabet, Amazon, and Meta Platforms alone invested more than $50 billion in capital spending this quarter, much of it in AI.

Today’s large-scale language models, like OpenAI’s ChatGPT, are impressive in many ways, Acemoglu says. So why can’t they replace humans in many jobs, or at least help humans a lot? He points to reliability issues and a lack of human-level wisdom and judgment. , so people are unlikely to outsource many white-collar jobs to AI anytime soon. Nor can AI automate physical tasks such as construction or cleaning, he says.

“We need reliable information or the ability of these models to faithfully perform the specific steps that previous workers were doing,” he said. “In some places you can do things like coding under human supervision, but in most places you can’t.”

“This is a reality check of where we are right now,” he said.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP