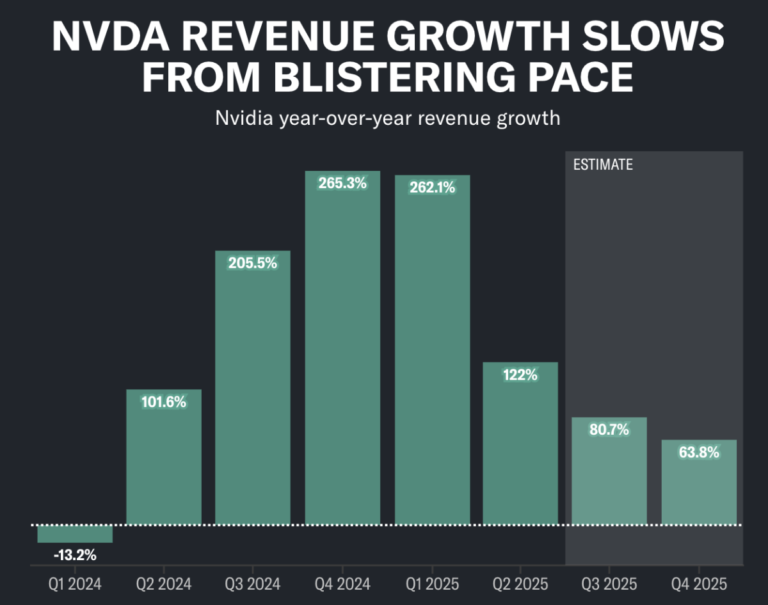

Nvidia’s (NVDA) growth metrics aren’t impressing Wall Street as much as they have in the past.

Nvidia reported earnings on Wednesday, showing the company’s profits and revenues increased by more than 100% year over year. However, this marked the company’s lowest one-year year-over-year revenue growth rate of 122%, and the year-over-year growth rate was less than half of the growth rate Nvidia reported for the first two quarters of 2024.

Shares were down as much as 3.5% early Thursday.

Gil Luria, managing director at DA Davidson, told Yahoo Finance that this slowdown in growth is his biggest concern for the stock right now and is why he maintains a neutral rating on the AI giant.

“We’re likely to see at least slower growth next year and potentially lower revenues at some point,” Luria said.

“If you look at the consensus and sell-side estimates, growth is expected to continue at a very high rate, but it’s very hard to justify that given that NVIDIA’s revenues are at the margins of other companies.”

Luria argued that big tech hyperscalers like Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL, GOOG), and Meta (META) will eventually slow their spending, which will likely pose a headwind to future revenue growth, given that these companies account for the majority of Nvidia’s current AI chip sales.

“Projections for next year and the year after are starting to spiral out of control,” Luria said.

Nvidia’s earnings call was still fairly upbeat: CEO Jensen Huang described demand for the AI leader’s new Blackwell chips as “incredible,” and most Wall Street analysts remained bullish on the stock as concerns about Blackwell chip delays eased somewhat during the call.

But slowing growth appears to be a sticking point for investors valuing a stock that has risen more than 1,000% since the start of the current bull market in October 2022. Nvidia’s current-quarter revenue guidance of $32.5 billion (plus or minus 2%) looks “good but not good enough,” Jefferies analyst Blaine Curtis wrote in a client note.

Nvidia’s results have also failed to wow Wall Street at the same pace.

The company posted its smallest upside surprise to Wall Street’s revenue expectations since the beginning of 2023. Its roughly 5% upside in earnings per share was also the smallest surprise since before the AI revolution began in 2023.

“This beat was much smaller than we’ve seen in the past,” Ryan Detrick, chief market strategist at Carson Group, said after the earnings release.

The story continues

“Future guidance was also raised, but again, not by as much as in the previous quarter. It’s still a great company with 122% revenue growth, but it looks like they set the bar a bit too high in this quarter’s results.”

Josh Schafer is a reporter for Yahoo Finance. Follow him at X @_joshschafer.

For in-depth analysis of the latest stock market news and events that are moving stock prices, click here.

Read the latest financial and business news from Yahoo Finance