Those who do not learn from history are doomed to repeat it, as the saying goes. Wise words and wise advice for investors. When the market is hitting new all-time highs every week and there is excitement on Wall Street and in the amateur investing world, it may feel like stocks will keep going up forever and valuations don’t matter. But this is exactly when investors should err on the side of caution.

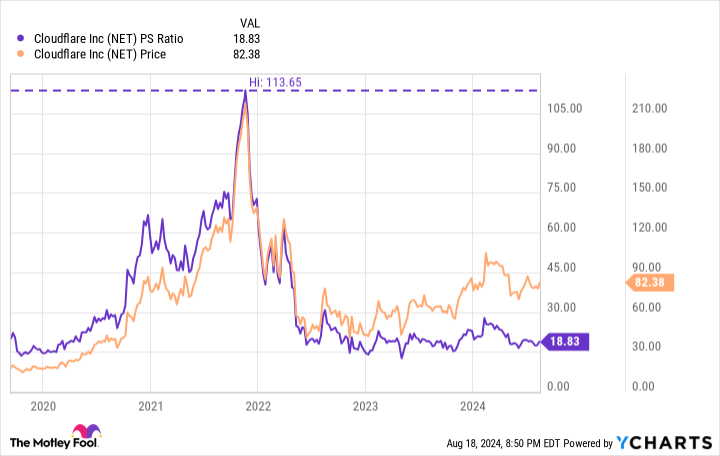

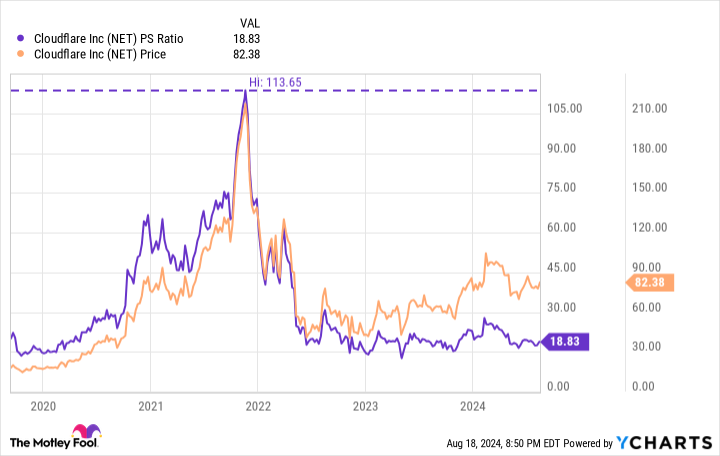

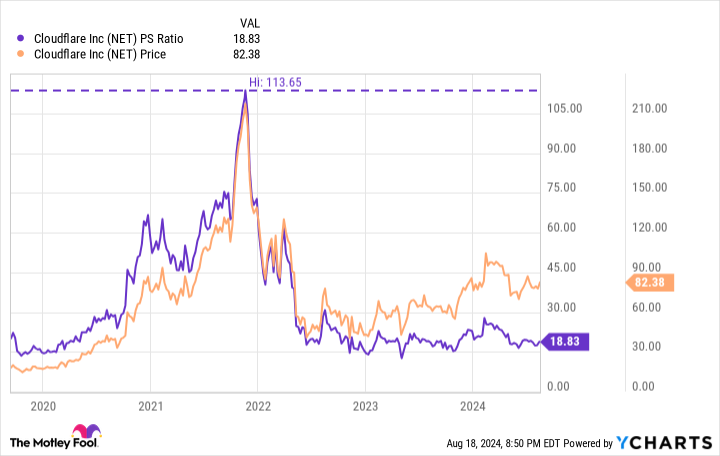

The most recent example is the 2021 tech bubble. The economy was flush with stimulus money, interest rates were near zero, and stocks traded at outrageous valuations. For example, edge computing company Cloudflare (NYSE: NET) As you can see below, the stock’s valuation has reached a staggering 114 times sales.

As you can see, the stock is now trading at a more reasonable 19 times sales, and the stock is down 62% from its all-time high. And guess what? Cloudflare is a great company, but it wasn’t a great investment at that lofty valuation.

In the current artificial intelligence (AI) boom, there are undervalued and overvalued stocks. Here are my take on three popular companies.

Amazon stock looks like a great value.

Amazon (Nasdaq: AMZN) The stock fell after the company reported second-quarter earnings, as revenue growth disappoints. Total sales rose 10% to $148 billion, and third-quarter guidance was for growth of just 8% to 11%. Product sales were the main driver, growing just 4% for the quarter.

Consumer spending is being deliberately slowed across the economy. Interest rates remain above 5% as the Federal Reserve keeps inflation in check. Some investors are concerned about a potential recession and further declines in consumer spending. However, the Federal Reserve is widely expected to cut interest rates soon. Additionally, most of Amazon’s profits come from Amazon Web Services (AWS), not from the sale of its products.

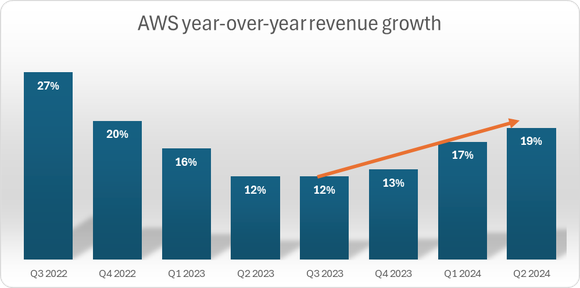

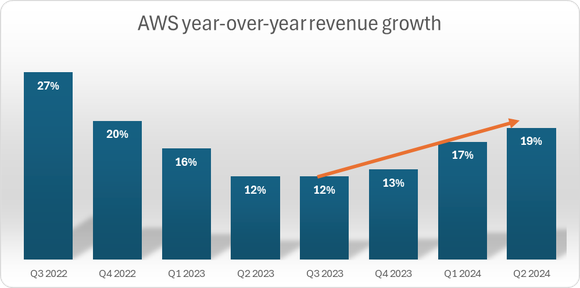

AWS has been the straw that stirs the drink for Amazon, and growth is back: As you can see below, AWS revenue growth has accelerated for four consecutive quarters after a dip in 2023.

Cloud data providers such as AWS will continue to grow due to AI data needs and the continued migration to the cloud.

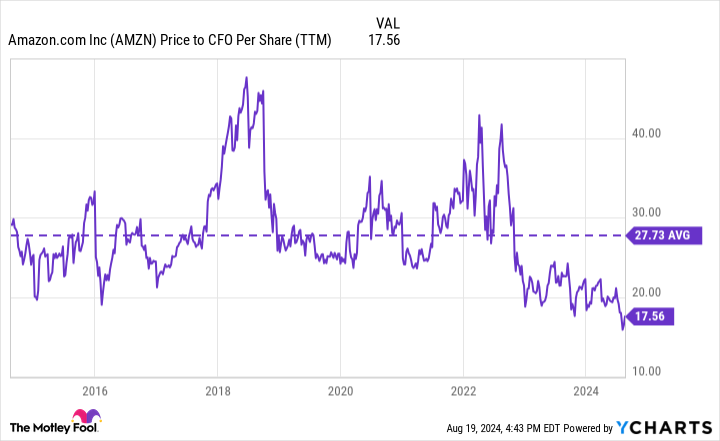

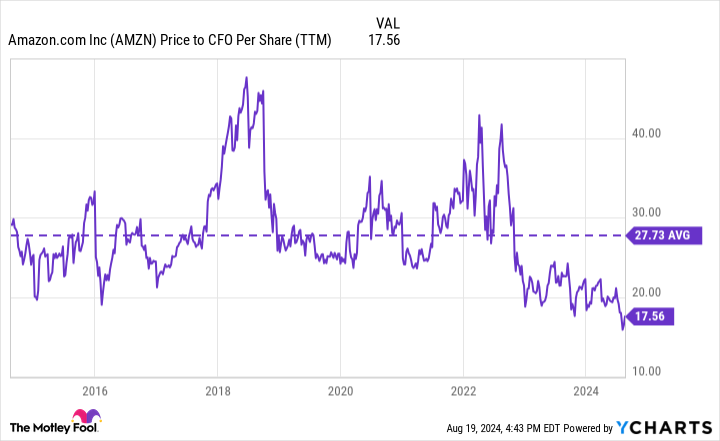

Amazon stock is undervalued by multiple measures. My preferred measure is price-to-cash earnings. In other words, how much am I paying for the cash this company generates in its core business? As you can see below, this is the first time Amazon stock has been this cheap by this measure in over a decade, and it is 50% cheaper than its 10-year average.

Given AWS’ accelerating growth, active AI tailwinds, and the stock’s historical undervaluation, Amazon now looks like a fantastic long-term value.

The story continues

Two great companies seem overpriced

AI is a huge benefit, and Arm Holdings (Nasdaq: ARM) Palantir (NYSE: PLTR) They are riding them for high valuations.

Arm Holdings designs the “architecture” of the semiconductors that technology giants sell. More than 99% of smartphones use its technology, and the company reports that 287 billion Arm-based chips have been sold to date. The company expects another 100 billion to be shipped by the end of fiscal 2026. The company earns royalties and licensing fees from companies that use its designs. The company stands to benefit greatly from the rise of AI, which requires high-performance chips.

Revenues rose 39% quarter-over-quarter to $939 million, and Arm expects sales of $3.8 billion to $4.1 billion and diluted earnings per share of $1.45 to $1.65 for the current fiscal year. Those are impressive results, but they still don’t justify the current valuation: Arm shares trade at about 40 times sales and 85 times forward earnings.

This is too expensive for me, but if the stock price falls below 25x sales I would definitely buy the stock back.

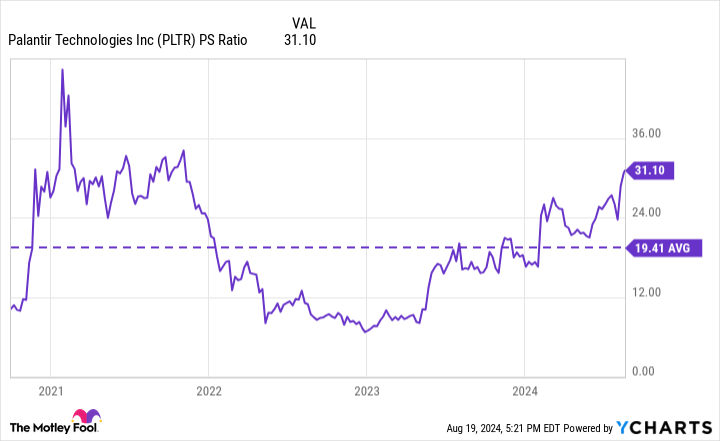

Palantir helps businesses harness vast amounts of data to help customers visualize, analyze, and make better decisions. The company has strong relationships with government customers, primarily the Department of Defense, and is rapidly gaining traction in the private sector as well. With its new Artificial Intelligence Platform (AIP), the company’s commercial customer base grew 83% quarter-over-quarter to 295 companies. Revenue grew 27% to $678 million, and Palantir is now steadily profitable.

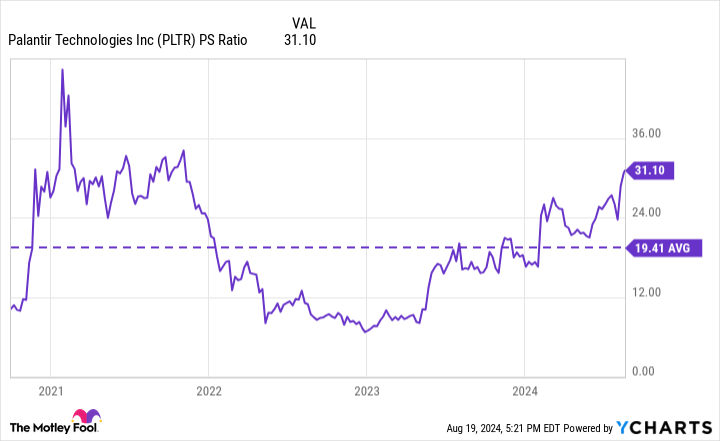

But like Arm, there isn’t much room for error in valuation. Palantir’s price-to-sales multiple of 31x is the highest since the 2021 tech bubble and 60% above its historical average, as shown below.

The stock deserves a premium price due to its stellar performance and AI tailwinds, but not to this extent. Patient investors will find better entry points.

The excitement around AI is real, as are the big tailwinds for Amazon, Arm and Palantir, but valuation remains key in the long term, and of the three tech giants, only Amazon is attractive right now.

Should I invest $1,000 in Amazon right now?

Before you buy Amazon stock, consider the following:

The analyst team at Motley Fool Stock Advisor has identified the 10 best stocks for investors to buy right now, and Amazon isn’t on the list — all of these stocks have the potential to generate huge gains over the next few years.

Let’s look back at April 15, 2005, when Nvidia made this list… if you had invested $1,000 at the time of our recommendation, you would have $758,227.!*

Stock Advisor offers investors an easy-to-follow blueprint for success, with portfolio construction guidance, regular updates from analysts and two new stock picks every month. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

View 10 stocks »

*Stock Advisor returns as of August 22, 2024

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, serves on The Motley Fool’s board of directors. Bradley Guichard invests in Amazon. The Motley Fool has invested in and recommends Amazon, Cloudflare, and Palantir Technologies. The Motley Fool has a disclosure policy.

1 Artificial Intelligence (AI) Stock to Buy Now, 2 to Wait for a Drop was originally published by The Motley Fool.