With all the attention on artificial intelligence (AI), it’s easy to focus on Nvidia as a top tech stock. It’s a great stock and has performed surprisingly well, but there are other stocks out there that are more attractive right now.

The three companies I am paying attention to are Taiwan Semiconductor Manufacturing Co., Ltd. (NYSE:TSM)Meta Platform (Nasdaq: META)Procore Technologies (NYSE: PCOR)All of these offer a great compromise between growth and value, and I think they’re much better buys than Nvidia right now.

Taiwan Semiconductor Manufacturing

Taiwan Semiconductor, or TSMC for short, is the world’s largest contract chip manufacturer. The company manufactures designs for big companies like Nvidia and Apple, which means that no matter who is ahead in the AI race, it will be the winner.

TSMC prides itself on being at the cutting edge of technology, with market-leading three-nanometer (3nm) chips and already working on next-generation 2nm chips that can be configured to deliver greater computing power and efficiency.

The computing power of existing technology is already impressive, so TSMC’s customers will likely opt for more efficient versions, especially as input costs for AI computing hardware are so high. This could further boost demand for the company’s chips, making the stock a strong buy.

With management projecting compound annual earnings growth of 15% to 20%, this could be a market-beating stock, and with the stock still down about 10% from its July high, now is the time to buy.

Meta Platform

Meta Platforms is the parent company of Facebook, Instagram, Threads, WhatsApp and Messenger, and also has a division called Reality Labs that offers products such as virtual reality headsets.

But what investors should really be focusing on is the advertising business on social media sites, which makes up 98% of the company’s revenue. Meta investors will have to learn how to balance the benefits of advertising with Reality Labs’ high profitability.

Overall, Meta is a really great business, with operating margins of 38% and revenue growth of 22%. These are great metrics, but the stock is trading at 24 times forward earnings. Given that the S&P 500 is trading at 23 times forward earnings, this really is a bargain, as the business is performing much better than the average S&P 500 member.

Meta is expected to continue its dominance in social media, and if its Reality Labs product proves a hit, the company’s stock price could rise significantly.

Procore Technologies

You may not have heard of Procore, but the company’s construction management software is revolutionizing the industry. Unlike nearly every other industry that has seen a software revolution in the past decade, the construction industry has only recently benefited from the widespread availability of cellular connectivity.

The story continues

Now that this is possible, Procore’s software has proven extremely popular because contractors, subcontractors, and project owners can all work from the same source of information, eliminating the extra costs associated with correcting errors. If an engineer makes a change to an electrical schematic, it can be uploaded into Procore, where the electrical contractor can access the change almost instantly on-site.

Despite its popularity, Procore still has a long way to go to grow in its target markets: In a 2023 investor presentation, the company estimated it captured about 12% of construction industry sales and less than 2% of business in the industry, and even less globally, about 1% and 2%, respectively.

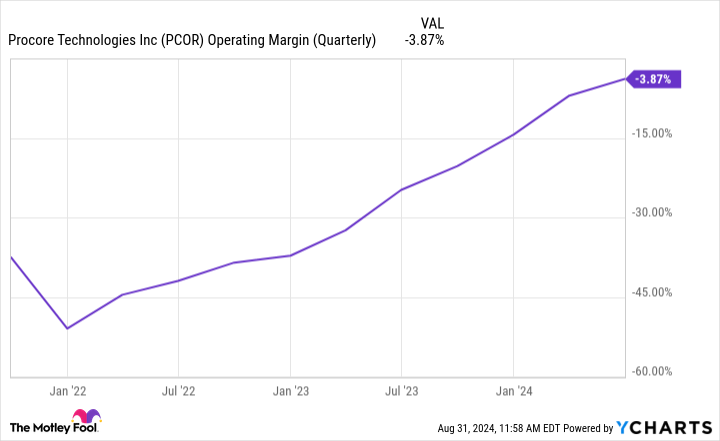

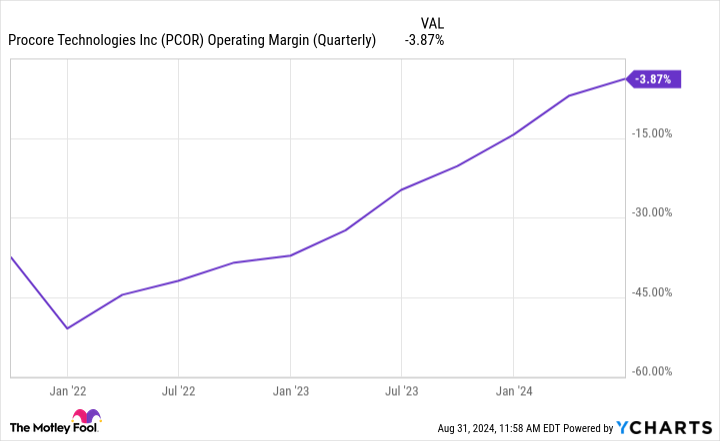

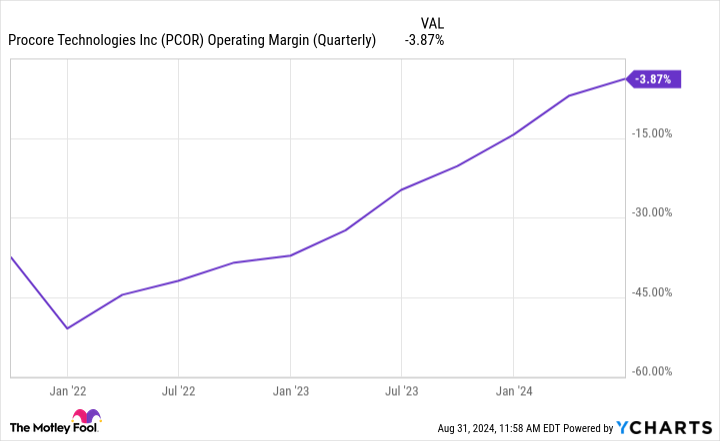

Given the size of the industry, Procore has the potential to become a huge business if it continues its growth trajectory. Second-quarter revenue grew 24% year over year. The business isn’t profitable, but it’s getting closer to profitability each quarter.

With its vast financial resources, it shouldn’t be long before Procore starts turning a profit and delivering benefits to shareholders.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before buying Taiwan Semiconductor Manufacturing shares, consider the following:

The analyst team at Motley Fool Stock Advisor just identified the 10 best stocks for investors to buy right now, and Taiwan Semiconductor Manufacturing Co. isn’t on the list. These 10 stocks have the potential to generate huge gains over the next few years.

Let’s look back at April 15, 2005, when Nvidia made this list… if you had invested $1,000 at the time of our recommendation, you would have $656,938.!*

Stock Advisor offers investors an easy-to-follow blueprint for success, with portfolio construction guidance, regular updates from analysts and two new stock picks every month. Stock Advisor The service is More than 4 times S&P 500 Recovery Since 2002*.

View 10 stocks »

*Stock Advisor returns as of September 3, 2024

Randi Zuckerberg is a former director of market development and communications at Facebook, sister of Meta Platforms CEO Mark Zuckerberg, and a member of The Motley Fool’s board of directors. Kissen Drury has invested in Meta Platforms, Procore Technologies, and Taiwan Semiconductor Manufacturing. The Motley Fool has invested in and recommends Apple, Meta Platforms, NVIDIA, Procore Technologies, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

3 Tech Stocks to Buy Instead of Nvidia was originally published by The Motley Fool.