Key Takeaways

Semiconductor stocks have tumbled this week, with the Philadelphia Semiconductor Index (SOX) falling 10%, its biggest weekly drop since January 2022.

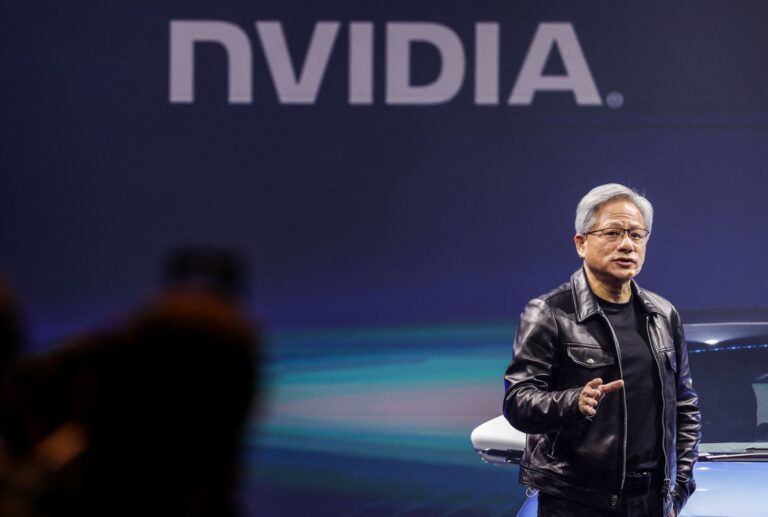

Market darling Nvidia (NVDA) fell 4.1% on Friday, ending the holiday-shortened week down nearly 14%, roughly matching the decline of Intel (INTC), which was hit on Tuesday by reports that it may lose its coveted spot in the Dow Jones Industrial Average.

Broadcom (AVGO) fell 10% on Friday after reporting disappointing quarterly earnings on Thursday afternoon. The company’s shares have fallen about 16% this week.

AI Spending Concerns Weigh on Sentiment

The tough week for semiconductor stocks came amid growing concerns about the health of the economy. Labor Department data released Friday showed U.S. payrolls were lower than expected in August, providing further evidence that the U.S. economy is slowing. A similar report on Aug. 2 capped the second-worst week this year for semiconductor stocks (-9.7%).

The economic worries coincide with a shift in investor sentiment around artificial intelligence. Once good news for Wall Street, corporate spending on AI has come under scrutiny in recent months. A surge in capital spending by big tech companies has some investors worried about when or if the spending will pay off. That’s dampening tech investor mood and weighing on shares of semiconductor companies whose products are key components of AI.

The industry’s second-quarter earnings, and especially its outlook for the rest of the year, are also struggling to meet investors’ sky-high expectations. Nvidia beat earnings expectations again last week, but growth has been slowing. And after a year of strong reports, the company’s upbeat sales outlook simply wasn’t good enough.