taiwan semiconductor (NYSE:TSM) It has been a great investment over the past 5 years. Its total return was about 350%, easily outpacing the Nasdaq 100 and S&P 500, which rose 170% and 110%, respectively.

TSMC has been a market-disrupting stock for the past five years, and I’m confident it will do so again in the next five years. This makes the stock a strong buy now, and to me there are three reasons why this stock is an attractive buy.

1. Significant revenue growth

Taiwan Semiconductor’s revenue growth is expected to increase steadily and strongly over the next five years. There are multiple tailwinds, especially in artificial intelligence (AI).

Management believes AI-related chips will grow at a compound annual growth rate (CAGR) of 50% through 2028, by which time they will account for about the low 10% of overall revenue. This is a rapid growth rate, and much of the future growth will come from 2-nanometer (nm) chip designs.

The current generation of chips is 3nm, but the next generation of chips will be significantly more advanced. When configured to maintain the same speed as a 3nm chip, 2nm chips are expected to be 25% to 30% more efficient. Energy is a significant operating cost for data centers that power AI models, so it’s no surprise that this innovation is set to hit TSMC’s customers. Management is already seeing strong demand, exceeding pre-production demand for previous 3nm and 5nm generations.

All of this is reflected in management’s forecast for revenue to grow at a CAGR of 15% to 20% over the next few years. This is an above-market growth and is the main reason why TSMC will once again outperform the market going forward.

2. Attractive stock price

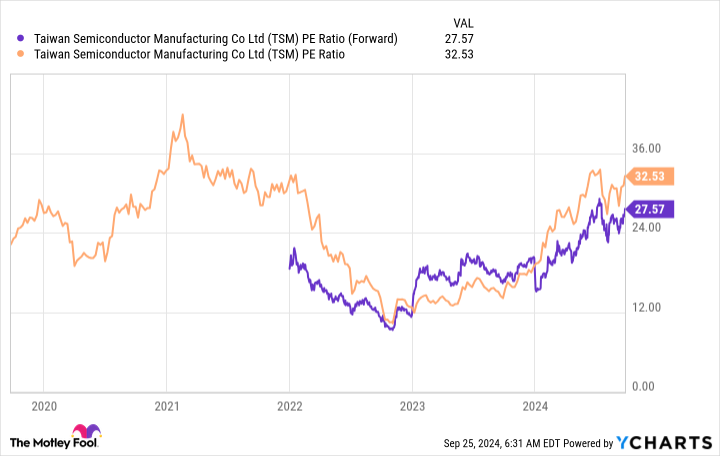

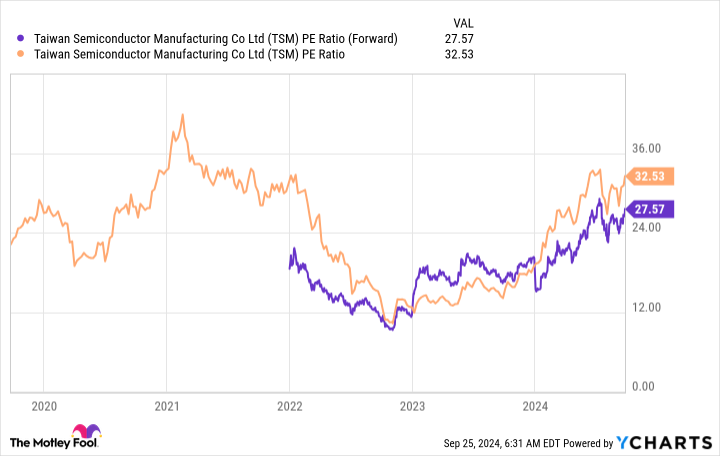

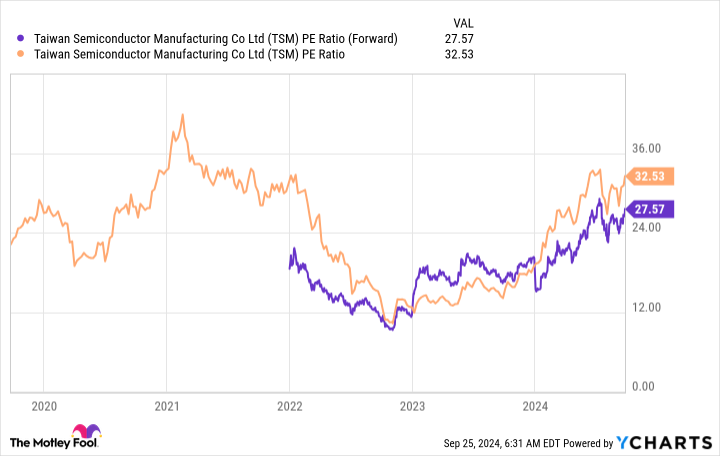

Despite TSMC’s solid outlook, the stock isn’t very expensive. On a price-to-earnings ratio (PER) basis, Taiwan Semi’s stock price is almost the same as it was five years ago. This is important because it shows you aren’t grossly overpaying for TSMC stock.

Obviously, it would have been better to buy the stock in early 2023, but that price is no longer there. In exchange, investors will have to pay about 27.6 times TSMC’s expected earnings, which isn’t a huge premium over the comparable index. In contrast, the S&P 500 and Nasdaq 100 have forward price-earnings ratios of 23x and 29.2x. This makes TSMC’s stock price fairly reasonable compared to the broader market, and should alleviate investors’ concerns that they are paying too much for the stock despite two strong years.

the story continues

3. TSMC’s dividend is increasing

Taiwan Semiconductor has not attracted the attention of most dividend investors, which is a shame. TSMC’s dividends are not huge, but they make up a significant portion of your overall investment.

TSMC’s dividend is based on New Taiwan (NT) dollars rather than US dollars, so its dividend is not as consistent as other stocks. However, from the perspective of the Taiwan dollar, the company’s management policy is to “maintain a sustainable and steady increase in dividends, and pay dividends every quarter and year at a level that is no lower than the previous year or quarter.”

TSMC’s policy of increasing its dividend every year makes it a good dividend investment. Although the yield is around 1.4%, yield is still an important part of TSMC’s investment thesis, especially if management consistently drives the yield higher.

Taiwan Semiconductor is expected to grow significantly over the next five years and can be acquired at a fair price. Additionally, it pays a sizable dividend that is scheduled to grow as well. TSMC is almost a no-brainer to buy, and I expect it to easily outperform the market going forward.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before buying Taiwan Semiconductor Manufacturing stock, consider the following:

Motley Fool Stock Advisor’s team of analysts has identified the 10 best stocks for investors to buy right now. Taiwan Semiconductor Manufacturing Co., Ltd. was not included. These 10 stocks have the potential to generate impressive returns over the next few years.

Consider when Nvidia created this list on April 15, 2005… If you invested $1,000 at the time of recommendation, you would have earned $743,952.!*

Stock Advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month. of stock advisor For the service more than 4 times The resurgence of the S&P 500 since 2002*.

See 10 stocks »

*Stock Advisor will return as of September 23, 2024

Keithen Drury works for Taiwan Semiconductor Manufacturing Company. The Motley Fool owns a position in and recommends Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The original author of “3 Reasons to Buy Taiwan Semiconductor Stocks Like There’s No Tomorrow” is published by The Motley Fool.