What trends should we look for to identify stocks that have the potential to double in value over the long term? Typically, we look for an upward trend in Return on Invested Capital (ROCE) and an associated trend of growing invested capital. This indicates that the company is a compounding machine and can continually reinvest earnings back into the business to generate higher returns. With that in mind, we weren’t too excited when we looked at Tower Semiconductor (NASDAQ:TSEM) and its ROCE trend.

What is Return on Invested Capital (ROCE)?

For those who don’t know, ROCE is the ratio of a company’s annual pre-tax profit (revenue) to the capital employed in the business. Here’s the formula for Tower Semiconductor:

Return on Invested Capital = Earnings Before Interest and Taxes (EBIT) ÷ (Total Assets – Current Liabilities)

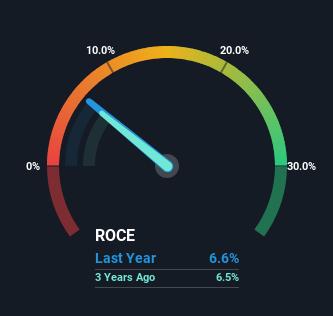

0.066 = US$177m ÷ (US$3b – US$290m) (Based on the trailing twelve months to June 2024).

That means Tower Semiconductor has an ROCE of 6.6%. In absolute terms, this is a low return, below the Semiconductor industry average of 9.0%.

Read our latest analysis for Tower Semiconductor

Above you can see how Tower Semiconductor’s current ROCE compares to its prior returns on capital, but the history can only tell you so much – if you’d like, you can see forecasts from analysts covering Tower Semiconductor for free.

So how is Tower Semiconductor’s ROCE trending?

Tower Semiconductor’s historical ROCE trend is nothing to write home about. The company has deployed over 61% of its capital over the past five years, yet its return on capital has remained stable at 6.6%. Given that the company has increased the amount of capital it has deployed, it appears that the investments made to date simply do not provide a high return on capital.

Tower Semiconductor’s ROCE conclusion

In summary, Tower Semiconductor is simply reinvesting capital and generating the same low rate of return as before. However, for long-term shareholders, the stock has delivered an impressive return of 103% over the past five years, and the market seems optimistic about the company’s future. However, if these fundamental trend trajectories continue, we don’t think the stock is likely to jump multiples from here.

If you wish to learn more about Tower Semiconductor, we’ve noticed 2 warning signs for Tower Semiconductor, and one of them makes us a bit uneasy.

Tower Semiconductor doesn’t have the highest profit margins, but check out this free list of companies with rock-solid balance sheets and high return on equity.

Valuation is complicated, but we’re here to simplify it.

Through a detailed analysis including fair value estimates, potential risks, dividends, insider trading, financials, and more, we determine whether Tower Semiconductor is undervalued or overvalued.

Access free analysis

Have feedback about this article? Concerns about the content? Please contact us directly or email us at editorial-team (at) simplywallst.com.

This article by Simply Wall St is of general nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodology, and our articles are not intended as financial advice. It is not a recommendation to buy or sell a stock, and does not take into account your objectives or financial situation. We aim to provide long-term analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned herein.