On August 28, Wall Street held its breath as the world’s most important artificial intelligence (AI) company reported its second-quarter results. I’m talking about NVIDIA. (NASDAQ: NVDA)Absolutely. While each member of the Magnificent Seven is seen as a beacon of where AI is headed, Nvidia has emerged as perhaps the ultimate barometer for the industry.

But fear not, Nvidia silenced the skeptics with another stellar earnings report. However, while sifting through the financial and operating metrics, we found one announcement to be a bit puzzling.

Specifically, Nvidia’s board of directors authorized an additional $50 billion in share buybacks (this is on top of the remaining $7.5 billion from a previous share repurchase program). The common belief is that stock buybacks can be very lucrative for investors, but in Nvidia’s case, I don’t see why.

Below, I explain some of the reasons why Nvidia announced a share buyback and why I don’t think this move is a reason to buy the stock right now.

Will Nvidia’s share buybacks get in the way?

One of the big announcements from Nvidia this year was the company’s 1-for-10 stock split in June. Nvidia shares have risen more than 750% since early September 2022. With the stock price now above $1,000 per share, it has become more difficult for some investors to build a position in Nvidia.

After a stock price has risen significantly, a company may choose to split its stock. Although a stock split does not essentially change a company’s market capitalization, the stock is often perceived as undervalued when the split-adjusted price falls, which may discourage investors from buying into the stock. As a result, the stock may actually become more expensive after the split as more investors start to flow in.

However, this is not the case with Nvidia stock. Since shares began trading on a split-adjusted basis on June 10, Nvidia shares have fallen about 2% (as of the market close on September 2). I will admit that a 2% drop is no reason to panic. That being said, I am a bit surprised that the stock split did not spur a notable increase in buying activity and drive Nvidia’s valuation to new highs.

Frankly, I view this buyback announcement as a PR stunt and an effort to re-excite investors.

Do Nvidia’s share buybacks make strategic sense?

Imagine watching a commercial featuring a celebrity you admire endorsing a product, only to find out later that the celebrity has never used the product and was simply paid to promote it. In a way, that’s similar to what’s happening with Nvidia right now.

The story continues

While adding more funds to an existing share repurchase plan may give the impression that management sees the stock as a good buying opportunity or even undervalued, it’s important to remember that insider selling has been all the rage at NVIDIA over the past few months. Executives including NVIDIA CEO Jensen Huang, Executive Vice President of Operations Deborah Shoquist, and board members Mark Stevens and Tench Cox all sold shares when NVIDIA’s stock price was soaring earlier in the summer.

Why should one buy Nvidia stock when the people responsible for creating shareholder value are selling it? This may be a harsh criticism, since Nvidia executives still own large amounts of stock and their net worth is closely tied to the performance of the business. But I have a few other concerns about share buybacks:

While NVIDIA is best known for its graphics processing units (GPUs), I wrote a while back about how the company is putting its record profits into growth initiatives outside of its core semiconductor and data center businesses. Additionally, given that NVIDIA’s biggest rival, Advanced Micro Devices (AMD), has made several notable acquisitions over the past two years, I think management is motivated to double down on R&D, marketing, and other efforts amid increased competition. I view those decisions as even more prudent given that NVIDIA had to delay orders for its latest Blackwell GPUs due to design flaws.

Finally, a word about competition outside of AMD: Nvidia is also facing increased competition from its own customers, especially from members of the Magnificent Seven. Electric vehicle (EV) manufacturer Tesla uses Nvidia chips heavily in the development of its autonomous driving software. However, Elon Musk’s recent comments indicate that Tesla may be moving away from Nvidia and competing with the chip giant in the future. Additionally, both Amazon and Meta are increasing their capital expenditures (capex) investments in several projects centered around designing their own semiconductor chips.

Is Nvidia stock worth buying now?

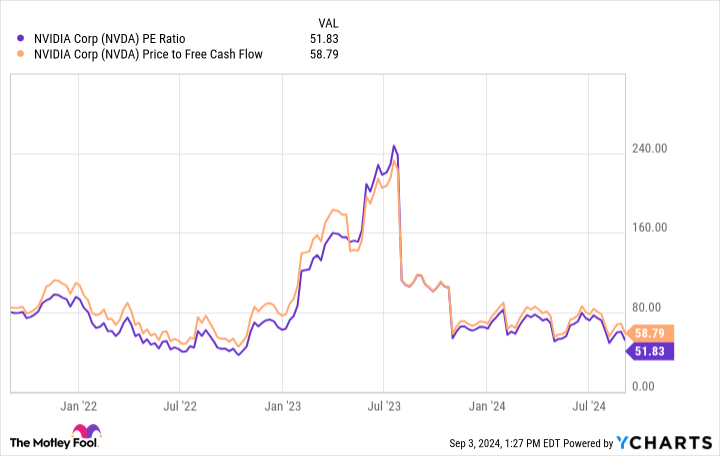

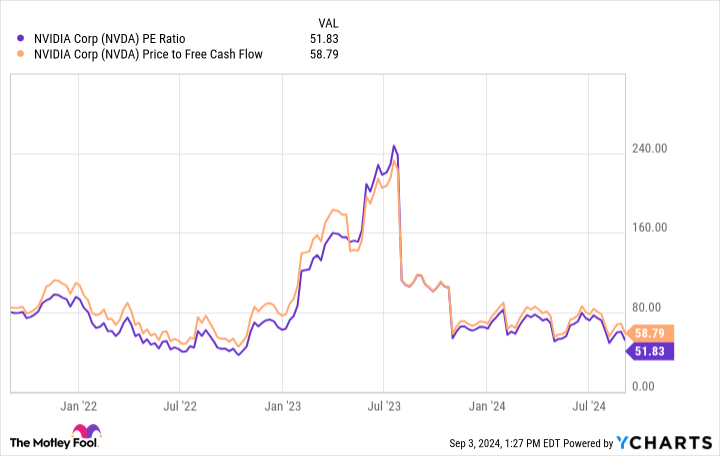

If you look at Nvidia purely from a valuation standpoint, you can make the argument that the company’s stock is a bargain right now: When you look at price-to-earnings (P/E) and price-to-free cash flow (P/FCF) ratios, Nvidia’s stock is actually cheaper now than it was a few years ago, and that’s due to newfound revenue and earnings growth.

However, I am beginning to worry that Nvidia may struggle to find opportunities to allocate capital to as competition heats up. I am not going to express the view that investing in Nvidia is a disastrous choice; I will save the apocalyptic statements for another time.

However, investors should be aware that Nvidia’s record growth in both revenue and earnings won’t continue forever. Eventually growth will normalize, hurting Nvidia’s margins. That’s why I’m skeptical of the $50 billion share buyback and don’t see it as a good reason to accumulate Nvidia shares at this point.

Should I invest $1,000 in Nvidia right now?

Before you buy Nvidia stock, consider the following:

The analyst team at Motley Fool Stock Advisor has identified 10 stocks that investors should buy right now, and Nvidia is not among them. The 10 selected stocks have the potential to generate big gains over the next few years.

Let’s look at April 15, 2005, when Nvidia made this list… if you had invested $1,000 at the time of our recommendation, you would have $630,099.!*

Stock Advisor offers investors an easy-to-follow blueprint for success, with portfolio construction guidance, regular updates from analysts and two new stock picks every month. Stock Advisor The service is More than 4 times S&P 500 Recovery Since 2002*.

View 10 stocks »

*Stock Advisor returns as of September 3, 2024

Randi Zuckerberg, former director of market development and public relations at Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of The Motley Fool’s board of directors. Adam Spatacco has invested in Amazon, Meta Platforms, Nvidia, and Tesla. The Motley Fool has invested in and recommends Amazon, Meta Platforms, Nvidia, and Tesla. The Motley Fool has a disclosure policy.

Opinion: Nvidia’s $50 billion share buyback is no reason to buy shares randomly. Here’s what concerns me: This was originally published by The Motley Fool.